Sean Kidney launches securitisation briefing paper at 7th Global Green Securitisation Summit in Mumbai on May 25th

Precursor to ‘Securitisation as an enabler of Green Asset Finance in India’ major report due soon from Climate Bonds

Sean Kidney and four of the India Securitisation Awards 2018 winners: Wadia Ghandy & Co., Northern Arc Capital Limited, Catalyst Trusteeship Services Limited, and Vivriti Capital Private Limited (left to right)

What’s it all about?

Securitisation, the process of transforming a pool of financial assets (for example, mortgages or lease receivables) into tradable financial instruments, has great potential to mobilise institutional capital at scale.

At the 7th Global Green Securitisation Summit in Mumbai last week, Climate Bonds released a new India based Briefing Paper in advance of a major new report due out in coming weeks. Sean Kidney was alson the special guest handing the India Securitisation Awards 2018 to the winners (photos above).

India Securitisation

In the past, India’s market’s growth has been hampered by regulatory hurdles including lack of clarity for different structures, tax inefficiencies and barriers to foreign investor participation.

These have now been largely addressed in the 2016 Finance Act and reforms in norms pertaining to participation of foreign institutional investors.

As of now the markets are showing signs of growth.

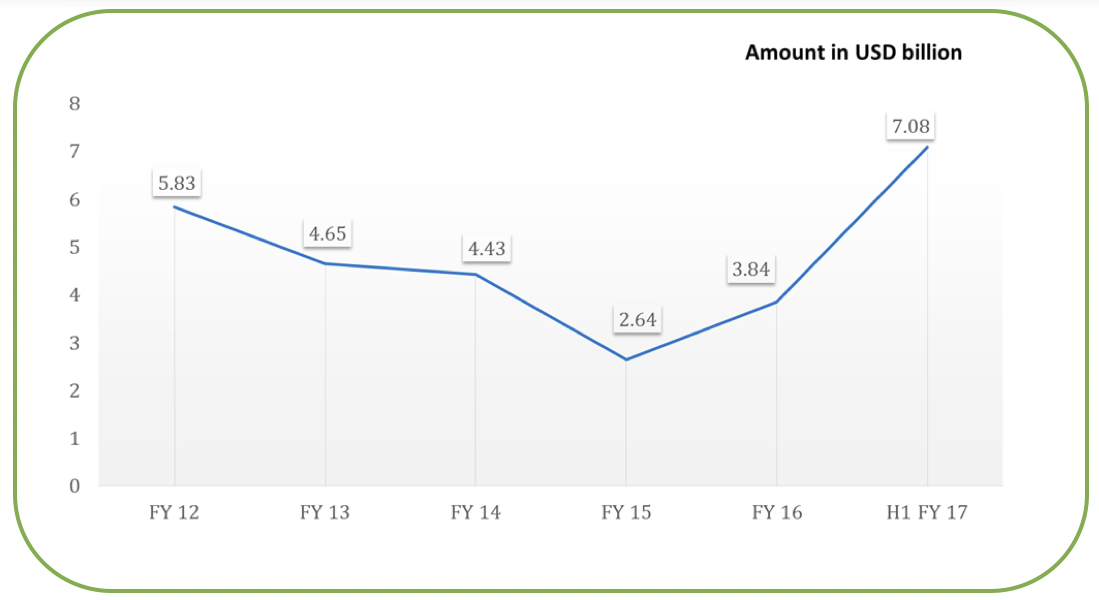

Figure 1: Annual volume of Indian securitisation market FY12 – H1 FY17

While most transactions in the Indian securitisation market have involved mortgages and vehicle loans, there is great potential for refinancing loans backed by green assets such as renewable energy, energy efficiency and low carbon transport.

The securitisation of microfinance loans is already established in India and green securitisation can be applied to sustainable farming and land management loans to help meet the sector’s financing needs.

Green securitisation can expand banks’ lending capacity by recycling balance sheet capacity and opening up a refinancing route for long-term loans.

