Resources:

In a world grappling with climate change, credible and robust frameworks are crucial in guiding climate investment. Enter the Green Bond Dataset (GBD) Methodology, a beacon in guiding investors towards a low-carbon and resilient future.

Our methodology regulates green UoP bonds, bolstering investor confidence and shaping policies to encourage climate investment. We rigorously assess bonds against our criteria, aiming to establish a robust framework for green assets. This document outlines GBD requirements.

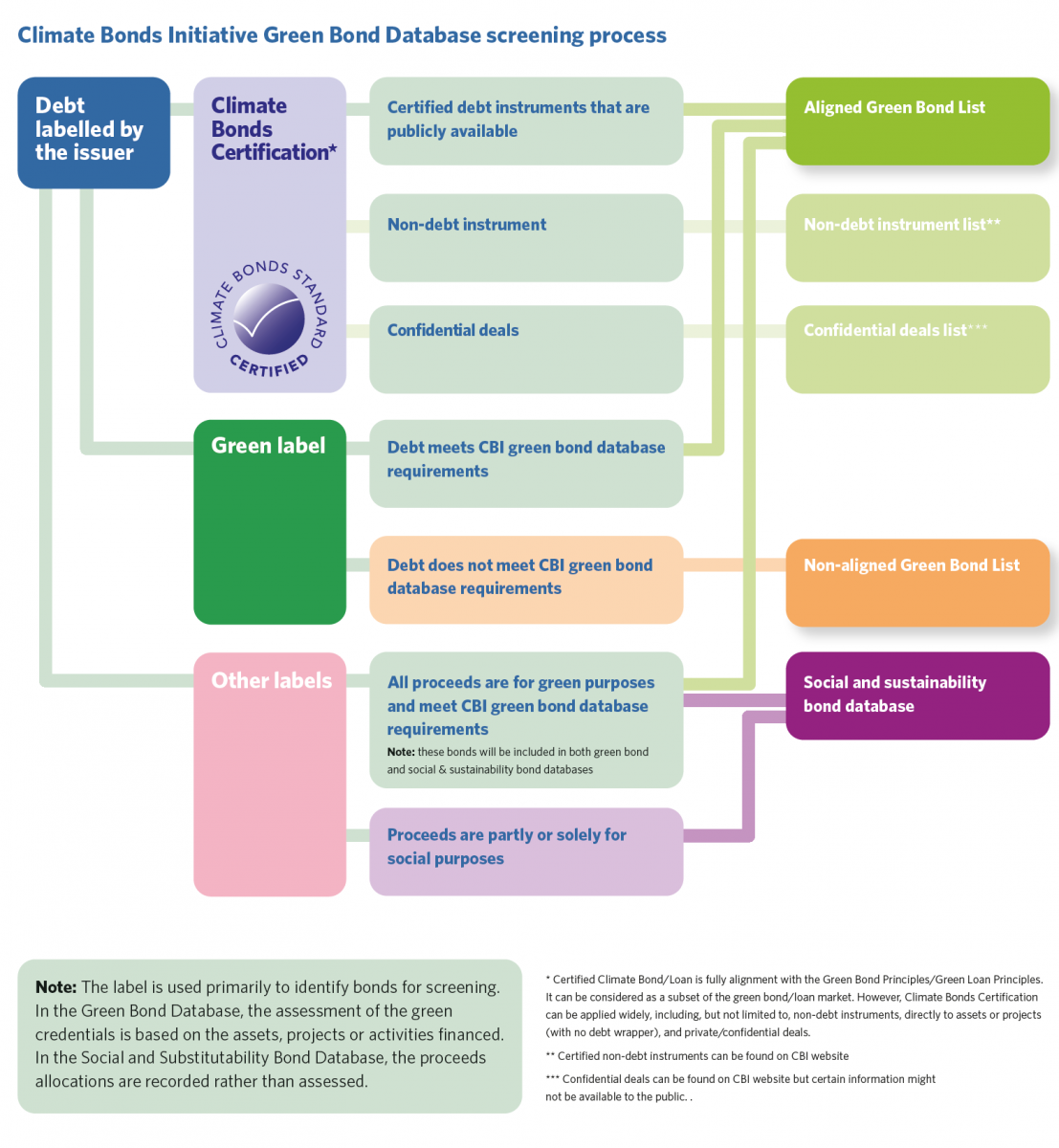

GBD screening process

The three-step screening process to classify a green bond as aligned covers the following:

A. Identification of debt and pre-requisite checks. Basic checks to ascertain whether a full screening assessment is possible/necessary.

