Reports

-

可持续发展挂钩债券数据库 方法论

气候债券倡议组织(Climate Bonds Initiative, CBI)是一个致力于调动全球资本以应对气候变化的国际非营利性组织。

-

气候债券标准4.0中文版本

气候债券标准和认证计划已拓展到为非金融企业(在经济中提供货物和服务的企业

-

2022年中国可持续债券市场报告

本次报告主要盘点了截至2022年末中国绿色及可持续主题债券市场的发展状况,涵盖了绿色、社会责任和可持续发展债券(GSS)市场以及可持续发展挂钩债券(SLB)和转型债券市场(统称为GSS+ 市场)等范围。

-

气候债券倡议组织 绿色债券数据库 方法论

Climate Bonds Initiative screens self-labelled debt instruments to identify bonds and similar debt instruments as eligible for inclusion in the Climate Bonds Initiative Green Bond Database (the Database).

The screening references the Climate Bonds Taxonomy, albeit using a modified sector list rather than the taxonomy indicators. This document provides information on the approach and the database maintenance process.

-

中国转型金融研究报告:债务工具支持电力行业低碳转型2022

气候债券倡议组织(CBI),华夏理财有限责任公司和香港中文大学(深圳)联合发布《中国转型金融研究报告:债务工具支持电力行业低碳转型》。本报告聚焦电力行业,分析了中国国内电力行业低碳转型过程中的机遇与挑战,梳理了支持电力行业转型相关的融资模式发展,重点关注转型债务工具的市场的发展和市场的现状,并对如何通过可信的转型框架为中国电力行业低碳转型提供融资支持给出了相关建议。

-

全球可持续债券市场2022年第三季度概览

据气候债券倡议组织(CBI)统计,截至2022年9月30日,全球绿色、社会责任、可持续发展、可持续发展挂钩和转型债券(GSS+债券)的累计发行量已达3.5万亿美元;其中,符合CBI 定义的绿色债券累计发行量已突破2万亿。GSS+债券市场已拓展至全球,遍布98个国家和地区。 本季度报告梳理了各标签市场的进展, 并聚焦中东和非洲地区。

-

2022年上半年全球可持续债务市场进展报告

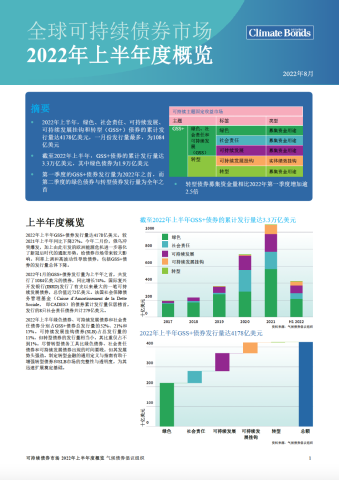

2022年上半年全球可持续债务市场进展报告

-

中国绿色债券市场报告2021

中国在2030年前实现碳达峰是可行的。2021年,中国绿色债券发行量的迅猛增长有力地印证了其加快碳减排工作的雄心; 而实现中国宏大的 “双碳” 目标还需要加快绿色和可持续的投资并进一步壮大其规模。

气候债券倡议组织(CBI)与中央国债登记结算有限责任公司中债研发中心在汇丰银行的鼎力支持下联合发布《中国绿色债券市场年度报告2021》。本报告旨在总结截至到2021年底中国绿色债券市场的发展亮点,并对市场发展趋势做出展望。

-

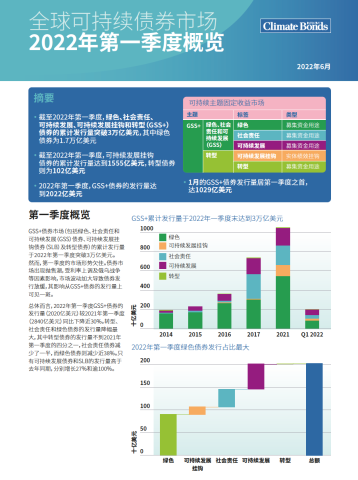

全球可持续债券市场 2022年第一季度概览

2022年第一季度,全球GSS+债券市场(包括绿色、

社会责任和可持续发展债券,可持续发展挂钩债券以及转型债券) 的发行量超过2000亿美元。GSS+债券累计发行量于第一季度 末突破3万亿美元大关。受利率上调及俄乌战争等因素影响, 第一季度发行量同比有所放缓。但长远来看, 贴标债券市场规模将继续壮大。 摘要:

