A new report indicates the objectives of the Paris Agreement are being integrated into the corporate strategy of climate Bonds across all sectors in the Asia-Pacific (APAC). The report authored by the Climate Bonds Initiative and Fitch Solutions, in partnership with the Asia Infrastructure Investment Bank (AIIB) and Amundi, shows the degree of strategic integration varies at country level and within each sector, pointing to the need for consistent policy support.

However, of the three objectives of the Paris agreement: climate change mitigation, adaption, and contribution to the transition to net zero, adaptation is the one receiving the least attention from entities in the form of physical risk assessment, and consequently the management of such risks. The country, sector and entity level performance are measured against AIIB - Amundi’s Climate Change Investment framework (CCIF). The framework was designed to help tailor investment portfolios that actively consider alignment with the Paris Agreement.

The Paris Agreement calls for ‘making finance flows consistent with a pathway towards low greenhouse gas (GHG) emissions and climate resilient development’. To achieve the Paris Agreement goals, all sectors of the global economy, and in particular hard-to-abate industries, must rapidly decarbonise. The report details the full findings and methodology.

Country-Level Analysis

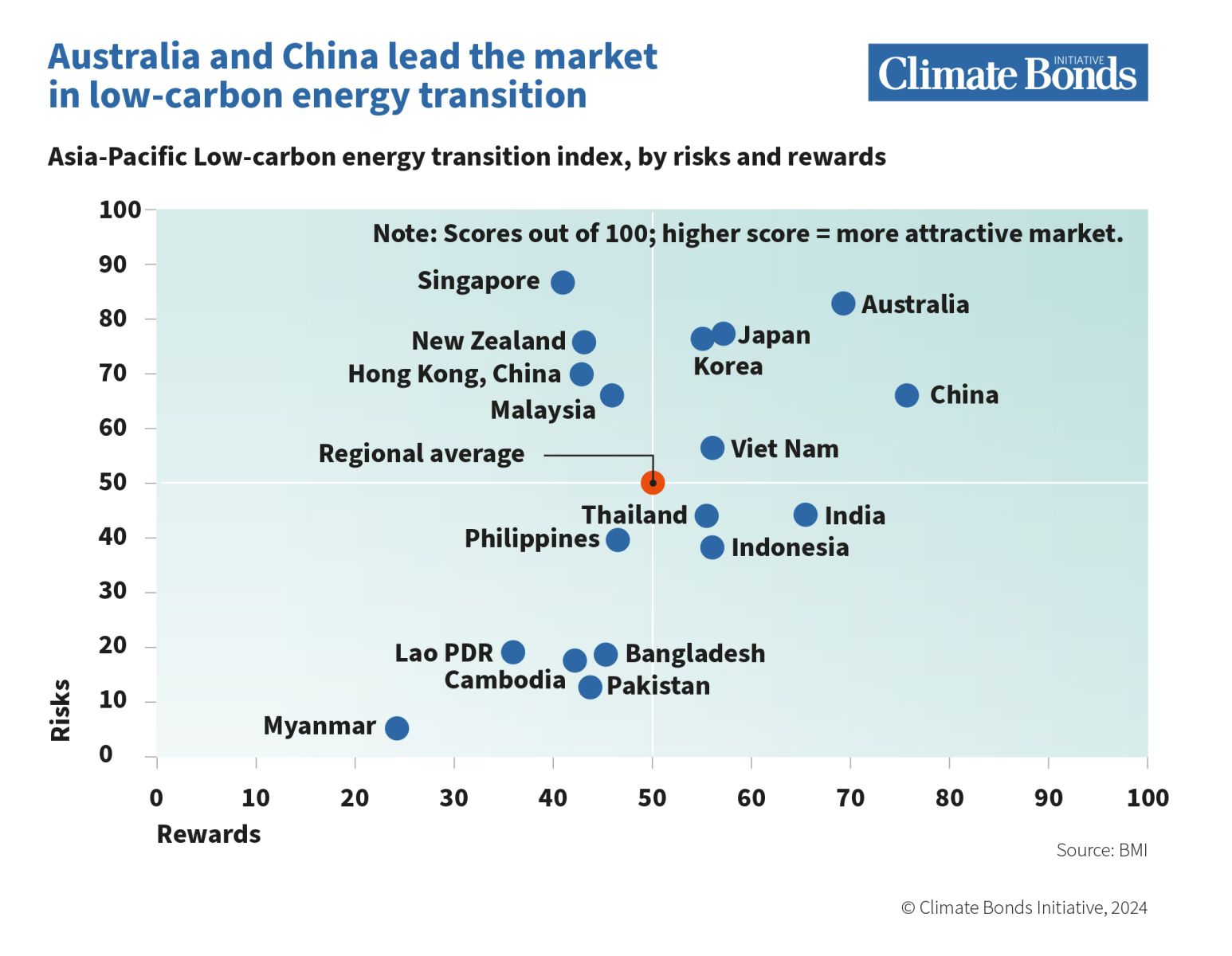

Australia and China perform very well in the framework due to their supportive business environments for low-carbon energy transition and robust renewable sectors. Overall, high-emission power types remain dominant in the regional power mix, accounting for almost 60% of power generation between now and 2032. This presents significant opportunity for low-carbon power as energy transition accelerates in APAC.

