Latest news from Climate Bonds: The Marine Technical Working Group has been launched to develop eligibility criteria for low carbon and climate resilient investments in the marine sector

The Marine Technical Working Group (Marine TWG) kicked-off with its opening meeting at the end of March. Convened by The Climate Bonds Initiative, the Marine TWG is made up of marine scientists, academics and industry experts from around the world with expertise covering sustainable fisheries, aquaculture, marine energy, coastal zones, ports and marine infrastructure.

It will meet on a monthly basis to develop criteria that low carbon marine-related investments must meet if they are to be certified under the Climate Bonds Standard.

These criteria will form the basis of a draft standard that will be available for public comment. Once completed and released, the marine standard will allow certification of marine-related investments under the Climate Bonds Standard.

The objective is to catalyse increased public and private investment, in marine based climate mitigation, adaptation and resilience interventions. To achieve this goal verifiable and science-based criteria for certifying marine-related climate or green bond issuances are necessary.

“Investors continue to have very strong appetite for the sustainable energy sector, and thus I’m delighted to support the Marine TWG in developing a more consistent framework under which marine projects can be brought successfully to market.”

Andrew Buglass, Buglass Energy Advisory & Marine TWG Member

Who’s on the Marine TWG?

TWG Lead Specialists

|

|

||

|

Clarmondial |

Versant Vision |

|

|

Technical Working Group Members

|

|

|

|

|

| Marine Stewardship Council (MSC) Dr. David Agnew Science & Standards Director |

National Oceanic & Atmospheric Administration (NOAA) Dr. Bill Karp Science & Research Director |

European Investment Bank (EIB) Nancy Saich Senior Advisor on Climate Action & Environment |

Partnerships in Environmental Management for the Seas of East Asia (PEMSEA) Ryan Whisnant Head of Professional Services |

World Fish / CGIAR Dr. Michael Phillips Director, Aquaculture & Genetic Improvement |

|

|

|

|

|

| WWF Louise Heaps Chief Advisor on Marine Policy |

Caelulum Ltd / Euro Marine Energy Centre Max Carcas Managing Director |

GlobalGAP Roberta Anderson Sustainable Agriculture Expert |

CSIRO Dr. Stuart Whitten Economics & Future Pathways |

Ocean Assets Dr. Michael Adams CEO |

|

|

|

|

|

| International Sustainability Unit Lucy Holmes Senior Programme Manager |

Great Barrier Reef Foundation Prof. Paul Greenfield Chair, Science Advisory Committee |

Global Climate Adaptation Partnership / Grupo Laera Dr. Carmen Lacambra Ecosystems-based Adaptation Expert |

Independent Consultant Nick Shufro Sustainability & Resilience Finance |

Pacific Northwest National Laboratory Dr. Andrea Copping Marine Sciences Laboratory |

|

|

|||

| Coastal Risk Consulting, LLC Dr. Brian Soden Vice President, Science & Technology |

Buglass Energy Advisory Andrew Buglass Founder |

Why develop eligibility criteria for marine-related low carbon investments?

“If global warming is not limited, the adverse effects on coastal and marine ecosystems, and the billions of coastal residents who rely on them, could be profound. It’s essential that investment in coastal and marine industry, infrastructure and ecosystems contribute to a rapid transition to a sustainable, low-carbon economy. By identifying low-carbon and resilience factors for marine-related projects, the Marine criteria will help achieve this.”

Ryan Whisnant, PEMSEA & Marine TWG Member

Climate change poses significant risks to marine ecosystems with high potential to negatively affect productive uses of marine resources and related socio-economic systems.

The marine sector encompasses a range of activities and investment opportunities, including fishing, shipping, coastal economic activities, ports, energy generation, tourism and mining. Yet, mismanagement; pollution, overfishing, habitat and species loss, and poorly planned and managed coastal infrastructure, is estimated to incur over USD 200bn per year in economic damage. Climate change exacerbates this and damage to the ocean is estimated to rise to USD 322bn per year by 2050 due to climate change impacts.

“Climate change is going to have profound impacts on the productivity, sustainability and resilience of marine ecosystems. With current trends of unlimited warming and limited adaptation capacity, billions will feel adverse effects. Marine activities and infrastructure must become compatible with limiting global warming to 2°C and sound adaptation and resilient actions are required to ensure such activities sustain.”

Dr. Carmen Lacambra, Global Climate Adaptation Partnership / Grupo Laera & Marine TWG Member

Green and Climate Bonds can be a solution

Green and climate bonds are used to finance low carbon infrastructure. They provide lower cost capital to high-quality, low-carbon projects and assets catalysing increased investment in marine based climate mitigation, adaptation and resilience interventions. However, concerns on the credibility of the green label are growing.

