Sovereign Green, Social, and Sustainability Bond Survey

Climate action & market development motivations for sovereign green issuance:

First of its kind analysis from Climate Bonds: Nineteen issuing nations share perspectives

LONDON:14/01/2021:13:00GMT: Supporting government initiatives around climate, catalysing local sustainable finance markets and attracting new investors were amongst the major benefits identified by respondents to a first of kind international survey of sovereign green, social and sustainability bond issuers (GSS). Amplifying transparency, pricing benefits and increased collaboration were also identified among the benefits of GSS issuance within larger strategic government initiatives.

The ‘Sovereign Green, Social, and Sustainability Bond Survey’, was carried out by Climate Bonds Initiative during late 2020 to aggregate and assess the experiences of GSS issuers and their role in market growth.

As of November 2020, twenty-two (22) national governments had issued sovereign GSS bonds totalling USD96bn. For the survey, nineteen (19) issuers originating thirty-two (32) bonds with a combined amount outstanding of just over USD93bn (covering 97% of total sovereign GSS issuance) were interviewed. Eight (8) respondents were from Developed Markets, and eleven (11) from Emerging Markets.

The survey explored in detail the front to back process of issuing a GSS bond and solicited views on additionality as well as advice for other issuers.

Survey Highlights:

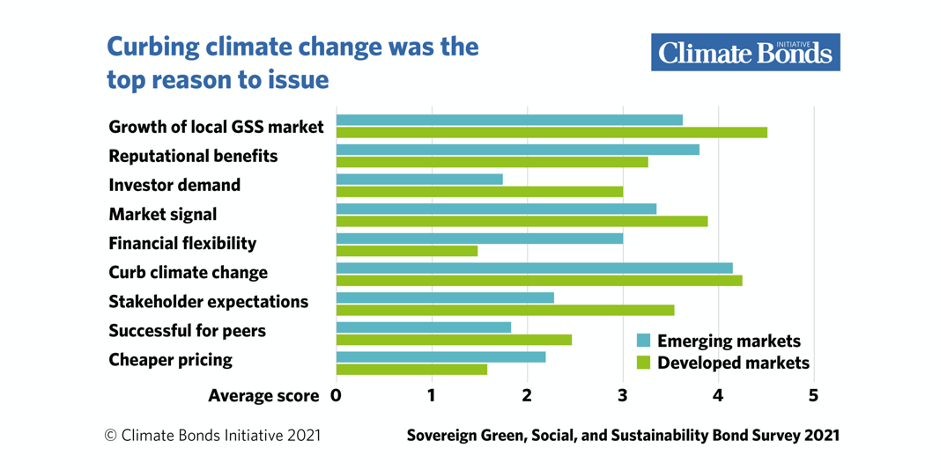

Supporting climate strategies, a trigger to issuance:

In most cases, wider strategic initiatives to achieve NDC targets, address SDGs, and mitigate climate change and social inequalities triggered the decision to issue GSS sovereigns. These plans included policies designed to address emission reduction goals as well as net-zero ambitions. With an average score of 4.2 (out of 5), curbing climate change was the leading reason why governments issue GSS bonds.

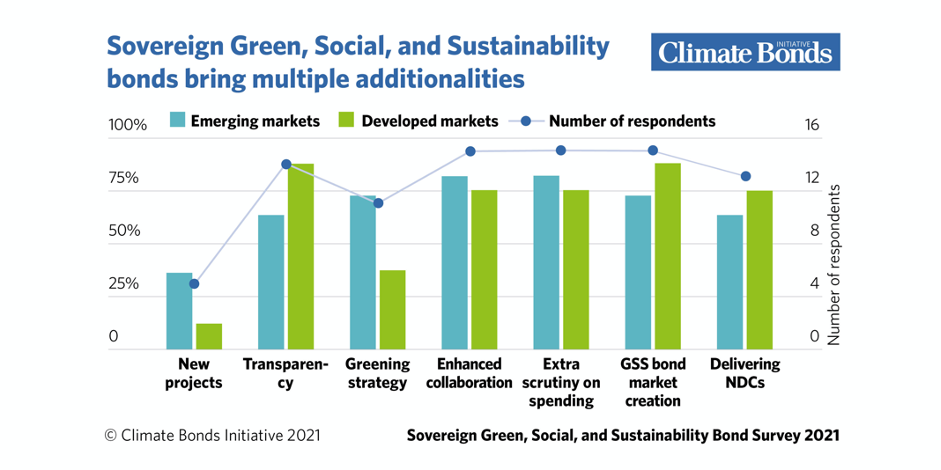

GGS played catalyst role in market creation, collaboration and transparency:

GSS bond market creation as well as enhanced collaboration, and extra transparency were all considered additionalities by most participants. The former was stated as a key motivation for issuing a sovereign GSS bond by multiple respondents. Sovereign issuers can serve as role models for other types of issuers and can provide investors with safe, liquid investment opportunities.

Diversifying and increasing the investor participation:

In most cases, a sovereign GSS bond broadened and diversified the investor base, a key motivation for issuing. Sovereign GSS bonds also encouraged investors to initiate dedicated GSS investment strategies.

Amplifying transparency:

The process of issuing a sovereign GSS bond typically involved a budget tagging exercise and commitments to report on the allocation of proceeds and their impact. These audits greatly increase transparency for ministries and extend to external stakeholders such as investors.

