Impact Reporting in the green bond market: A closer look at climate and environmental practice

Impact Reporting in the green bond market: A closer look at climate and environmental practice

Only a few weeks ago we launched our latest study Post-Issuance Use of Proceeds – Trends and Best Practice.

The report is Climate Bonds Initiative’s first detailed study of current practice around post-issuance reporting of green funding and monitoring of green bond allocation.

The Post-Issuance Use of Proceeds – Trends and Best Practice data pool is 191 green bonds from 146 issuers to the value of USD66bn all with an issue date before 1 April 2016.

This date was chosen as most issuers commit to annual reporting so this gave a full year plus a 2 month grace period to allow issuers to publish reporting.

With increasing attention being paid to impact reporting across investment classes, we look a little closer at the findings and issues.

What is "impact reporting"?

Impact reporting indicates any type of reporting (by a green bond issuer on the bonds' use of proceeds) that looks to quantify the climate or environmental impact of a project or asset that is expressed numerically.

This level of reporting is gaining prominence in green bond markets, and helps investors measure positive externalities through their investments.

An externality being the consequence of an economic activity affecting someone/something who is not directly involved in it, and it can either be positive or negative. Climate and green bonds by their nature produce positive externalities - emissions or water or energy savings are examples.

To many investors and market stakeholders it is increasingly important. Particulary as the green bond issuer base widens - across geographic regions, across ratings bands, and as the asset base extends from the mainstays of renewable energy to infrastructure and other sectors.

For some potential issuers it remains an additional task and potentially a discincentive. For some institutional investors, it is becoming a mainstream ESG consideration.

The Overview

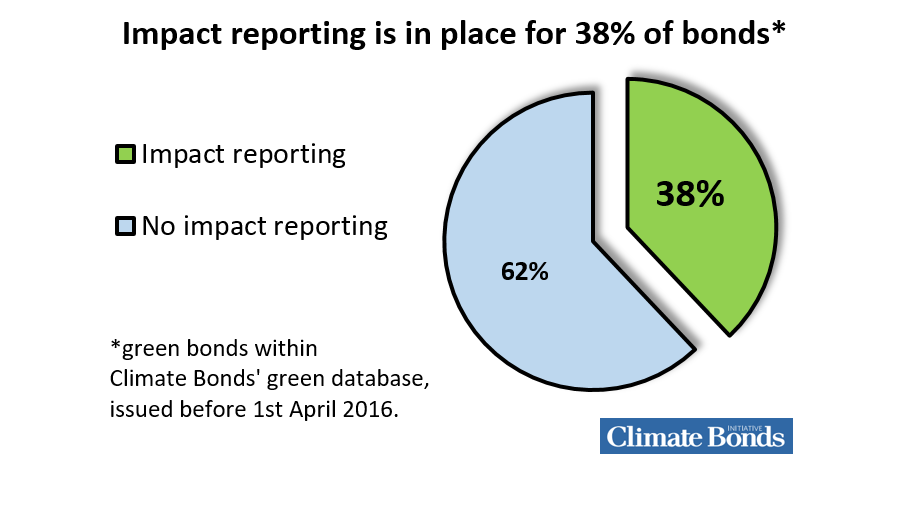

Of the 191 green bonds in the reports' data pool, some form of impact reporting was in place for 38% of bonds.

(Figure 1)

(Figure 1)

The Year on Year Trend

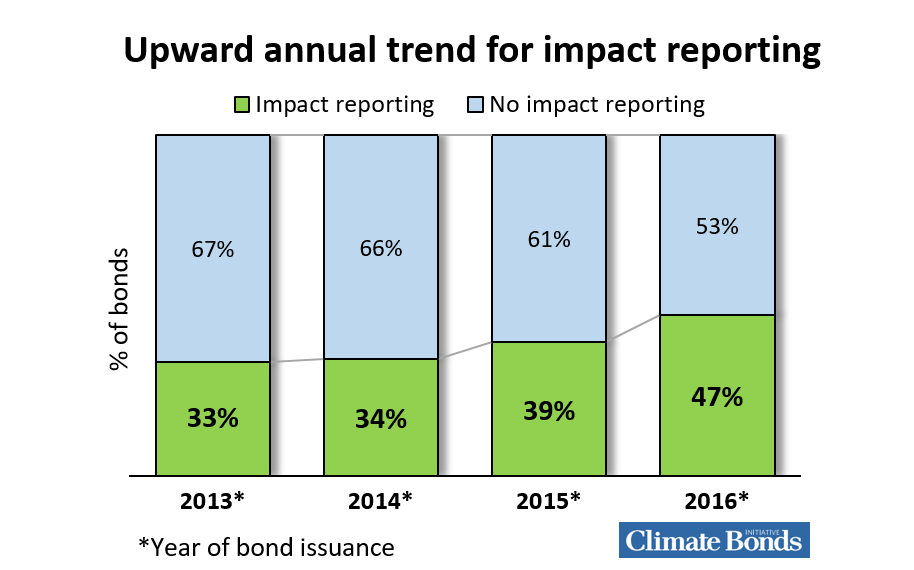

The report also finds that the percentage of issuers providing impact reporting has been rising on a yearly basis, from 33% in 2013 to 47% in 2016.

(Figure 2)

(Figure 2)

Should everyone provide impact reporting?

Post-issuance reporting is critical to ensure the integrity of the green bonds market and therefore a requirement by most market guidelines (Climate Bonds Standard, Green Bond Principles or country-specific guidelines), however impact reporting is not key to differentiating between a green and a non-green asset.

Individual investor’s expectations differ according to circumstances, some of them do not demand impact reporting, whereas for others it is a conditio sine qua non.