Further country wide findings:

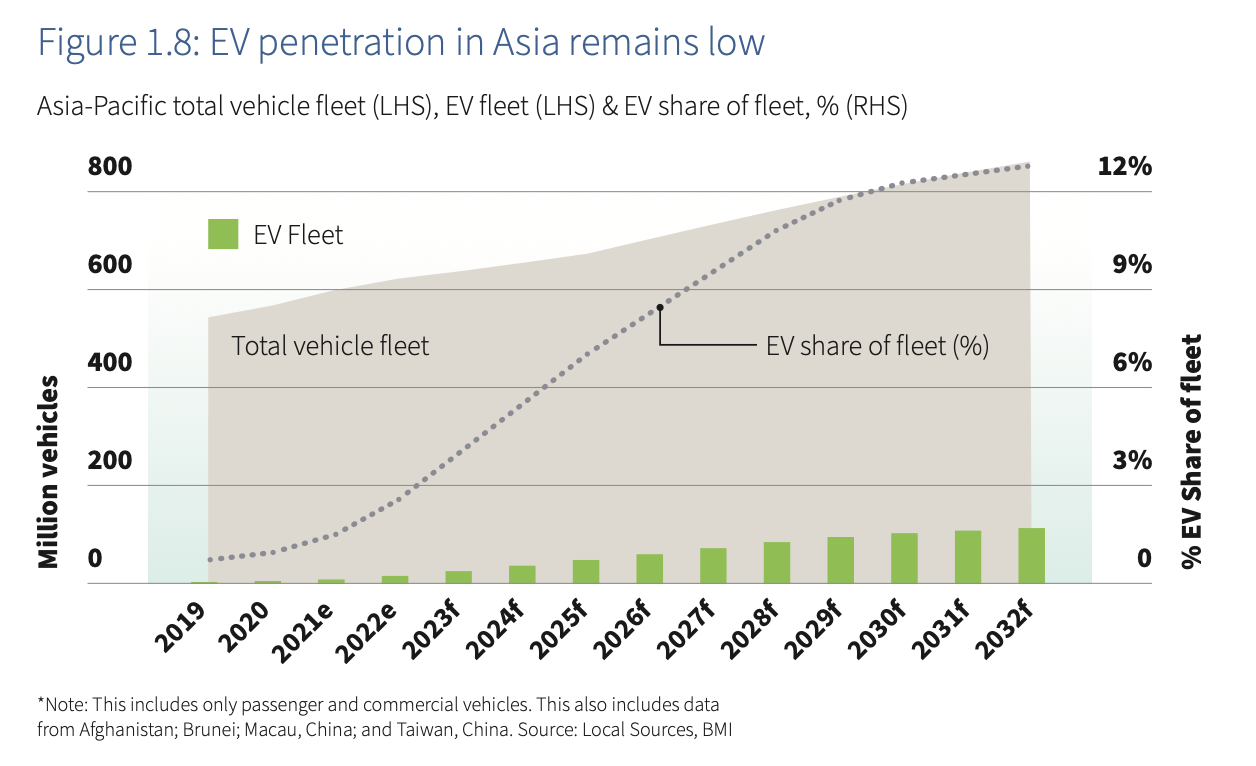

- Newer technologies such as EVs and hydrogen are still limited in the region. Electrification efforts are supporting these new technologies, which should drive an increase in electricity consumption.

- The energy trilemma of cost, sustainability, and security presents a challenge for APAC markets in terms of energy policy. There needs to be a balanced approach to energy policy across the region.

- Developed markets across the region tend to have stronger country fundamentals, benefit from higher government spending, and as a result suffer from lower grid losses, meaning renewable development in these markets is less risky.

- Developing markets carry risk but some, such as Thailand, Indonesia and India score well on the Rewards part of the framework. Moreover, India, Indonesia, Vietnam, and the Philippines account for 90% of global coal growth, offering financial institutions ample opportunities to support a transition.

Sector-level analysis.

