Our new China Green Bond Market Newsletter with all the latest bond issuance, market developments and updates

Full versions in both English & Chinese can be found here.

At a Glance

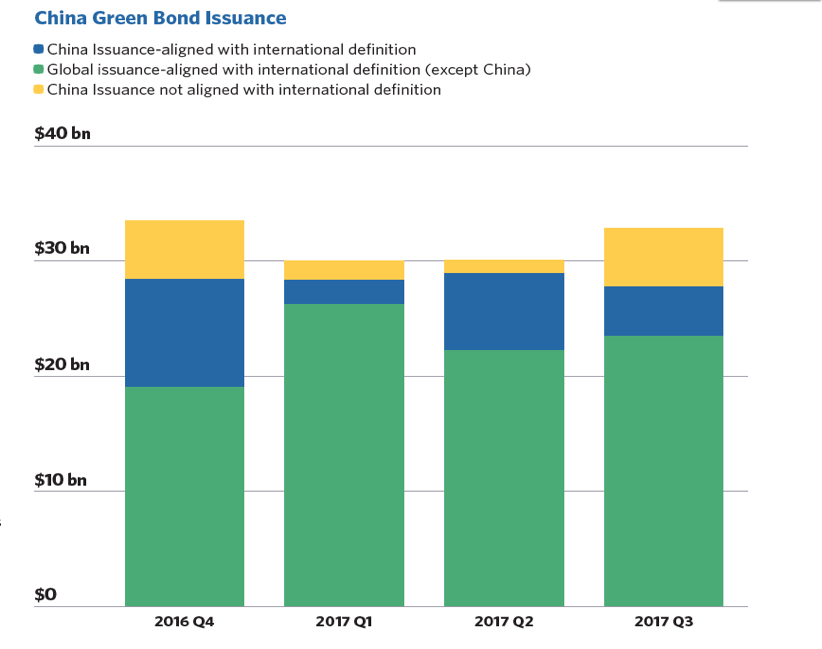

In the third quarter, China’s green bond market gained further momentum, bolstered by city commercial banks and local government investment and financing vehicles. The issuance amounted to USD9.38bn (RMB62.36bn), up 13% qoq, making the largest quarterly issuance of the year.

Headline figures for Q3

- 2017 issuance to Q3: USD20.91bn (RMB141.87bn)

- Percentage of internationally-aligned Chinese labelled green bonds: 63.5%

- All Chinese green bonds were designated investment grade with more diverse notches (except for privately placed debt financing tools and subprime asset-backed securities)

- More long-term Chinese green bonds emerged

- 57% of issuance received second party reviews

- Top 3 largest issuers of Q3:

- Wuhan Metro (RMB6.5bn)

- China Development Bank (RMB5bn)

- China Three Gorges (RMB3.5bn)

Also in this edition:

- The fifth national financial work conference encourages the development of green finance

- Local governments actively promote green financial reform and establish innovation pilot zones

- Nine local government bonds included in the ChinaBond Green Bond Indices

- The first retail green bonds on sale

- Shanghai Stock Exchange and Luxembourg Stock Exchange tightened partnership to promote green bonds

Green Bond Discussion

In this edition, we take a closer look at the growing trend of green finance from state to local level, and the need for better environmental disclosure on local government green bonds.

While we expect to see cities and sub-sovereigns increasingly turning to the green bond market, and that sovereign or sub-sovereign issuance to fuel China’s market momentum going forward, we also see the need for better disclosure on use of proceeds and environmental benefits of bond issuance.

China Central Depository and Clearing (CCDC) announced in late August that they would include nine local government bonds in their ChinaBond China Green Bond Indices. However, throughout the identification process, it is found that in terms of environmental disclosure on special bonds, there is still room for local government to improve.

There are some discrepancies in the level of disclosure on underlying projects information at this level and there is absence of disclosure about quantitative indicators of the projects.

Read more in the full Quarterly Newsletter here.

We hope you’ll enjoy it!

'Till next time,

Climate Bonds Initiative

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or debt instrument or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the financial merits or otherwise of any debt instrument or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

Certification under the Climate Bond Standard only reflects the climate attributes of the use of proceeds of a designated debt instrument. It does not reflect the credit worthiness of the designated debt instrument, nor its compliance with national or international laws.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative public communication.