* 截至2022年第一季度,GSS+债券的累计发行量突破3万

亿美元,其中绿色债券为1.7万亿美元 * 截至2022年第一季度, 可持续发展挂钩债券的累计发行量达到1555亿美元,转型债券为

102亿美元 * 2022年第一季度,GSS+债券的发行量达到2022亿美

元

* 1月的GSS+债券发行量居第一季度之首,达1029亿美元 -

中国绿色金融政策分析报告2021

气候债券倡议组织和商道融绿共同发布《中国绿色金融政策分析报告2021》,本报告得到了英国加速气候转型合作伙伴计划(UK PACT)的支持。

报告面向国内和全球范围内关注中国快速发展的绿色金融市场最新动态的利益相关方,探讨了中国绿色金融和绿色债券市场相关政策发展的四个要素:

-

中国绿色金融政策聚焦碳中和的相关进展;

-

-

中国绿色债券 投资者调查 2022

中国绿色债券 投资者调查 2022气候债券倡议组织和商道融绿在香港交易及结算所有限公司和法国外贸银行的支持下,于今天发布了《中国绿色债券投资者调查报告2022》。 报告中的问卷参与对象(42家机构)均来自中国银行间市场交易商协会发布的中国主要绿色债券投资者名单,以及活跃在中国绿色债券市场的国际投资人。该调查显示绿色资质和信用基本面是进一步提高中国市场绿色债券吸引力的关键。欢迎下载阅读! -

全球绿色分类标准制定、统一及实施进展研究报告

气候债券倡议组织(Climate Bonds Initiative)与英国加速气候转型合作伙伴计划(UK PACT)合作,发布了全球绿色分类标准制定、统一及实施进展研究报告,该报告重点介绍了绿色分类标准发展的最新趋势及对可持续金融市场的影响。

该报告将欧盟和中国的绿色分类标准作为案例研究,比较了它们的指导原则和技术筛选标准,及中欧推出的《共同分类目录》中考虑的相关要素。此外,该报告讨论了绿色分类标准在绿色金融市场的应用,包括产品开发、风险管理、品牌推广和信息披露方面。

该报告现已提供中文和英文版本下载。 -

中国转型金融研究报告

《中国转型金融研究报告》是由气候债券倡议组织和中节能衡准科技服务(北京)有限公司共同撰写,并由英国加速气候转型合作伙伴计划(UK PACT)资助。本报告梳理了当前转型金融的最新进展,提出实现可信转型应遵守的原则,并以中国钢铁行业为例,讨论如何应用转型金融。

-

中国可持续债券市场盘点报告

《中国可持续债券市场盘点报告》分析了中国可持续债券市场截至2021年上半年的发展情况,重点关注现有可持续债券品种的定义、监管框架和市场发展,并将视角拓展到市场标准和激励/约束政策的最新发展。这份报告由气候债券倡议组织和兴业研究联合推出,感谢英国加速气候转型合作伙伴计划(UK PACT)的支持。

-

金融支持农业绿色发展的共同语言 --农业绿色发展分类方案和评估方法

推進農業綠色發展,是統籌推進經濟、政治、文化、社會、生態發展的具體體現,是農業供給側結構性改革的重點。

為中國農業部門的綠色轉型融資在很多方面都很重要。它不僅鼓勵對農業產業綠色發展的投資,而且提高農業經營主體的成本、市場和風險意識,促進農業綠色發展的產業、生產和管理體系的發展。

下載我們的最新報告,了解更多關於中國在當地農業綠色轉型之路上的信息。

-

全球气候相关债券市场与发行人报告2020年

CBI《2020年全球气候相关债券市场与发行人报告》提供了全

球非贴标气候相关债券市场的最新进展和全面分析, 揭示了贴标债券市场以外的可持续投资机会。 非贴标气候相关债券市场(climate-aligned bonds universe)

是气候债券倡议组织通过特别开发的方法论长期追踪的市场, 强调了那些未被发行人明确标记为“绿色”的投资机会。 通过追踪这一部分债券市场, 可进一步引导全球资本投向与气候相关资产和活动。 目前,绿色、

社会和可持续贴标债券是气候相关债券发行人在资本市场上为其业务 运营进行再融资的主要工具。CBI的数据分析发现, 贴标债券发行人往往拥有更广泛的投资者基础, 并从绿色标签提供的额外可见度和负溢价中获益。 -

绿色、社会和可 持续主权债券: 发展贴标债券市 场的中坚力量

基于与19个主权债券发行人的对话, 气候债券倡议组织(以下简称“气候债 券”)撰写了全球首份针对绿色、社会及 可持续主权债券(Sovereign green, social, and sustainability (GSS) bond,以下简称“贴标主权债券”)的调 查报告。