The Marine criteria will set out which projects and assets are sufficiently low carbon that they limit global warming to 2°C. They will allow investors to be sure of the environmental credentials of their investments through certification under the Climate Bonds Standard.

The Marine criteria will promote climate change mitigation and adaptation and facilitate increased resilience of communities, infrastructure and ecosystems. They will indicate to investors which investments are contributing to a 2°C mitigation and adaptation trajectory. This is vital knowledge for a rapid transition to a low carbon economy.

“The Marine sector offers a plethora of investment opportunities; marine energy, sustainable fisheries, aquaculture and ports and marine infrastructure. However, if projects invested in now are not low carbon we are locking in years of high emission infrastructure; and if they’re not climate resilient we miss the opportunity to future-proof them.”

Dr. Michael Phillips, WorldFish/CGIAR & Marine TWG member

Developing sector criteria

Justine Leigh-Bell, Global Standards Manager, Climate Bonds Initiative:

“Marine is a complex sector; the internationally recognised expertise represented in the Technical Working Group ensures that that eligibility criteria are rigorous and robust. ”

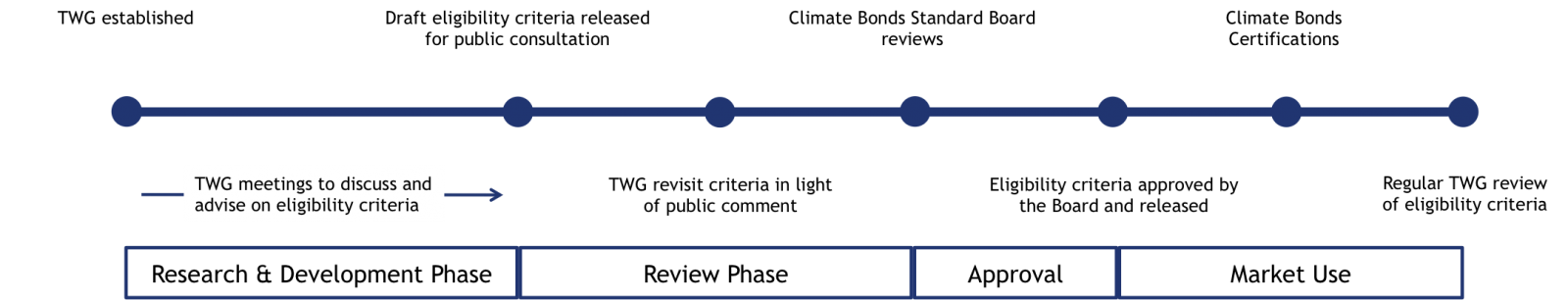

The TWG undertakes the following process when developing sector-specific criteria:

Sector criteria are currently available for Solar, Wind, Geothermal, Low Carbon Buildings and Low Carbon Transport.

Soon to be available are criteria for Water, Bioenergy and Agriculture and Forestry. In addition to Marine, 2016 will see development begin on Hydropower, Industrial Energy Efficiency and ICT & Broadband.

The Last Word

Sean Kidney, CEO, Climate Bonds Initiative:

“Investments in marine related sectors are critical to climate change adaptation and resilience in vulnerable ecosystems and human communities. Coastal, port and marine infrastructure, marine energy and sustaining seafood supply chains all require active support. Standards for green bonds will help scale up investment in assets and projects that make a real difference.”

The Climate Bonds Standard

The Climate Bonds Standard provides green definitions that issuers can certify their bonds against. It is not a financial standard; rather it assesses the low carbon credentials of a bond. It is a science backed screening tool that investors, issuers and intermediaries can use to evaluate the environmental integrity of green and climate bonds.

The Climate Bonds Standard allows easy prioritisation of climate and green bonds with confidence that the funds are being used to deliver climate change solutions. It consists of the overarching Climate Bonds Standard and a suite of sector-specific criteria.

Sector criteria are currently available for Solar, Wind, Geothermal, Low Carbon Buildings and Low Carbon Transport. Bonds are certified under the Climate Bonds Standard; assets funded must meet the requirements of the relevant criteria.

The Climate Bonds Standards Advisory Board* reviews all criteria and documentation prior to final release. Decision-making is implemented through consensus.

Members of the Climate Bond Standards Advisory Board* include:

- California State Teachers Retirement Service (CalSTRS)

- California State Treasurer

- CDP (formerly the Carbon Disclosure Project)

- Institutional Investors Group on Climate Change (IIGCC)

- The International Cooperative and Mutual Insurance Federation (ICMIF)

- Investor Group on Climate Change

- Investor Network on Climate Risk

- The Natural Resources Defense Council

*Disclosure: The CBSAB is an Advisory Committee to the Climate Bonds Board.