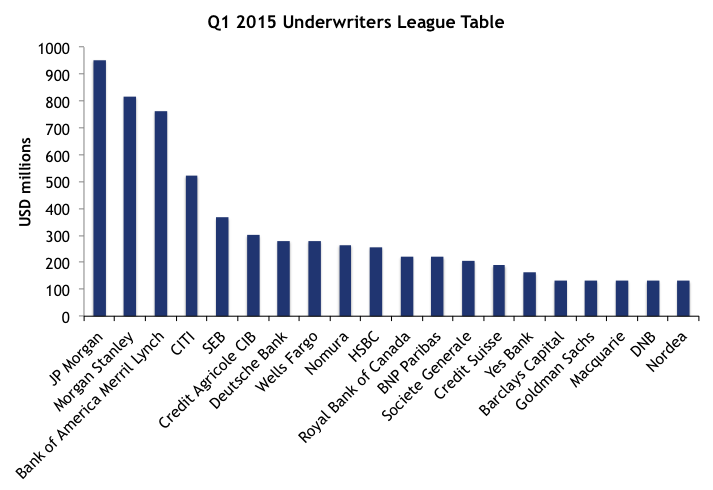

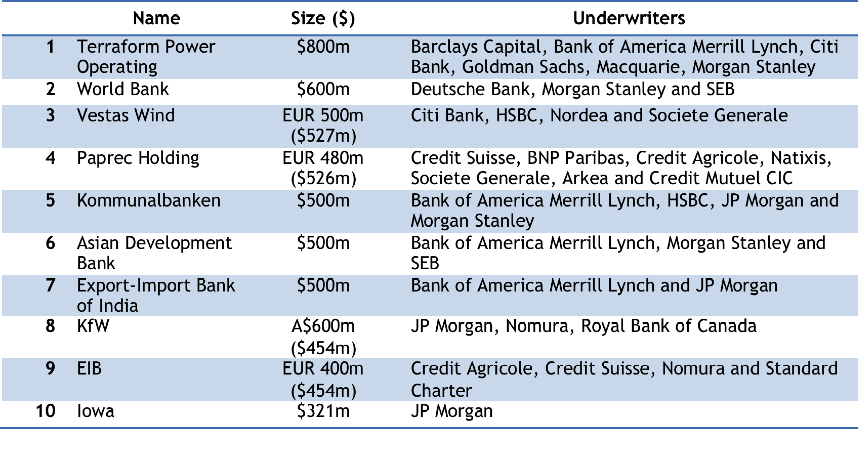

All change at the top of the underwriter’s league table in Q1 2015 compared to the standings for Q4 2014. JP Morgan takes the lead for the first time ever! Despite not being involved in the 3 biggest deals of Q1, JP Morgan still managed to come out top after underwriting green municipal bonds for Iowa and City of Tacoma. JP Morgan was also involved in green bonds from KfW, Kommunalbanken and World Bank during Q1.

Slipping to second place is Morgan Stanley after topping the table in Q4 2014. Morgan Stanley was involved with the two biggest deals of the quarter, Terraform Power Operating and World Bank’s $600m green bond.

Top deals in Q1 2015

Bank of America Merrill Lynch (BAML) also dropped a place compared to last quarter to come in third in Q1 2015. BAML was involved in four of the top ten deals in this quarter (Terraform Power Operating, Kommunalbanken, Asian Development Bank and EX-IM Bank of India) showing global reach underwriting deals in US, Europe and Asia.

In the fourth spot is CITI after its involvement with the inaugural Vestas green bond and Indiana’s two green water bonds. SEB was involved in the large World Bank green bond and the inaugural green bond from Asian Development Bank. In sixth place is Credit Agricole CIB, which was involved in the French recycling corporate green bond from Paprec Holding.

India’s Yes Bank jumped into the underwriters market by underwriting its own green bond (INR 10bn, 10yr, AA+) in February, also the inaugural green bond in the Indian market.

Wells Fargo also shifted up a few places thanks to US green muni issuance for green property in US state universities (Arizona and Virginia).

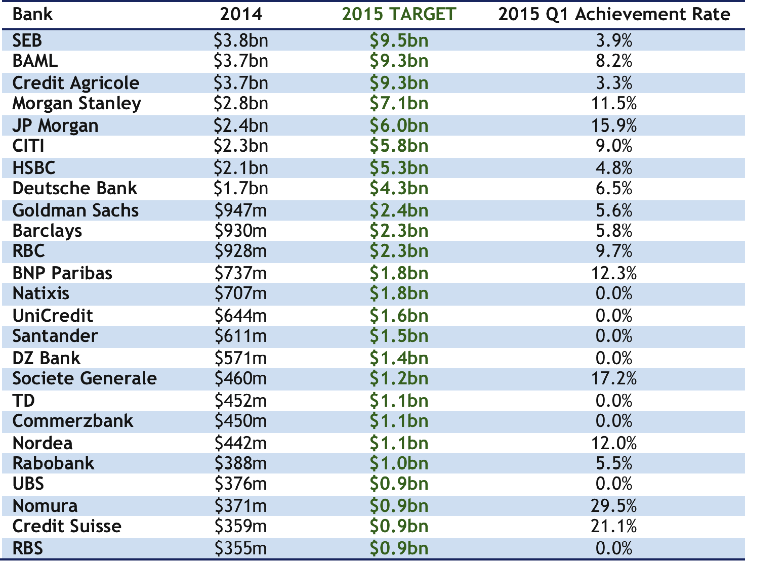

So, how are the underwriters getting on with the targets we set for them at the beginning of the year?

At the beginning of the year, Climate Bonds set some targets for the underwriting banks to help them aim even higher for green bonds in 2015 than they did in 2014. We based our targets on each bank’s relative performance (share of green bonds’ underwriting) in 2014 and our stretch target for total green bond issuance hitting $100bn in 2015. In other words, those banks that were really busy in 2014– such as Credit Agricole CIB, SEB and BAML, have been set the biggest targets for 2015.

Now, as the main chunk of 2015 issuance is still to come, as we pointed out in our Q1 overall market review, it is no surprise that the banks with the largest targets are lagging a bit behind the aims we set for them for the first quarter. But they have another three quarters to ramp up their numbers, so just keep pushing!

Q1: How the Underwriters are going against their green bond targets

There are plenty of ways to make a league table and each bring with them different outcomes, so here are a few notes:

- Graphs include only the largest 20 underwriters in each time period but there are many others that have underwritten deals

- All data includes only bonds labelled and marketed to investors as ‘green’ or ‘climate’, the primary definition of this market. This means that figures do not include renewable energy projects or other bonds linked to green projects but not labelled and marketed as such

- Totals are calculated by taking the total deal size divided by the number of lead managers as is the general practice

- Other league tables representing a larger market would usually present data by year, by currency or both. Given that this green bonds market is still relatively small, there is limited scope to break up the market at this stage

- Some issuances fall on the cusp of the quarter in which case we use the announcement date as recorded on Bloomberg to determine its quarter

- Exchange rates taken as the last price on the announcement date