Climate Bonds Initiative publishes first Nordic and Baltic Public Sector Green Bonds Study, with the support of the UK Foreign & Commonwealth Office

Local government, local government lending agencies and public entities generate almost half of green issuance in Nordic and Baltic states

What’s it all about?

The Climate Bonds Initiative has published a comprehensive study Nordic and Baltic Public Sector Green Bonds, exploring the contribution of sub-national public sector entities to green finance in selected Northern European countries.

The study was conducted with the support of the UK Foreign & Commonwealth Office.

The report has a specific focus on the role of local governments, municipally owned companies (MOCs), state-owned enterprises (SOEs), and Local Government Funding Agencies (LGFAs) and along with Scandinavian nations includes Estonia, Latvia and Lithuania in its scope.

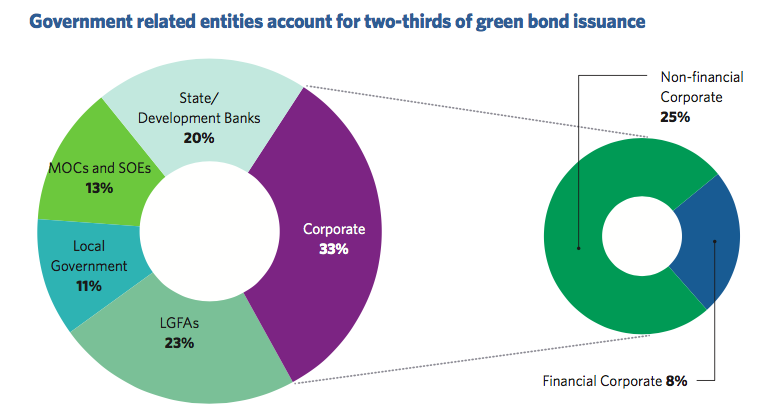

Public sub-national entities account for 48% of green issuance

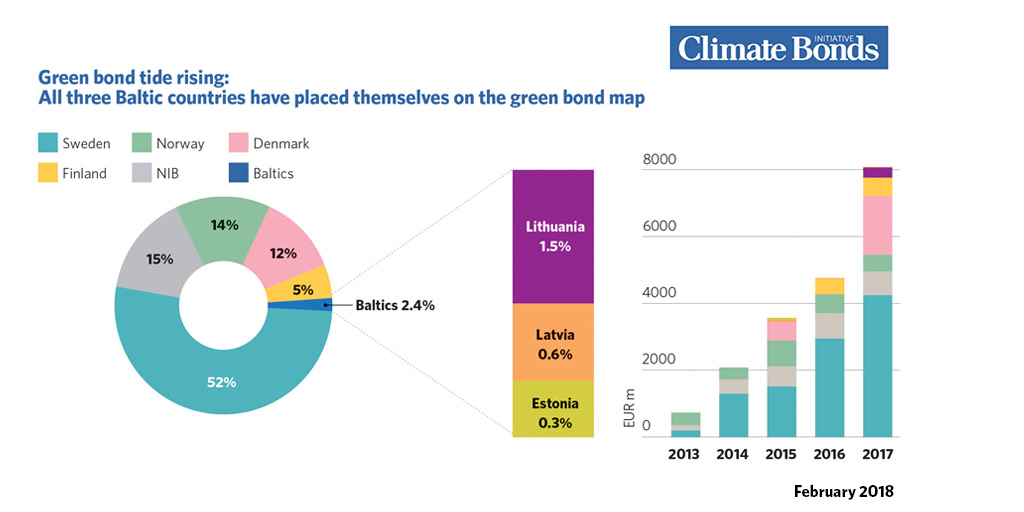

The Nordic and Baltic green bond market has experienced steady growth, with 2017 total issuance up 70% compared to 2016 and 11 times higher from market inception in 2013.

The public sector accounts for a large portion of the region’s green bond market, with issuance to date amounting to EUR9.4bn, or 48% of the total.

With the region’s local governments characterised by a high level of fiscal autonomy and LGFAs dominating public lending, the public sector is well positioned to fund climate action at a sub national level through increased green lending and green bond issuance.

Opportunities

At a city or municipal level, domestic issuance in local currency is common, due to low funding requirements. However, the use of green bond programs is on the rise and an increasing number of issuers are listing their bonds internationally. Stockholm’s Läns Landsting and tow other Swedish cities, Gothenburg and Malmö are all repeat issuers on the London Stock Exchange (LSE) and are among 28 Nordic issuers quoted on its green bond segment.