-

中国的绿色债券发行与机遇报告

全球范围内,绿色基础设施建设正带来巨大的投资机遇。为了实现《巴黎协定》中提出的减排目标,从现在起至2030年,全球预计将产生价值约100万亿美元1( 707万亿人民币)的气候适应型基础设施需求。但目前该领域仍然缺乏可识别、可投资、可盈利的相关项目。同时,对于符合绿色金融条件的资产和项目类型也缺乏明确的界定。

为应对这一挑战,本报告旨在明确并展示中国的绿色投资机会,倡导增进对于绿色定义和投资方向的认知,并助力作为绿色基础设施融资手段的绿色债券的发行。本报告还有助于满足对于绿色投资机会持续增长的需求,并支持中国向低碳经济的转型过渡。报告致力于促进项目所有者、开发商以及机构

投资者间针对这一主题进行的更多参与。报告中探讨了绿色投资机会和相应的绿色金融工具,并展示了各领域的投资选择。 -

中国绿色债券市场 2019 研究报告

本报告总结了中国作为2019年全球最大贴标绿色债券来源的重要发展,聚焦绿色债券发行情况、相关政

-

Hong Kong Green Bond Market Briefing 2019

Produced in partnership with HSBC, and supported by the Hong Kong Monetary Authority (HKMA) and the Hong Kong Green Finance Association (HKGFA), Climate Bonds Initiative’s second Hong Kong Briefing Paper examines a range of green bond deals from domestic issuers, and for the first time assesses their post-issuance disclosure.

-

Comparing China’s Green Definitions with the EU Sustainable Finance Taxonomy (Part 1)

This briefing provides a preliminary analysis on China's Green Bond Endorsed Project Catalogue, the Green Industry Guiding Catalogue and the EU Sustainable Finance Taxonomy in terms of their guiding principles, users, classification and screening criteria. The aim is to identify the differences in green definitions across Europe and China and facilitate the harmonisation process.

-

China Green Bond Market Newsletter H1 2019 / 中国绿色债券市场季报 2019 上半年度

In the first half of 2019, total green bond issuance from China went up to USD21.8bn, a 62% increase year on year, largely due to contributions from regional banks and the private sector as a whole.

-

中国绿色债券市场2018

第三份中国绿色债券市场报告,

对此全球第二大绿色债券市场2018年的关键发展进行了分析, 聚焦绿色债券发行情况、相关政策制定和更广泛的市场增长。 -

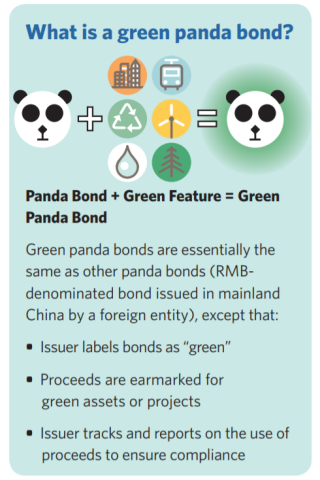

Green Panda Bond Handbook

China’s green bond market, with clear rules, active market players, and supportive investors and policymakers, offers a great opportunity for foreign green bond issuers.

-

The Climate Bonds Taxonomy (Chinese)

The Climate Bonds Taxonomy is a guide to climate aligned assets and projects. It is a tool for issuers, investors, governments and municipalities to help them understand what the key investments are that will deliver a low carbon economy.

-

Facilitating Cross-Border Capital Flows to Grow China's Green Bond Market

This ground breaking new report explores the challenges of increasing inter-country capital flows into China’s green bond market and puts forward potential measures and solutions to facilitate and improve capital flows to support the expansion of green investment and the green bond market.

-

Study of China's Local Government Policy Instruments for Green Bonds

This report is jointly released by SynTao Green Finance and Climate Bonds Initiative at China's Green Finance Committee Annual Conference in April 2017. It provides an overview of local government policy instruments for developing green bond market in China with further recommendations.

-

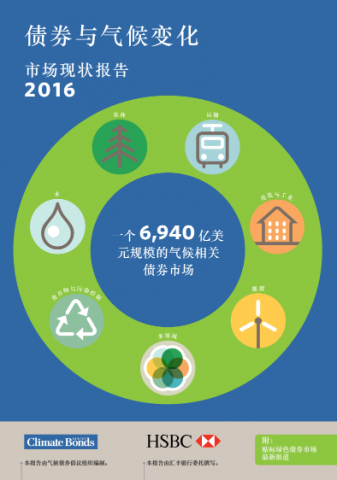

Bonds and Climate Change 2016: Chinese Version

The reports reveals China is the largest country of issuance in the climate aligned universe.

-

Roadmap for China's green bond market

This 2016 series of discussion papers is issued by the Climate Bonds Initiative and the International Institute for Sustainable Development (IISD) on prospects for the Chinese green bond market.