However, while impact reporting is the best of best practice, most investors do not expect impact reporting for all types of issuers and all types of projects.

Smaller issuers with small bond programs are not typically expected to provide impact reporting because it can be time consuming and resource-intensive.

Smaller issuers can make an effort to provide basic information about how proceeds are being allocated, and leave impact reporting for wide asset bases and more ‘complicated’ sectors. In 'easy’ sectors like wind or solar power, the call for impact reporting is not as significant comparing to water or greenhouse gasses.

A wide range of metrics

At present, impact reporting lacks a standardized procedure and the metrics being used are inconsistent.

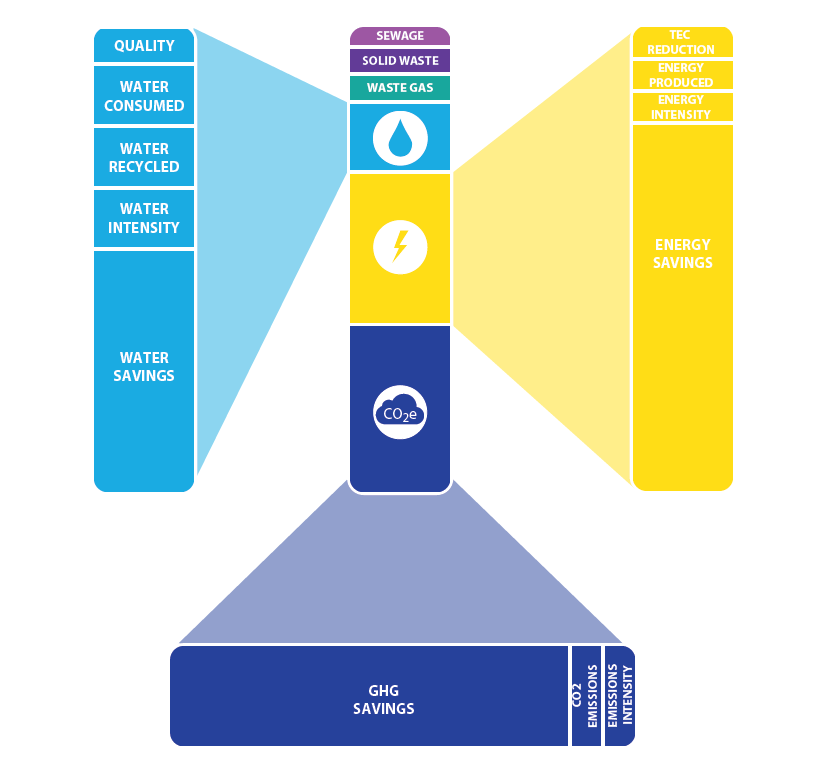

Figure 3 below reflects the many variations we observed.

For greenhouse gas emissions reporting is mostly on ‘CO2 savings’, however some issuers report on ‘intensity’ or ‘emissions’.

While for energy reporting ‘savings’ is the most common metric, but ‘energy intensity’, ‘TCE reduction’ and ‘production of (clean) energy’ metrics are also used.

The lack of a norm might hold back impact reporting becoming a standard practice.

Focus on specific sectors

As we previously pointed out, some sectors need impact reporting more than others.

For example, buildings themselves are not ‘green’ or ‘low carbon’ assets. Instead, a building can be called green if it achieves certain energy efficiency metrics and certification. In this case, the metrics are what enable investors to define which buildings are green and which are not, with impact reporting holding the key to this judgement.

For solar power, on the other hand, the technology itself is ‘green’ and the energy saving metrics are not required to differentiate one solar plant from another. Here, impact reporting metrics are good to have but not critical to understanding the environmental credentials of the asset.

Variations in Metrics

Figure 3: A breakdown of the differing metrics identified in the analysis.

Best practice example from a corporate: Berlin Hyp*

Berlin Hyp* uses two baselines to benchmark the performance of its buildings:

- The average energy performance of existing European buildings. This means that every building in the pool is compared to the average energy performance of existing European buildings. Against this baseline, Berlin Hyp buildings perform very well.

- The current energy references for different real estate asset classes according to the German Energy Savings regulation (Energieeinsparverordnung, EnEV). This baseline gives a more conservative assumption of carbon emissions that Berlin Hyp has avoided.

The Last Word

As the issuer base widens, investor expectations around transparency and disclosure will continue to grow.

Impact reporting can be a useful tool for the development of a transparent and harmonised green bond market, and gives institutional investors more confidence to commit long term capital allocations.

Whilst noting an increasing trend in transparency and demand for further disclosure, overall the Post-Issuance Use of Proceeds – Trends and Best Practice report reflects that additional progress still needs to be made in post-issuance reporting, in areas such as comparability, recommended guidance and failure to report.

Impact reporting being the further step for complex sectors needs development in both procedures and metrics.

Best Practice and 2020

For the green finance market to accelerate sharply over the next few years from the current $100bn- $130bn + annual range to the $1tn size by 202 that influential voices are calling for, best practice in impact reporting should be part of that growth path.

To read more about post-issuance reporting, download the full report here.

‘Till next time,

Climate Bonds

Disclosure: Several organisations named in this communication are Climate Bonds Partners. A full list of Partners can be found here.

Disclaimer: The information contained in this communication does not constitute investment advice in any form and the Climate Bonds Initiative is not an investment adviser. Any reference to a financial organisation or investment product is for information purposes only. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not endorsing, recommending or advising on the merits or otherwise of any investment or investment product and no information within this communication should be taken as such, nor should any information in this communication be relied upon in making any investment decision.

A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind, for any investment an individual or organisation makes, nor for any investment made by third parties on behalf of an individual or organisation, based in whole or in part on any information contained within this, or any other Climate Bonds Initiative publicly communication.