Global Green ABS

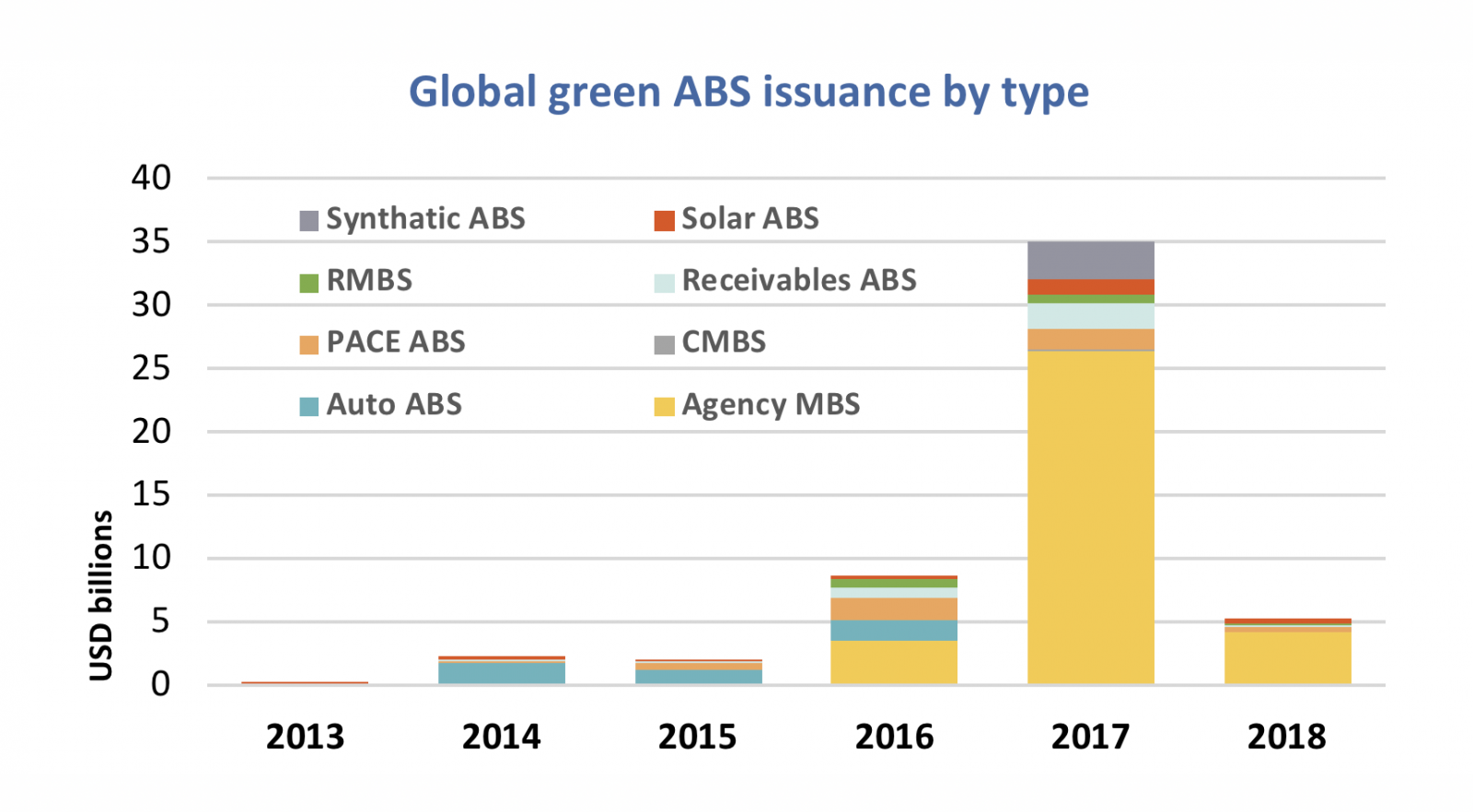

A securitisation can be defined as ‘green’ when the underlying cash flows relate to low carbon assets or where the proceeds from the deal are earmarked to invest in low carbon assets.

In 2016, green ABS made up 10% of global green bond issuance. 2017 saw rapid growth, driven mainly by US government agency Fannie Mae, and ABS reached a 22% share in the global green bond mix.

Figure 2 – Global Green ABS 2013 - 2018

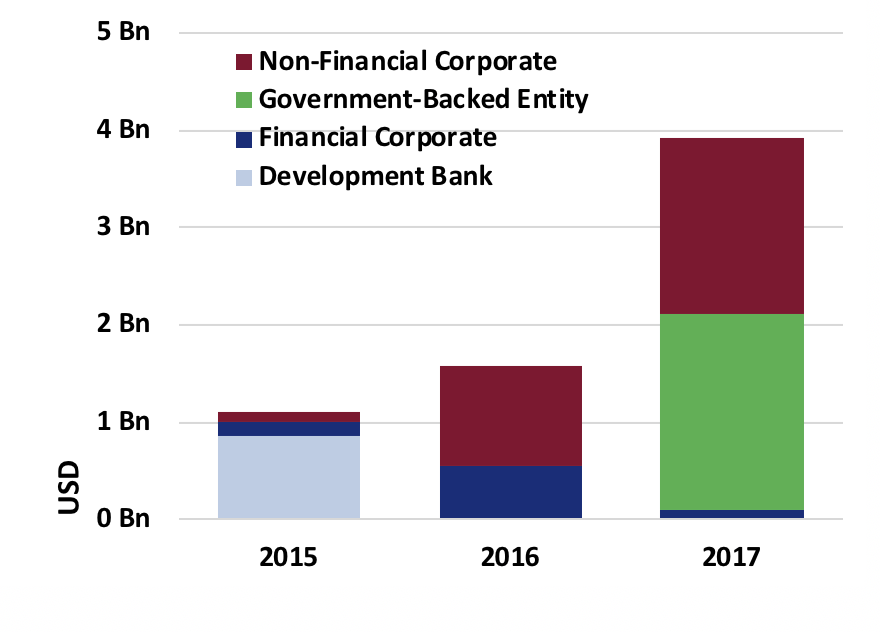

India Green Bonds

In India, the green bond market is well established and growing, reaching almost USD4bn in 2017, placing India in the Top 10 of global issuers for the year, a slow but steady increase from the 2015 total of USD1 billion.

Green bonds have help to finance renewable energy, energy-efficient buildings, low carbon transport and resilient water infrastructure. Climate Bonds “State of the Market – India” report from April 2017 provides more background.

Figure 3: India: Green Bond Issuance CY 2015 -2017

Who’s saying what?

Vinod Kothari, Director, Vinod Kothari Consultants

“The significance of green financing in India – with its ambitious targets for renewable energy of 100 GB by 2020, the significance green construction, and the stress electric transport facilities, mass rapid transportation, etc. – cannot be over-emphasized.”

“Given the long-term nature of several of the green financing applications, securitization provides an ideal take-out financing tool for banks and primary lending institutions, which may move the funding to capital markets once the respective assets get stabilized and turn into streams of cashflows.”

“We are so happy to be contributing to Climate Bonds Initiative’s coming publication on the potential for green securitization in India. We are hopeful that the overlaying of securitization techniques with green financing applications, and with requisite doses of regulatory inducements outlined in the report, green securitization may become a real force in time to come.”

The Last Word

It is expected that securitisation is likely to grow in India, resulting in better utilisation of the domestic investor base, which has immense corpus in the pension funds, insurance companies, mutual funds and entities like non-banking financial corporations and alternative investment funds carrying out wealth management functions.

A quick look at the agenda from last week’s 7th Securitisation Summit in Mumbai shows the depth of the existing market in India. You can also find the post-conference summary here.

More lending to green sectors

In order to grow green securitisation, lending to green sectors should be prioritised. Addressing court backlogs for these sectors, establishing definitions to include green assets in priority sector lending, and standardising documents are all actions to help grow a green securitisation market in India.

To grow origination and buying of asset-backed deals, policymakers should set up a warehouse for green loans and a dedicated Bond Guarantee Scheme.

Watch for the coming Securitisation report

These topics and more will be covered in detail when we launch ‘Securitisation as an enabler of Green Asset Finance in India’.

Meanwhile here’s our introductory Briefing Paper on green securitisation in India to get you started.

We’d also like to acknowledge that both the Briefing Paper and the coming full report have been prepared with the generous support of Vinod Kothari Consultants and sponsored by the Rockefeller Foundation and by UNDP as a partner of the Climate Bonds Initiative in the Climate Aggregation Platform.

‘Till next time

Climate Bonds