8am Ottawa/2pm Paris/1pm London: Today, Climate Bonds and Sustainable Prosperity are releasing the fourth annual Bonds and Climate Change: State of the Market in Canada 2015, which is a special supplement to the Bonds and Climate Change: The State of the Market in 2015.

Every year, we collaborate to track the highlights from the current year, the emerging trends, and the opportunities ahead for green bonds in Canada. Here, Sustainable Prosperity’s Michelle Brownlee and the Climate Bond Initiative’s Tess Olsen-Rong outline this year’s findings from the Canada Report.

Highlights from 2015

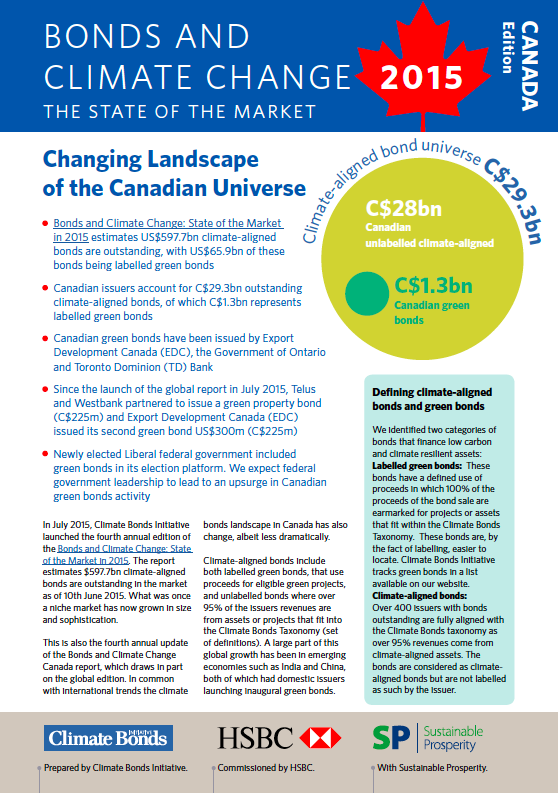

The global report estimates US$597.7bn climate-aligned bonds are outstanding in the market as of 10th June 2015, with US$65.9bn of these bonds being labelled green bonds.

Canadian issuers account for C$29bn in outstanding climate-aligned bonds as of June 10, 2015, of which C$1.3bn represents labelled green bonds.

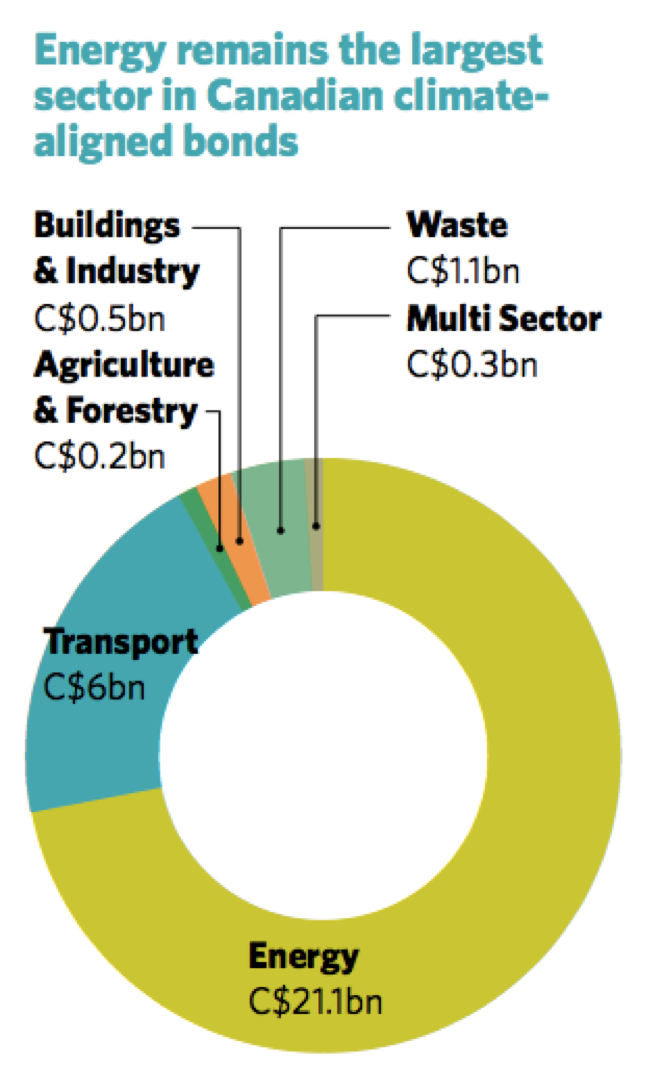

Canadian climate-aligned bonds are supporting projects across different green sectors, but energy is clearly the sector taking the lead, representing over 2/3rds.