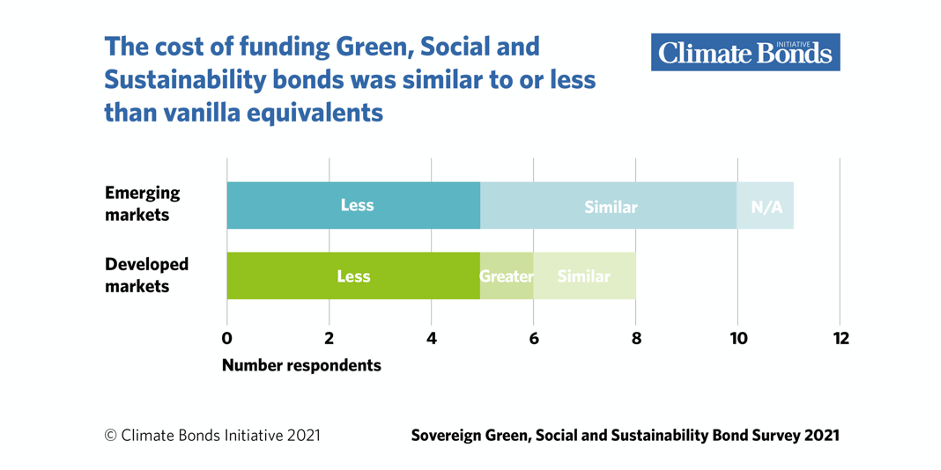

Offering pricing benefits:

A broader investor base can facilitate tighter pricing. If this persists, we expect domestic Debt Management Offices (DMO) to encourage governments to identify and develop a pipeline of suitable GSS expenditures.

Facilitating cross border collaboration and enhance visibility:

Many respondents collaborated with DMO counterparts both pre- and post-issuance. Even the use of proceeds bore an element of international collaboration through funds being used to finance projects beyond the borders of the issuing country.

Delivering benefits that outweigh challenges:

Challenges such as being unable to open a separate account to manage the proceeds from GSS bonds can be overcome and additional costs at issuance are outweighed by benefits including increased visibility. In addition, many channels of support are available, for example from development banks and structuring advisors.

Governments can issue GSS bonds in less than a year:

Despite longer periods to get the ‘green light’ for issuing a GSS bond, once the decision has been made, 89% of the participants stated it takes one year or less to issue the bond.

Jonathan Drew, Managing Director, ESG Solutions, Global Banking, HSBC:

“In a world now focused on the transition to a low carbon economy, sovereign green issuance is pivotal in funding the green investments to be made by the public sector and supporting the development of green finance markets. There is no doubt that sovereign green issuance has been key in raising awareness of the urgent need to tackle the climate crisis and the commitment of governments to take action.

“Public sector issuance has, by setting benchmarks and driving the creation of market infrastructure, been a catalyst in encouraging private corporate and institutional issuers to follow suit, and the mainstreaming of green considerations in financial markets.”

‘With our international network, HSBC is well-positioned to provide support to sovereign green issuance across all regions. We are committed to bringing together public and private sector issuers with investors to drive the transition to a sustainable future.”

Sean Kidney, CEO, Climate Bonds Initiative:

“Sovereign green issuance sends a powerful signal of intent around climate action and sustainable development to governments and regulators. It catalyses domestic market development and provides impetus to institutional investors. Multiple issuances even more so. Doubling the number of sovereign GSS issuers to forty and supporting initial emerging market transactions should amongst climate finance objectives for governments, central banks and development finance institutions.”

<Ends>

For more information, please contact:

Head of Communications & Media

Climate Bonds Initiative (London)

+44 (0) 7914 159 838

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy. More information on our website here.

Survey Background: Climate Bonds surveyed 19 Sovereign GSS bond issuers speaking to individuals involved in the issuance process to gain a comprehensive understanding of the experience, benefits and challenges for governments to issue such bonds. ‘Sovereign Green, Social, and Sustainability Bond Survey’ captures sovereign Green and Sustainability bond issuers. They range from recent and one-off issuers to experienced issuers who joined the market in its early stages.

Respondents were divided into Developed Markets (8) and Emerging Markets (11). These categories are used to describe respondents throughout the paper.

Acknowledgements: Climate Bonds Initiative thanks HSBC for their sponsorship and support in the production of this report.

Suggested citation: Harrison, C., and Muething, L., Sovereign GSS Bond Survey, Climate Bonds Initiative, January 2021

Webinar Briefing:

A Launch Webinar will be held on 28th January 2021, 11:00 London / 12:00 Paris / 13:00 Cairo to discuss report results in detail.

Registration can be found here.

Survey Participants:

Public Debt Department, Ministerstwo Finansow, Republic of Poland

Agence France Tresor, Ministere de l’Economie et des finances, French Republic

Belgian Debt Agency, Kingdom of Belgium Ministry of Economy,

Republic of Fiji Department of Blue Economy,

Republic of Seychelles Debt Management Office,

Federal Republic of Nigeria Ministry of Finance,

Republic of Indonesia EM DM

Ministerio de Hacienda (Hacienda), Republic of Chile State Treasury Department,

Ministry of Finance of the Republic of Lithuania

National Treasury Management Agency, Republic of Ireland

Hong Kong Monetary Authority, Hong Kong SAR

Dutch State Treasury,

Ministerie van Financien, The Kingdom of the Netherlands

Government Debt Management Agency (ÁKK), Republic of Hungary

Secretaria di Hacienda Y Credito Publico (SHCP), United Mexican States Debt Management Office,

The Kingdom of Thailand Ministry of Finance,

Kingdom of Sweden Deutsche Finanzagentur, Federal Republic of Germany Ministere des Finances, Grand Duchy of Luxembourg Capital Markets and Debt Management Unit,

Ministry of Finance, Arab Republic of Egypt

Charts:

Figure 1: Intentions for issuing a Sovereign GSS bond

Figure 2: Additionalities of Sovereign GSS bonds

Figure 3: Cost of funding

ENDS