"We believe the Forum has helped bring the financial element that has been missing into climate discussions, especially involving implementation of Brazil's COP21 NDCs.”

Elizabeth de Carvalhaes, Executive President of IBA (Brazilian Tree Industry)

What’s it all about?

150 Brazilian stakeholders and international investors gathered at London’s Guildhall to discuss green finance opportunities as Brazil begins to implement policies to meet its NDCs, and associated goals for energy, agriculture, land use, and forestry.

The New Economy forum took place against the back drop of the recent establishment of USD 144m Sustainable Energy Fund (Fundo de Energia Sustentável) by national development bank BNDES and the announcement from paper giant Suzano of their second green bond issuance.

The BNDES Fund is intended to lead private sector green investment and spur the growth of the domestic Brazilian green bond market. The new Suzano green bond is the first issued in local currency, the Real (and 3rd for Brazil).

According to Marcelo Bacci, CFO at Suzano, their green bond had “the lowest yield ever in a CRA (green securitisation) in the local markets, mostly due to its green characteristics.”

Brazil, the giant

Brazil is big. In lots of ways. It has the world’s largest area of arable land in a single country, is the biggest economy in Latin America and 9th largest internationally.

It's also the 5th in population. It’s largest city, São Paulo, is amongst the top 20 global megacities in 2016, and is set to remain there in 2030 with an estimated population of almost 25 million.

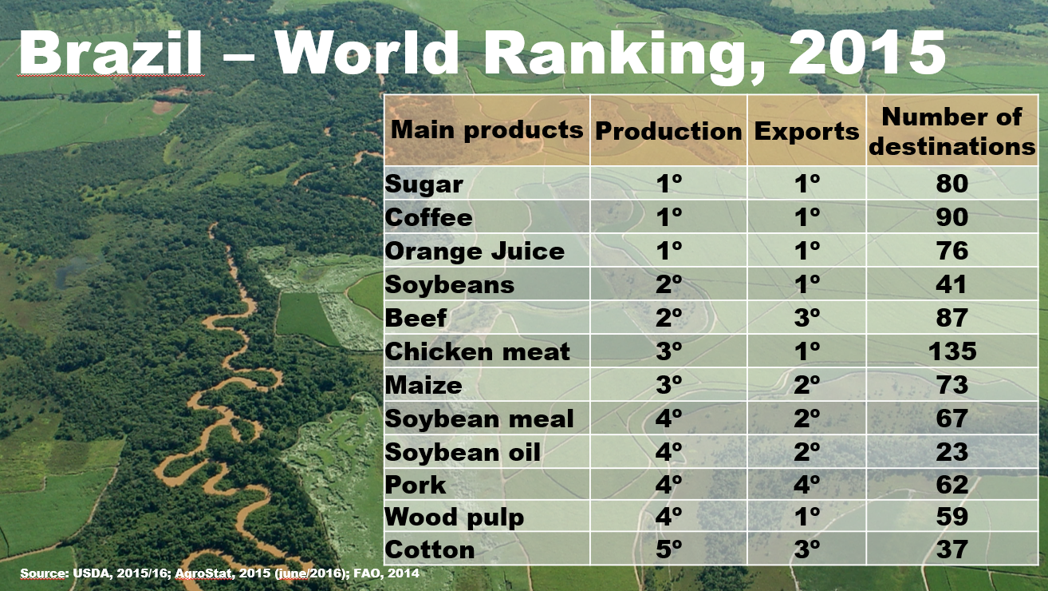

World leading numbers:

- Brazil is the world’s largest exporter of sugar and soybeans,

- 2nd largest producer of Ethanol,

- 2nd largest eucalyptus pulp producer,

- 3rd largest exporter of corn,

- 4th largest producer of fibre furnish,

- Largest producer of sustainable FSC certified packaging,

- 10th in installed wind capacity and by 2019, is expected to be the 6th largest wind market in the world.