Emerging Trends: Growing number of labelled green bonds

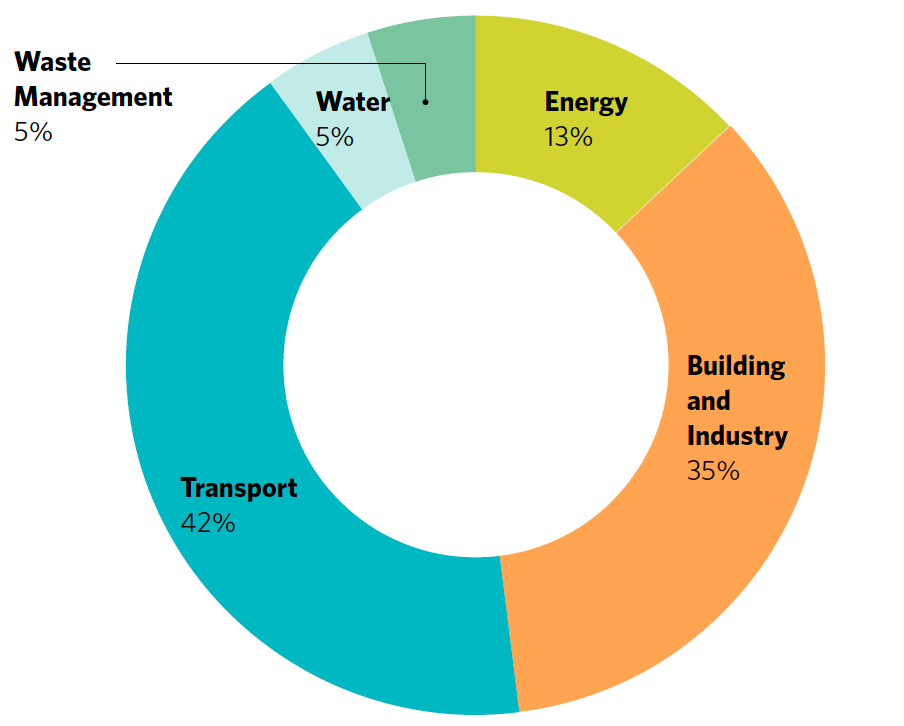

Part of the growth in the global market in recent years is due to Canadian green bond issuances: two $300m green bonds by Export Development Canada, C$452m by TD Bank, C$448.2m by Province of Ontario, etc. These labeled green bonds are financing a wide range of projects:

And while the first part of 2015 was a bit slower in terms of Canadians issuances than last half of 2014, it looks like 2015/2016 is going to be a big year for issuances. Just this month, EDC released a US$300 million green bond. The Province of Ontario has committed to another green bond issuance in 2016, and political commitments to green bonds made by Canada’s new federal government may lead to an upsurge in Canadian green bonds supply.

Fertile ground for green bond market growth in Canada

Looking globally, this month’s climate change Conference of the Parties (UN COP21) meetings will likely lead to both short-term announcements of upcoming green issuances and new national climate finance policy developments.

In Canada, there’s no lack of opportunity for projects to finance, in all the sectors that are already benefiting from green bond investment, and in others - there are untapped opportunities at the municipal level, and in areas such as water, which is an active green bond hot spot in the US.

Shifting political winds in Canada are positive for green bond market development

Canada’s new national government supports policies promoting green bonds. Here are 7 ways policy makers can help catalyze the growth of a domestic green bond market in Canada.

The bottom line – green bonds are an important financial tool and have potential to shift large amounts of capital to climate projects in Canada.

Both internationally and in Canada, green bonds markets are big, growing, investment-grade, and of critical importance in helping finance the transition to a low-carbon economy and to meet global, national and local sustainability objectives.

Want to know more? Check out the full report here.

This blog is written by Michelle Brownlee (Sustainable Prosperity), Tess Olsen-Rong and Kaboo Leung (Climate Bonds Initiative).