Quarter 1 of 2016 saw a remarkable take-off of the green bond market with a total issuance reaching $16.5bn, the largest ever-quarterly amount issued! That's almost a $1bn more than our inital tally.

This fantastic growth is driven in part by China which accounted for over half of all green issuance in the quarter.

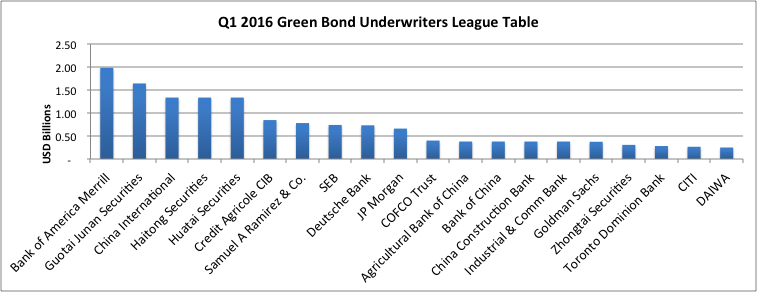

Bank of America Merrill Lynch maintained its high gear from last year and tops the Underwriter League Table for the first quarter of 2016, with a total underwriting amount of $ 1.99 bn from 11 deals.

These include joint lead underwriter for the $1.5bn Apple corporate green bond (alongside Goldman Sachs, Deutsche Bank and JP Morgan) and sole underwriter for three US issues of the quarter.

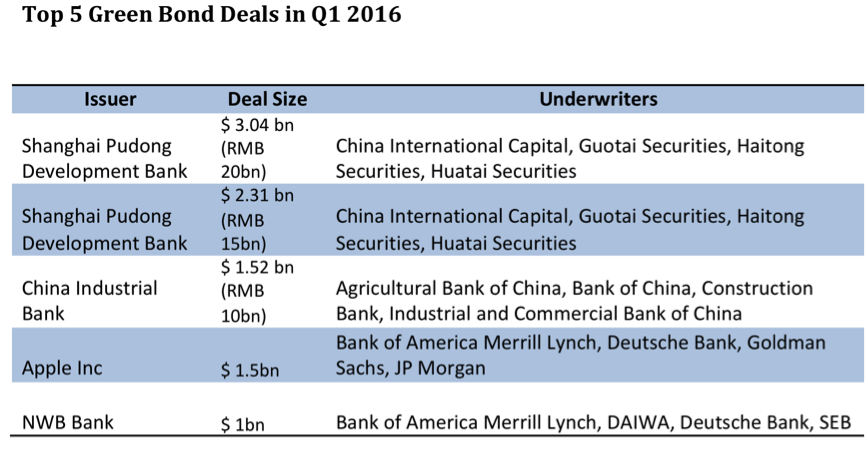

But, the main story for the market has been the great leap forward in the Chinese green bond issuance with a total $7.9 bn from 10 deals of 4 issuers, all by commercial banks during the quarter.

Not surprising then to see Chinese underwriters fill the remaining four spots in the Top 5.

The New Line Up

Chinese Underwriters

Guo Tai Jun An Securities ranks 2nd with a total amount underwritten of $ 1.65 bn from four separate deals, joint-underwriter for the Bank of Qingdao green issuance and the co-underwriter for the two sizable Shanghai Pudong Development Bank green bond deals.

Then come three Chinese underwriters who all underwrote the same amount of $ 1.34 bn. China International Capital, Haitong Securities, and Huatai Securities, all acted in the two mammoth Shanghai Pudong Development Bank issuances totalling $5.8 bn.

Regular names in the Green Bond league table have been pushed back following this Chinese influx

Credit Agricole CIB (CA-CIB) comes in at sixth with a total of amount of $0.85 bn from eight deals, including acting as a sole underwriter for its own Uridashi issuance as well as EBRD and World Bank green bonds over the quarter.

Samuel A Ramirez & Co. INC, SEB, Deutsche Bank, JP Morgan are also ranked in the top ten with $0.78 bn, $0.74 bn, $0.73 bn, and $0.66 bn underwritten respectively.

Another five Chinese underwriters ranked in Top 20 are Agricultural Bank of China, Bank of China, China Construction Bank, Industrial & Comm Bank of China, and Zhongtai Securities.

This round of reshuffling in the underwriter league table has revealed some exciting momentum in the Chinese green bond market.

As the market grows we are expecting more new underwriters to emerge.

Want to hear more from CBI? Catch Sean Kidney tomorrow (12th April 2016) speaking on a webinar hosted by S&P DJI and Trucost entitled “A Process for Rating the Green Impact of Green Bonds”.

The webinar will be led by Julia Kochetygova, Head Sustainability Indices (S&P DJI) and Neil McIndoe, Head of Environmental Finance, Trucost. Register interest here.

Coming Up

Look out for future webinars on CB Standards coming up in the next month.

--

Understanding our league table

There are plenty of ways to make a league table and each bring with them different outcomes, so here are a few notes about our green bond league table:

Graphs include only the largest 20 underwriters in each time period but there are many others that have underwritten deals

- All data includes only bonds labelled and marketed to investors as ‘green’ or ‘climate’, the primary definition of this market. This means that figures do not include renewable energy projects or other bonds linked to green projects but not labelled and marketed as such

- Totals are calculated by taking the total deal size divided by the number of lead managers as is the general practice (with exception of the US municipal bonds where the total deal size is allocated to the lead underwriter which follows the general practice in the US municipal bond market)

- Other league tables representing a larger market would usually present data by year, by currency or both. Given that this green bonds market is still relatively small, there is limited scope to break up the market at this stage

- Some issuances fall on the cusp of the quarter in which case we use the announcement date as recorded on Bloomberg to determine its quarter

- Exchange rates taken as the last price on the announcement date

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.