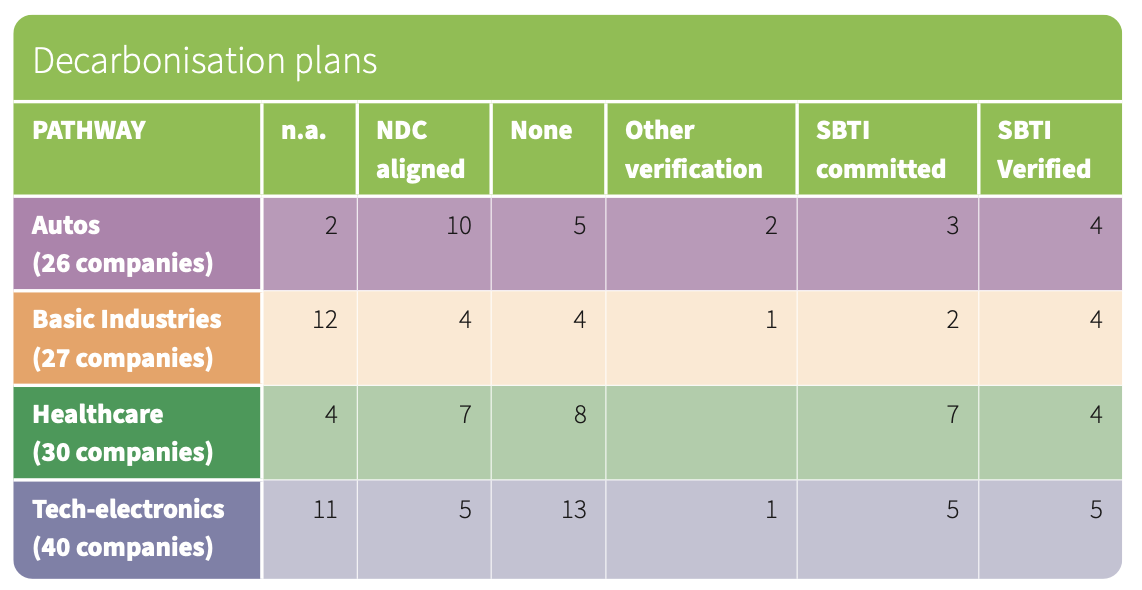

Fitch Solutions applied the CCIF to four sectors of economic activity, each with a different role to play in the transition: the auto sector, tech-electronics, healthcare and basic industries.

The auto sector provides an example of a sector that needs to shift its whole business to new product ranges, and this process is already well underway for most entities operating in the sector.The adoption of EVs will drive electrification efforts and power demand over the next five years. Twelve out of the 18 markets covered in this framework are expected to experience growth in their EV fleet from the end of 2022 to 2027.

However, EV penetration is still limited currently (see Figure 1.8), at less than 3% of the automotive fleet. This is expected to reach to 10% in 2027 and 13% in 2032 which will increase the need for clean electricity to supply the grid, and grid management solutions such as battery storage, adding potential to these sectors.

Company Level analysis

Of the 26 auto companies assessed, all 26 companies except one are including EV/batteries in their product offering and board oversight of the transition is standard for most. Despite venturing into EV production, most manufacturers’ product offerings remain ICE-dominant, particularly in Asian and developing markets. The auto sector has a major role to play to accelerate the decarbonisation of the supply chain but despite 75% of companies having a green procurement policy, yet no concrete engagement to procure green steel had been announced among the sample studied.

The tech-electronics and the healthcare sectors are not material GHG emitters and technologies are established to cut their direct emissions. Both sectors still have a role to play in a net-zero economy but their business models are not directly impacted by the transition. The tech-electronics sector is seen as an enabler as it can deliver new technology solutions to help the rest of the economy become energy efficient. Whilst climate change does not influence the strategic orientation of the 40 techelectronics companies, sustainability still matters. Half of the sample has identified the opportunities generated by climate change and made changes to the product offering. Half of the companies have announced a green procurement policy but there is no indication yet that their effort is having a material impact on the supply chain.

Basic industries provide a typical example of a hard-to-abate sector, for which technological and economic feasibilities are known challenges to the transition. There is a shortfall in data being reported on ESG across these four sectors which requires an integrated policy-driven approach to the imposition of data reporting standards. A regional – or even sub-regional – framework is required so that governments take a more uniform approach to data reporting.

The report finds that the main potential contribution that the healthcare sector can make to the transition is through its supply chain engagement, particularly with the chemical sector. Climate Bonds analysis demonstrated that a majority (19) of the companies have already green procurement in place.

When targets are set, a material proportion of companies do not yet align these with a decarbonisation pathway. For those companies that are more advanced, the main pathway followed is in line with NDC. SBTi verifications remain a minority.

Adaptation plans remain the least advanced objective of the CCIF in each sector and planning is not observed more in high-risk countries.

The Last Word: Asia-Pacific is Full of Investment Opportunities

Although there is a wide spread of risks and rewards across the diverse mix of markets in APAC, this offers financial institutions a range of opportunities for investing in the energy transition. Unsurprisingly, the framework reveals the more developed markets offer investors a low-risk environment, with these countries presenting lower operational risks and a more stable political environment.

Climate Bonds would also like to thank Amundi, Asian Infrastructure Investment Bank (AIIB) and BMI a Fitch Solutions Company, for their support in producing the report. You can read the full report here.