Creating Green Bond Markets, Insights Innovations and Tools from Emerging Markets released in Washington

Focus on stakeholders, green finance progress, preparations for harmonisation and market expansion

New Green Bond Market Development Toolkit to assist nations in growing domestic markets and green investment

Green bond policy in emerging markets

Creating Green Bond Markets, Insights Innovations and Tools from Emerging Markets has been released today by the IFC-facilitated Sustainable Banking Network (SBN). The research, conducted by IFC and Climate Bonds, is drawn from examination of thirteen country and regional green bond frameworks; twenty-two SBN members surveyed, and nine interviews with regulators, stock exchanges and banking associations.

It reflects strong market-based action, with policy leadership taking place among emerging markets to drive capital to investments and assets with environmental and social benefits.

New regulations and market-level guidance is enabling rapid growth and innovation in green bond issuance, vital to achieve both global climate targets and the (SDGs). In emerging markets, as of June 2018, China is the largest issuer with USD57.1bn in issuance, followed by Mexico with USD6.7bn and India with USD6.6bn.

Market scale, issuer and investor diversity, standards and most importantly, the acceleration of these numbers is now the next stage in development.

New Green Bond Toolkit

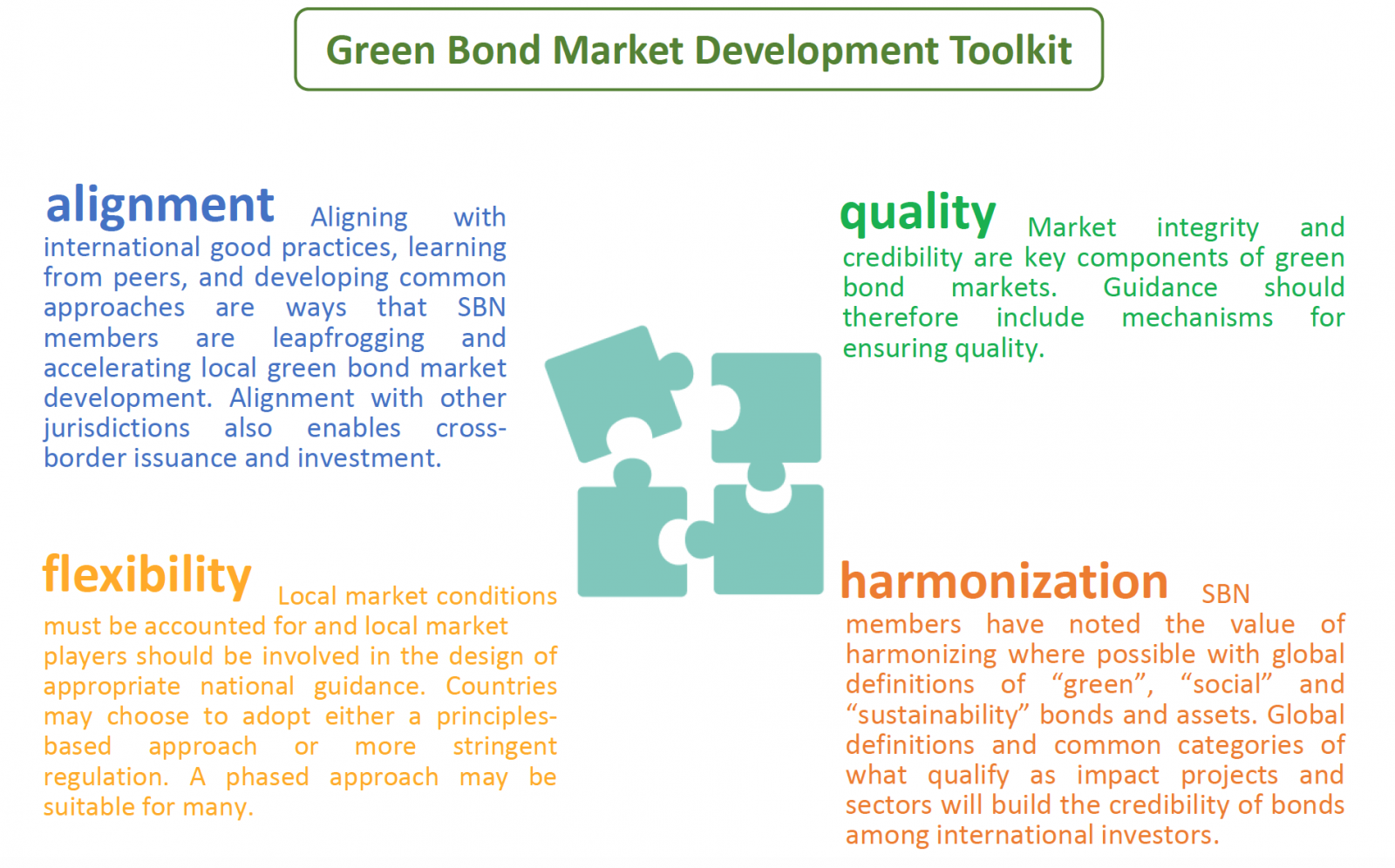

The report incorporates Green Bond Market Development Toolkit; a major step forward to assist SBN members in developing robust domestic green bond markets.

The Toolkit includes the following:

- Common Objectives

- Self-assessment and Planning Matrix

- Roadmap with Common Milestones

- Capacity Building Needs Assessment

Together these spell out the particular steps emerging economies can take to encourage issuance and investment of green bonds. The emerging consensus highlights alignment with international good practices and approaches, as well as efforts to harmonise definitions of what is 'green'.

Common objectives for market development

A total of 13 country and regional green bond frameworks were reviewed for the report and 22 SBN members surveyed and/or interviewed. Most countries report carrying out careful studies of international best practice and extensive consultation within their institutions and with market participants to develop national green bond guidance.

All the national and regional guidance reviewed in the report has some level of substantive consistency with, or direct reference to, international guidelines as provided by the Green Bond Principles (GBPs) and the Climate Bonds Standard.

Roadmap with Common Milestones

Who’s saying what?

Jamie Fergusson, Manager IFC Sustainability Leadership Team, host of SBN Secretariat:

“Green bonds are paving the way for a rich ecosystem of sustainability-themed financial products by igniting policy and regulatory reform, sector wide dialogue, and market evolution."

“This report empowers emerging markets’ regulators with decision making tools to design more sustainable financial markets.”

