Climate Bonds launches new Transition Finance for Transforming Companies Discussion Paper

Five hallmarks that identify credible transition

LONDON: 10/09/2021 14:30 GMT+1: The Climate Bonds Initiative has published the discussion paper, presenting hallmarks that will form the basis for Certification of financial instruments and also, how whole companies could be Certified.

The Climate Bonds Standard and Certification scheme intends to extend to instruments beyond use-of-proceeds bonds, including SLBs and similar (e.g., Sustainability Linked Loans - SLLs). The intention is to provide transparency over the science-based criteria for credible SLBs and similar instruments, and assurance for investors that those requirements have been met in respect of any certified issuance. Consideration is also being given to the certification of companies (i.e., not in association with any particular financial instrument).

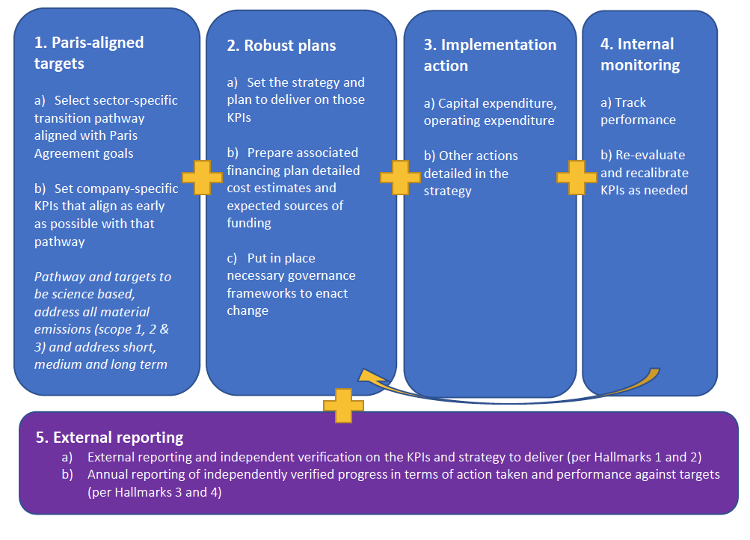

This paper presents the proposal of the five hallmarks of a credibly transitioning company, i.e., a company whose transition is rapid and robust enough to align with the global goal to nearly halve emissions by 2030 and reach net zero by 2050, in line with the Paris Agreement. These would be the key elements that would be the focus of assessment for certification, and all five hallmarks would need to be satisfied.

The hallmarks are (Chart 1.):

- Paris-aligned targets

- Robust plans

- Implementation action

- Internal monitoring

- External reporting

Anna Creed, Associate Director of Thought Leadership, Climate Bonds Initiative:

“The early momentum behind corporate net zero targets and sustainability linked bonds is very exciting. It needs extension and acceleration. We want to closely link them both –to ensure liquid and robust sustainable finance flows to companies, backed by rigor and best practice around transition plans, 1.5-degree alignment and Net Zero ambitions. Our ambition doesn’t stop at corporates, we want the best market standards also applied to investment by banks and sovereigns.”

Sean Kidney, CEO, Climate Bonds Initiative:

“The 2030 & 2050 targets have been set. Climate finance at the entity level, capex shifts & capital flow towards Net Zero business models and that especially in the high emission sectors, is now a core challenge for both corporates and investors.”

“We are putting these five hallmarks of credible transition out to the market for active engagement. Our goal is the rapid development of a robust and transparent transition finance market that supports acceleration of decarbonisation at the entity level. What took almost a decade to develop in green finance, we need to develop in a couple of years for transition finance.”

<Ends>

Press contact:

Senior Communications & Digital Manager,

Climate Bonds Initiative (London).

+44 (0) 7593 320 198

Notes for Journalists:

About the Climate Bonds Initiative: The Climate Bonds Initiative is an investor-focused not-for-profit, promoting large-scale investment for climate action.

Climate Bonds undertakes advocacy and outreach to inform and stimulate the market, provides policy models and government advice, market data and analysis, and administers an international Standard & Certification Scheme for best practice in green bonds issuance. More information on our website here.

About Climate Bonds Standard and Certification Scheme: The Climate Bonds Standard and Certification Scheme is a labelling scheme for bonds, loans & other debt instruments. The overarching science-based, multi-sector Standard which is overseen by the Climate Bonds Standards Board, allows investors and intermediaries to easily assess the climate credentials and environmental integrity of bonds and other green debt products. The Scheme is used globally by bond issuers, governments, investors and the financial markets to prioritise investments which contribute to addressing climate change.

Chart 1.: