The race continues in the quarter and year with record-breaking green bond issuance levels

The big underwriters, the new entrants in the top 20, US Muni green bond issuance impact on the rankings and more captured in our latest figures

2017 has been a great year for green bonds, with total issuance reaching USD155.5bn – a new record and well beyond our 2016 forecast. Q4 was the busiest in the year with green bonds at USD46bn. November was the biggest month accounting for 13% of 2017’s total.

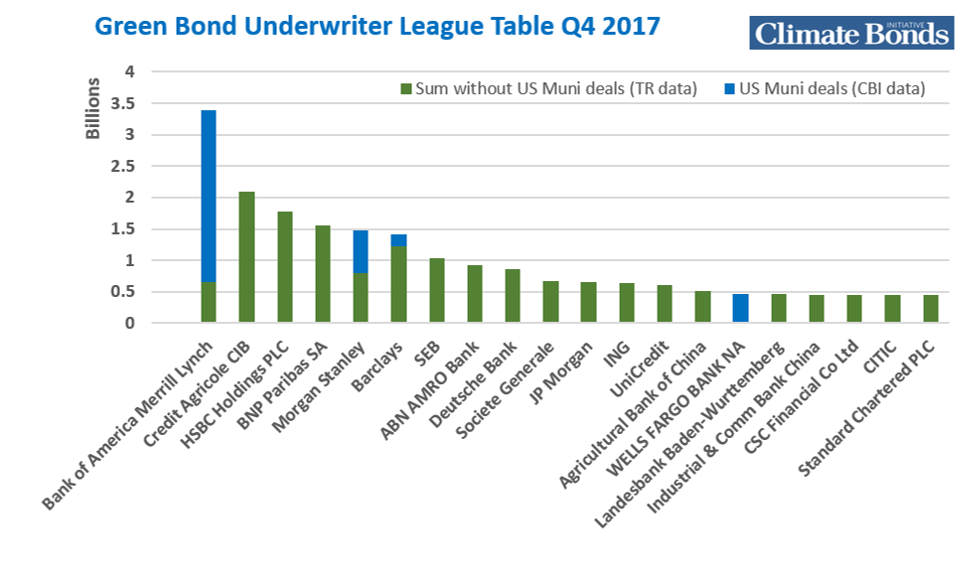

So, how did underwriters do in Q4?

Bank of America Merrill Lynch (BAML) takes the lead in Q4 with USD3.2bn underwritten deals, representing 12% of the quarter’s market share. Up from the 4th place in Q3, BAML’s leadership in the last quarter of 2017 was driven by US Muni deals, which accounted for 86% of its total underwritten volume.

New York MTA’s USD2.2bn green bond – referred to in our latest Media Release as one of the ten largest bonds of the year - provided a significant boost to the bank’s ranking. Citi, Goldman Sachs, JP Morgan, Williams Capital and PNC also participated in the deal.

Crédit Agricole CIB came in second* in the Q4 league table with USD2.2bn, up one position from the last quarter.

HSBC listed a close third*, slipping back a spot compared to Q3. Underwritten deals for the quarter total USD1.8bn. It facilitated the offshore green bond deals from Industrial and Commercial Bank of China, Bank of China and China Development Bank. All three deals are Certified Climate Bonds.

ABN Amro Bank and SEB were also big movers coming from well down the ranks in Q3 to appear in the Top 10.

US Muni deals in Q4

US Muni deals helped drive the rise in rankings of other banks as well. Morgan Stanley made its return to Top 10 after a Q3 absence, with 46% of underwritten deals coming from US Muni green bonds. Barclays also secured a position in the Top 10 rankings also thanks to US Muni deals, which accounted for 13% of its total.

Los Angeles MTA’s USD471.4m was the issuance that ensured Wells Fargo 15th spot representing the total of the bank’s underwritten deals of the quarter.