Sean Kidney, CEO Climate Bonds Initiative:

“Green capital formation is a vital factor in funding of climate mitigation, adaptation and resilience measures in emerging economies and to close the climate finance gap.”

“The report provides a new platform for regulators, banks, investors and other stakeholders to support the development of robust domestic market frameworks and growth of new green bond driven investment.”

The Sustainable Banking Network

Representing 35 countries and over USD43tn (more than 85%) of banking assets in emerging markets, the Sustainable Banking Network (SBN) is the leading global knowledge and capacity building platform comprised of financial regulators and banking associations committed to collectively advancing sustainable finance. Established in 2012, IFC serves as Secretariat and technical advisor to the Network.

The report was guided by the SBN Green Bond Working Group members and observers from 21 countries and 30 organizations, including the International Capital Market Association (ICMA).

The Working Group is co-chaired by the Latin American Banking Federation (FELABAN), the Morocco Capital Markets Authority (AMMC) and the Financial Services Authority of Indonesia (Otoritas Jasa Keuangan, OJK).

The last word

Following from the release earlier this year of the SBN Global Progress Report, SBN members have shown again that it is possible to unite a wide array of countries in support of sustainable finance; in this case, to accelerate green bond market development with a collective ambition and a consistent approach.

Achieving the right balance between delivering quality products and allowing flexibility for issuers is cited by several SBN members interviewed as a major challenge. Respondents highlighted the need to establish and maintain credibility within local green bond markets in order to build investor confidence and ensure that positive impacts are achieved.

The risk of ‘greenwashing’ was mentioned by a number of interviewees. The need for adopting consistent and tight green definitions also emerges; however, references to both Green Bond Principles and the Climate Bonds Standard are a positive foundation.

Global trends including development of the EU Taxonomy and the harmonisation efforts between China and EU on definitions of green are signalling the direction of travel.

Climate finance long since has joined the frontlines of climate action. Emerging economies: China, India, Brazil, the cities of today and megacities of tomorrow in Asia, Africa and LATAM are the frontlines, where the trillions in green capital must flow, building resilient infrastructure and financing new low carbon development models.

The report, a six-month long undertaking, gives the members of Sustainable Banking Network a new platform for green market expansion.

It puts the emphasis on action in emerging economies, squarely where it’s needed most.

Download: Creating Green Bond Markets, Insights Innovations and Tools from Emerging Markets

Till next time,

Climate Bonds