Media release

The Climate Bonds Initiative today released further data from their recent report ‘Bonds & Climate Change: the state of the market in 2013’, showing which lead managers are driving growth in this market.

"The report shows that there's a large amount of issuance out there in the climate bonds space, but the real game is with the underwriters. We continue to see very strong demand, so a step-up is needed in origination" said Sean Kidney, CEO of the Climate Bonds Initiative.

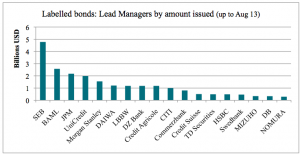

Kidney added "There are two groups of leading underwriters. The first is the labelled climate bonds market (including IFC and World Bank Green bonds) where Swedish Bank SEB is the clear leader, punching way above its weight, followed by Bank of America Merrill Lynch and JP Morgan."

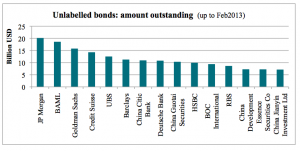

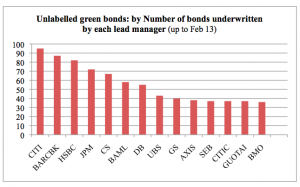

"The second is the unlabelled climate bonds market, as identified in the report ‘Bonds & Climate Change: the state of the market in 2013’. In that much bigger universe it’s JP Morgan, Bank of America Merril Lynch, Goldman Sachs and Credit Suisse who dominate in terms of deal size and Citi, Barclays and HSBC leading in terms of number of deals."

The climate bonds space is becoming increasingly attractive for the large banks. Suzanne Buchta, a Managing Director from BofA Merrill Lynch’s Debt Capital Markets division, noted that "BofA Merrill Lynch has been a leader in the Green Bond market since we led the first such bond, the European Investment Bank’s EUR600mm Climate Awareness Bond, in 2007. Since then we have led other green bonds for the World Bank, the Korean Import-Export Bank, EIB, Commonwealth of Massachusetts, OPIC and others. We are excited by the growth in the market with larger issuance sizes, additional issuers and increasing investor interest."

Michael Eckhart, Managing Director and Global Head of Environmental Finance at Citi’s Corporate and Investment Banking division, added "This information is useful for all parties including issuers, underwriters and investors. Citi applauds the work of Climate Bonds Initiative."

SEB’s leadership in the labelled market highlights how a relatively small bank can create a significant business by promoting issuance in this space. SEB’s green bonds lead Christopher Flensborg noted that "After years of hard work of early investors, issuers and banks - it is great to see the traction Green Bonds get now."

"For the first time ever, I think, we see mainstream portfolios engaging in climate financing in a direct and thoughtful manner - the work done by The World Bank and other early issuers have enabled this activity and the contributions from institutions like the Climate Bonds Initiative to map the potential market and raise awareness has been very important. From SEB we see a clear trend of the market taking off and will continue to show strong commitment in our interaction with issuers and investors."

Kidney said "The labelled green bond market from development banks has shown what can be done and the scale of demand. We now expect to see the model being used in the corporate sector. For that market, however, stringent green or climate bond standards will be of paramount importance."

"For investor demand to remain high there has to be trust in the green credentials of the bonds. Independent verification in the corporate sector will be pivotal to ensuring trust that bond proceeds are used as they are marketed."

Sean Kidney will be speaking at Bloomberg LP in New York City today at 12:45pm as part of Climate Week.

Disclosure: BofA Foundation is a funder of the Climate Bonds Initiative.

League Tables

Underwriters in the $9bn “labelled” green and climate bond market.

Note: Full value of the bond has been attributed to each of its lead managers

Lead underwriters in the $346bn climate-aligned bond market (by amount outstanding)

Note amount outstanding has been divided by the number of lead managers and allocated equally

Lead underwriters in the $346bn climate-aligned bond market (by number of bonds)

Source: Research completed for Climate Bonds Initiative “Bonds & Climate Change: the state of the market in 2013”, commissioned by HSBC.