B. Screening of green credentials, which relies on determining alignment to a set of sector-specific definitions and eligibility conditions.

C. Evaluating the UoP threshold. Only bonds which are expected to allocate 100% of net proceeds to green assets, with a minimum of 90% directed specifically to aligned green assets, projects, activities, or expenditures, are included in the GBD.

Screening sectors and green credentials

Each bond is reviewed based on the green credentials of the UoP. The key is that the asset, project, or activity to be (re)financed is green, i.e., yields mitigation and/or environmental benefits.

The methodology’s sector screening draws primarily from the Climate Bonds Taxonomy and the Climate Bonds Sector Criteria, supplemented by insights from the EU Taxonomy's criteria for substantial contribution to climate change mitigation (SCC) and other industry standards. The methodology uses an adapted list of eligible sectors and types of assets, projects and activities. Using an adapted list of eligible sectors and asset types, our methodology provides clear guidelines for assessing eligible assets, projects, and activities.

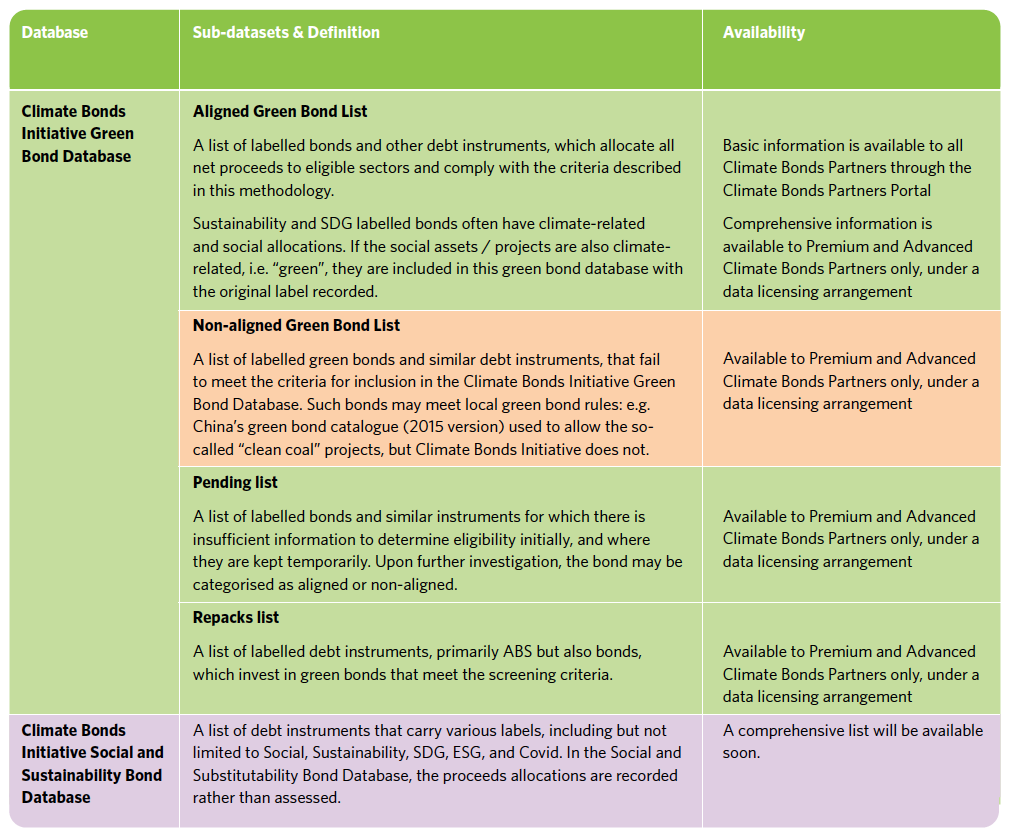

Classification of instruments