Turning to our 2017 annual league table…

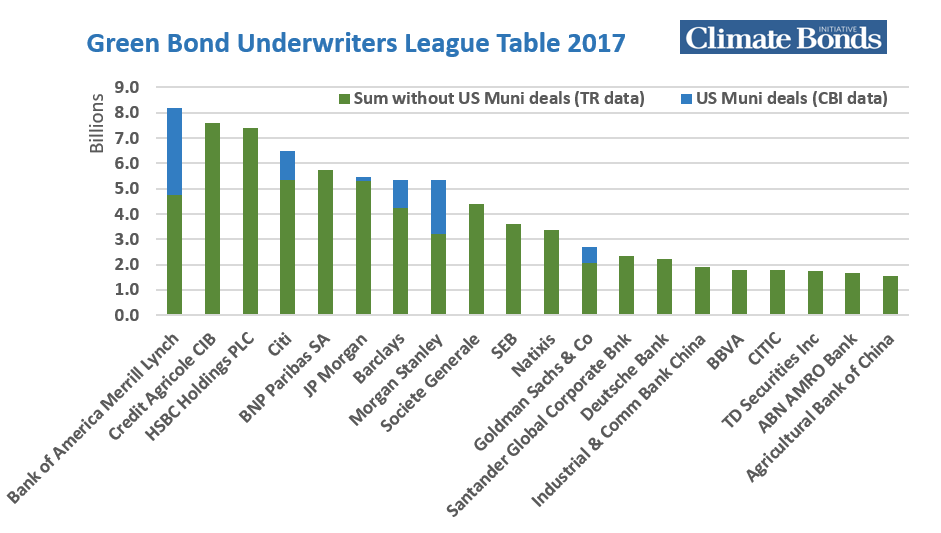

US, French and English underwriters dominate the annual league table. BAML retains the top spot for the third year running!

BAML underwrote USD8.2bn through the year with 42% of the deals coming from US Muni issuance, another indicator of the importance of that market.

26% of the USD42.4bn US total green bond issuance in 2017 came from green muni bonds.

Crédit Agricole listed a close second place with USD7.6bn, up from third place in 2016. HSBC closely followed, jumping from 9th spot in 2016 to being the 3rd largest green bond underwriter of the year with a total of USD7.4bn in deals.

Driven by its top performance in the first three quarters of the year, Citi ranked 4thwith 17% of its deals coming from US Muni green bonds. BNP Paribas made a return to the Top 10 since 2015 and took the fifth spot in the rankings.

France’s big Sovereign Green Bond of EUR 9.7bn (USD10.7bn) – the largest single green bond issued to date – made a significant contribution to BNP’s ranking and also to Credit Agricole and Natixis who both participated in the deal.

International banks have facilitated offshore large individual green bond issuance from emerging markets, especially green bonds denominated in euros or US dollars. Examples range from India’s Power Finance Corporation Certified USD400m issue, underwritten by Barclays, to the ICBC One Belt One Road Green Climate Bond - the inaugural green bond from the world’s largest bank - with BAML, Crédit Agricole and HSBC among the joint bookrunners.

In contrast, domestic green bond issuance in emerging markets was dominated by local banks and securities companies. China’s CITIC Securities made it into the Top 20 underwriters in 2017.

Along with the familiar faces, we also saw a few new ones: ICBC, BBVA, ABN AMRO and the Agricultural Bank of China all made it to the 2017 annual Top 20 table for the first time.

European & Chinese Underwriters

Between them, European and Chinese underwriters comprised 70% of the 20 leaders for the year.

If yesterday’s recommendations from the EU HLEG on Sustainable Finance gain traction and Chinese market growth continues, the 2018 table may show some more.

Till our next quarterly update, bragging rights are with BAML, congratulations!

‘Till next time,

Climate Bonds

P.S.: Methodology and data

Since Q3 2016, the underwriters league tables are collated using data from Thomson Reuters except for US municipal bonds which are calculated by the Climate Bonds Initiative. As such, ranking volumes differ from Thomson Reuters tables. Volumes may differ from other league tables as they include all ABS deals and US municipal bonds and exclude bonds which have less than 95% of proceeds going to environmental assets/projects or aren’t within the Climate Bonds taxonomy.

Methodology notes from Thomson Reuters

- Primary Issuance only

- Underwritten transactions only

- Thomson Reuters data excludes tax exempt Muni bonds

- The global table includes transactions that mature at least 360 days after settlement, for international 18 months and above.

- Transactions that mature or are callable/puttable less than 360 days after settlement are excluded, for international 18 months and above.

- Self-funded straight debt transactions are excluded (excluding mortgage and asset securitizations) unless two or more managers/underwriters unrelated to the issuer are present. The unrelated firm in a self-funded transaction with only two Book runners in the syndicate will receive league table credit.

- Transactions with an issue size of less than USD 1 million (equivalent) are included, sole led MTN take owns with a minimum size of USD 50m for core currencies are included, USD 10m for non-core.

- Deals must be received within five business days of pricing to be eligible.

- For a transaction to be green league table eligible, deals must have 100% of proceeds formally earmarked for green projects.

- Issuances where there is a mixed use of proceeds designated across different projects, are not eligible for example, ESG bonds that combine both social and green projects.

For further queries please contact ian.willmott@thomsonreuters.com.

*Correction: An earlier version of this communication had incorrect rankings, also placing Santander in the 2nd position in the Q4 League Table, with a reference in the headline. This error has now been rectified. The rankings in the Q4 table have subsequently been adjusted, as has the associated text, to reflect the correct order of all underwriters. These errors did not affect the 2017 Table and rankings. Our apologies for any confusion this may have caused.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.