Local Government Funding Agencies (LGFAs) play an essential role, especially in the Nordics, acting as aggregators of funding that would, individually, be too small to enter the market. Their outstanding green bonds are typically benchmark size and listed on the LSE or Luxembourg Green Exchange (LGX).

At present green bonds still represent a very small portion of LGFAs issuance. There is a clear opportunity for them to increase green lending to provide further support for sub-national and city-based climate action.

Potential in the Nordics…

Given its bond market size, Sweden is expected to retain its position the largest issuer within the region even as neighbouring countries increase climate-based investment and accompanying green finance activity.

There are also growing expectations for the nation to issue a sovereign green bond, following the recommendations of their green bond enquiry presented to government in January 2018.

In Norway, there is significant scope for local government, energy, district heating and rail companies to increasingly transition lending policies from vanilla debt to green bonds issuance.

The study also identifies the state export credit agency and development fund Norfund as potential green bond issuers.

Helsinki is a potential candidate for the first municipal green bond issuance from Finland and there is also the possibility for Finland’s six largest cities (6Aika) to pool their resources and enter the market as joint issuers.

Several state-owned companies operate in sectors conducive to green based finance and existing bond issuers such as export credit agency Finnvera and development finance agency Finnfund also represent potential candidates.

Denmark’s KommuneKredit provides almost all the country’s public sector financing, which provides a firm foundation for increased green issuance.

There is also conversion potential in the mortgage sector, given that mortgage bonds represent 78% of the country’s outstanding bonds. Railway company DSB is also a potential candidate given its near-term investment plans and the suitability of rail as a green bond sector.

A number of cities and municipalities from Iceland have accessed the domestic debt capital market. Reykjavik’s climate action plans – such as explicit support for electric cars – make it a good candidate for city based green bonds.

The study has identified three other vanilla bond issuers as candidates: Municipal Credit Iceland, the Icelandic LGFA, the Housing Financing Fund and national power company Landsvirkjun, particularly in relation to geothermal power.

A further option could see Iceland issuing a sovereign green bond to provide initial market impetus.

…And Baltics

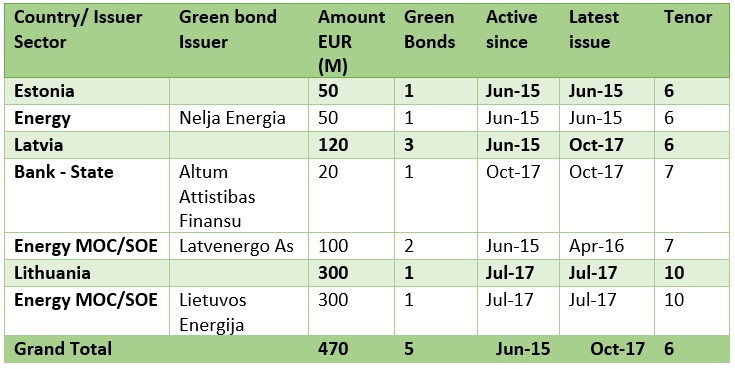

All three Baltic countries have issued green bonds: an impressive achievement given their relative size.

Green bond issuance has come from government-backed energy companies Latvenergo (Latvia) and Lietuvos Energija (Lithuania), clean energy developer Nelja Energia (Estonia) and financial investment company Altum (Latvia).

Lietuvos Energijais’ EUR300m issue is by far the largest green bond from the Baltics, accounting for nearly the whole of the region’s corporate market (EUR306m).

To date no green bond issuance from cities or municipalities has emerged. Potential local government issuers in Estonia, Latvia and Lithuania are on the small side of the scale.

However, the use of an aggregation platform similar to the LGFAs in the Nordics is a possible solution. This would allow larger deal sizes and possibly increased international access. Eurozone membership is also a credit-risk positive for international investors.

The Last Word

While each of the Nordic-Baltic countries presents some unique and differentiating characteristics, the public sector plays an active role throughout the region in supporting and increasing green investments aimed at achieving national climate action goals.

The scoping study shows that there is still significant opportunity for public sector entities to harness green finance to help fund climate-resilient infrastructure and developments at a municipal, sub-national, and national level.

A combination of increased backing by investors, stock exchanges, cost-focused incentives for smaller issuers, and continued use of aggregation to pool funding requirements will also further contribute to market growth.

Download the full report here.

‘Till next time,

Climate Bonds

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.