This Chart from the Ministry of Agriculture’s presentation at the New Economy forum tells the full story:

Who’s said what?

The impact of the event in building for Brazils sustainable economic direction and climate finance goals has been widely acknowledged…

Eduardo Dos Santos, Ambassador of Brazil to the UK:

"Beyond green finance opportunities, the forum highlighted Brazil’s ambition to reinforce its position at the forefront of a model of development that is prosperous, inclusive and sustainable – not only economically, but also socially and environmentally.”

“Brazil’s increasingly engaged private sector and solid green policy framework is already unleashing a revolution in terms of demand, scale and governance for new sustainable development projects."

Flávio Girão Guimarães, Brazil Ministry of Finance:

“The new framework behind Brazil's infrastructure projects cannot be missed by investors who live in a world of low yields. It is an opportunity to combine economic grow, sustainability and return.”

Elaine Lustosa, Director of Capital Markets BNDES:

"The Climate Bonds Initiative event in London and our Fundo de Energia Sustentável (Sustainable Energy Fund) are positive steps to boost green finance and a strong domestic green bond market. Together they can attract domestic and international investors and grow the Brazilian low carbon economy."

Michelle Lourenço Corda, IR Director Suzano Pulp and Paper:

"Participating in the New Economy Forum was a unique opportunity for Suzano to share with investors the experience of being the first Brazilian company to issue green bonds in USD in the international market. We look forward to the development of the market for green financing opportunities in Brazil."

Flávia Carvalho, IR Superintendent CPFL Renováveis:

"As a pure-play renewables company, CPFL Renováveis is confident in the development of the green bond markets in Brazil and we believe it’s an important alternative to incentive sustainable projects. The opportunity to participate at the Brazil's New Economy forum in London with the Climate Bonds Initiative London, is one we could not have missed."

Elizabeth de Carvalhaes, Executive President of IBA (Brazilian Tree Industry):

"We believe the forum has helped bring the financial element that has been missing into climate discussions, especially involving implementation of Brazil's COP21 NDCs.”

Milton Menten, CEO Ecoagro:

“Ecoagro was proud in participating in the Climate Bonds Initiative 'Investor Roadshow for Brazil's New Economy' in London. It was pretty clear that Brazil is expected to assume a prominent position in the short term as one of the world's main players in green bonds, especially those related to agribusiness, such as green CRAs.”

“The event was also a good opportunity to demonstrate Ecoagro´s leadership in this segment and promote the first ‘green CRA’ issuance in Brazil last November."

The Last Word

The FAO estimates Brazil will have to increase its food production significantly to help meet demand from global population growth of the next decades. The Vice Minister of Agriculture’s presentation to the forum projected increases of more than 33% in grain, milk, pulp and meat production over the next the next decade (check the presentation here).

Simultaneously the world’s largest and most diverse tropical rainforest (the lungs of our planet) needs protection.

A quick look at the rankings and review of United Nations' Food and Agriculture Organization estimates show that accelerating international sustainable land use, agriculture and forestry practices is really all about new ways to feed a large part of the world. And will help meet many of the Sustainable Development Goals (SDGs).

In November 2016 International Finance Corporation’s (IFC) Climate Investment Opportunities in Emerging Markets report, estimated Brazil’s climate smart investment potential for selected sectors at USD 1.3 trillion from 2016–2030.

Investment in sustainable agriculture and low carbon land use will not just be beneficial for Brazil.

This are some of the reasons why Climate Bonds has been so active in Brazil over the past two years, working with the UK Embassy and FCO and the PRI, with local investors and the Business Council for Sustainable Development (CEBDS) to establish the Council for Sustainable Market Development in order to develop market mechanisms and catalyse a robust pipeline of green investments.

Brazil’s New Economy event in London was another step in matching global capital with the climate future that Brazil represents. They’ll be more to come in 2017.

‘Till next time,

Climate Bonds Communications