(Apologies for the double post. This is the correct one)

1. The total size of the global debt securities market is (drum roll): $78 trillion … not the previously reported $100 trillion

If you’re thinking that figure looks odd, you’re right, this is some $20 trillion less than last reported – but it’s just change in counting methodology, not some sort of calamitous drop in the bond market.

The Bank of International Settlements did a review of their methodology and found that there was considerable double counting in what they classified as domestic bonds and what they referred to as international bonds. Taking domestic and international debt securities together had over-estimated total global debt securities by roughly $20 trillion! They have amended their methodology now to take a consistent approach between the two and now report a total global debt securities figure of $78 trillion.

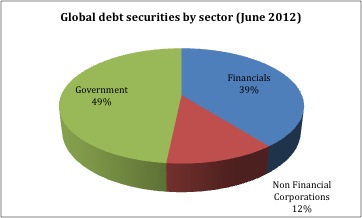

2. Debt securities from non-financial corporations make up 12% of the market

Data compiled by the Bank for International Settlements, http://www.bis.org/publ/qtrpdf/r_qa1212.pdf

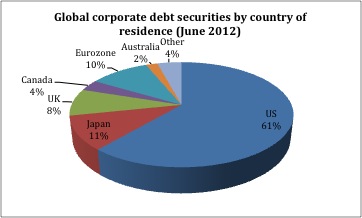

3. The majority of corporate debt outstanding is issued by US resident entities.

The US corporate bond market is the most developed and liquid corporate bond market in the world, affording US corporations valuable added financial flexibility. Eurozone issuers are, notably, only 10% of the global market, well below what the size of their corporations would otherwise suggest. This is because the European corporate debt funding market has historically been dominated by bank financing. The credit crisis has highlighted the dangers of being over reliant on the banking sector, resulting in a recent shift in focus from European corporations towards diversifying their funding into corporate bond markets. This trend has been further supported by European bank regulators forcing their banks to de-lever, resulting in a decreased availability of bank funding. Not great for business, nor for renewables and energy efficiency investments.

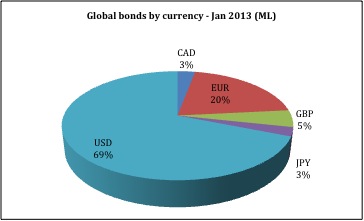

4. Approximately two thirds of corporate bonds outstanding are issued in USD, while 20% are issued in EUR[1]

The depth of the US market makes funding in USD attractive not just to US residents but also to foreign companies. These foreign companies can be seeking to hedge a USD cost base or simply to tap the deep US market with its sophisticated investor base.

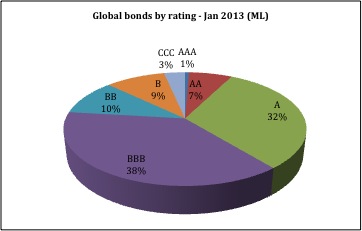

5. Approximately three quarters of corporate bonds outstanding are issued by investment grade issuers

The lower risk nature of investment grade bonds (BBB to AAA) allows for greater portfolio allocations, particularly from pension and insurance funds. Supply of investment grade bonds is also larger as most large multi-national corporations tend to structure the balance sheet to be consistent with investment grade credit rating.

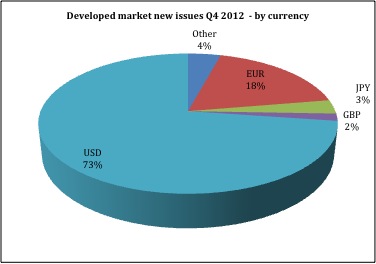

6. Three quarters of corporate bonds issued in the fourth quarter of 2012 were in USD[2]

Encouraging signs from the US economy supported issuance from USD issuers over the quarter.

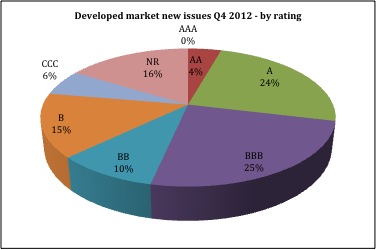

7. 31% of corporate issuance in the December quarter 2012 was from issuers with a high yield credit rating (BB, B and CCC)

There were approximately 861 new developed market corporate bond issues during the December 2012 quarter, raising over $484 billion. (Source: bond issues greater than $100m, listed on Bloomberg.) Investors anxious to achieve higher yields have increased holdings of sub-investment grade bonds, supporting issuance from these issuers.

8. US bond funds continued to attract inflows in the fourth quarter 2012

U.S. long-term mutual funds experienced $1.8 billion net outflows over the quarter (Source: Investment Company Institute). Despite the return in risk appetite, investors continued to invest in bond funds, with $65.7 billion of inflows while equity funds had $70.0 billion outflows. Early estimates of the first quarter 2013 suggest equity fund flows have reversed, while bond funds continue to attract inflows, suggesting a move out of cash into equities rather than bonds into equities.

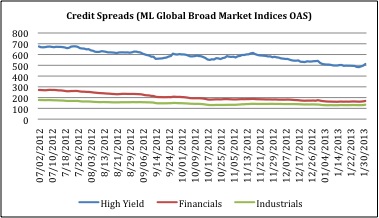

9. Credit spreads continued to tighten in the fourth quarter 2012 before easing off during January.

The move to tighter (lower) credit spreads means investor perception of risk is decreasing. A key catalyst for the market’s improved risk appetite was the European Central Bank’s moves to backstop the European banking system in early to mid 2012. It’s working.

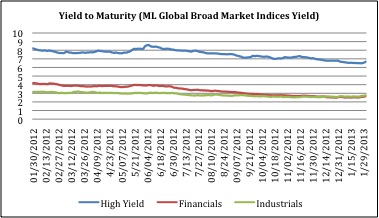

Central bank interference combined with benign inflation rates are keeping yields low

Source: ML Global Broad Market Indices

Central bank policy aimed at decreasing yields on government bond has dragged yields on corporate bonds down with it, with the compression in spreads driving yields down further. With interest rates so low it’s a wonderful time for corporates to be raise finance with bonds.

The take-away: Corporate Climate Bonds are this year’s story

Corporate climate bonds, where proceeds are ring-fenced to climate change related assets like renewable energy or climate-ready water infrastructure, will be an essential part of the climate economy in coming years.

With the investor climate so receptive we expect to see a lot of activity this year and next.

[1] Approximated by using Merrill Lynch Global Corporate and High Yield Index (ex financials) as a proxy for the global corporate bond market.

[2] Source: Bloomberg