Despite the political world’s best attempts, the earth is still spinning and issuing green bonds.

Meantime, the message coming from Morocco is, now more than ever, government and private sector action will need to step up between now and COP23 in Bonn on matching NDCs with climate finance.

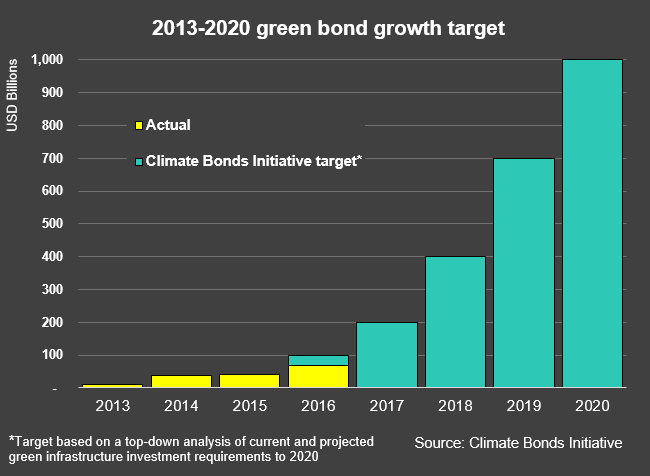

Onwards to the Climate Bonds target of USD 1trn in green bonds by 2020!

And onto the bonds…

Spotlight on Morocco

MASEN Solar Certified Climate Bond: A first for Morocco! 1.15bn dirhams (USD 100m) issuance.

Last week we blogged about a first for Morocco – a Certified Climate Bond to finance solar power projects issued by the Moroccan Agency for Solar Energy (MASEN).

Here’s are a few extra details:

State guarantee: the bond was underwritten by a state guarantee. This allowed MASEN to ensure an optimised interest cost involving just 10bp risk premium. A great example of government support for a nascent African green bond market!

Private Placement: Following the authorization of the Moroccan Authority of Capital Markets (AMMC) the bond issue was completed through private placement to: Al Barid Bank, Attijariwafa Bank, La Caisse Marocaine des Retraites and La Société Centrale de Réassurance.

Clean energy target: The solar projects are contributing to Morocco’s target of 52% clean energy by 2030.

This is the first bond verified under the Climate Bonds Standard by Vigeo Eiris.

According to Bloomberg, Saudi Arabian renewables developer Acwa Power International and China’s Chint Group Corp Ltd were chosen to build the 170 MW of solar projects: the Noor Ouarzazate IV project will have a maximum capacity of 70 MW, Noor Laayoune will have 80 MW and Noor Boujdour will have 20 MW.

The projects will be partly financed by Germany’s development bank KfW which will provide 60 million euros.

Al Huffington Post has some further information in French here.

Bank Al-Magrhib buys USD 100m green bond from IBRD

The Central Bank of Morocco, Bank Al-Maghrib, has purchased 3-year green bonds issued by the International Bank of Reconstruction & Development (IBRD) arm of the World Bank as part of its reserves management program.

Reuters Africa reports that this is its first purchase of this kind of debt product.

We think the statement by Mr. Abdellatif Jouahri, Governor of Bank Al-Maghrib tells the overall story:

"Having become increasingly aware of the effects of climate change at the COP22 in Marrakesh, countries are now specifying how to achieve commitments made in Paris. Bank Al-Maghrib's investment in World Bank Green Bonds has been made in this context. The investment will support sustainable development projects financed by the World Bank, including in countries in Africa."

The World Bank’s wider green bond program received a second opinion from CICERO.

Underwriter: Credit Agricole CIB.

L’AMMC a récemment publié un guide sur les ‘‘Green Bonds’’ au Maroc

(The AMMC has just released a Green Bonds guide for Morocco)

The full guide (in French) has been published by the Moroccan Capital Markets Authority (AMMC), with the support of the IFC. Its target audience includes issuers, investors and financial professionals.

The guide aims to facilitate the development of the green sector in Moroccan capital markets, by offering a clear overview of the green bond issuance process, identifying main requirements and best practices as well as clarifying key stakeholders’ roles.

Credit Agricole Morocco’s inaugural MAD 500m green bond closed as well as BMCE Bank of Africa’s inaugural MAD 500m green bond.

It’s a very exciting time for Morocco and Africa; we’ll keep you updated on these in our next blog!

Certified Climate Bonds

We covered MASEN’s Certified Bond above.

India: Renew Power’s Climate Bonds Certified wind private placement (INR 5bn, USD 75m)

Renew Power’s INR 5bn, 5 year tenor, green private placement in August 2016 was recently awarded Climate Bonds Certification for its 90 MW wind refinancing projects in central India.

One of our newest verifiers, Emergent Ventures India (EVI), undertook the verification report.

Mutual funds purchased the entire issue, a Bloomberg source wrote.

The green bonds will refinance debt bearing about 11 percent interest from Kotak Mahindra Bank Ltd. That funding helped ReNew Power build wind projects that were commissioned in March in Dhar and Ujjain districts in the central Indian state of Madhya Pradesh.

ReNew Power has almost 1 GW of solar and wind power in operation with another under construction.

Corporate Bonds

Bank of China break new ground again – this time with a USD 500m ‘dual recourse’ green bond

Foreshadowed by us on 14th September, here is something we haven’t seen much of before. The Bank of China (BoC) formally announced last week the issuance of a new type of green bond, a ‘dual recourse’ bond.

It’s not an entirely new structure, as it is similar to a covered bond (such as Berlin Hyp’s green covered bond/ pfandbrief). The concept is simple – it means that the bond is backed by the issuer’s balance sheet.

But that’s not all…

If the issuer goes bankrupt, the bondholder can also make claims over the assets in a defined ‘cover pool’ of assets. This gives investors an additional safety net and the bond an enhanced credit rating.

In the case of this bond, the cover pool is not mortgages (as in Berlin Hyp) but climate-aligned bonds that are part of the newly launched China Bond China Climate Aligned Index, compiled by China Central Depository & Clearing Co. Ltd (CCDC), China Energy Conservation & Environment Protection (CECEP) and the Climate Bonds Initiative. More info here.

Proceeds of the bond will be used to finance:

- Renewable energy: solar, wind, biomass

- Pollution prevention: wastewater treatment, recycling and waste-to-energy

- Clean transportation: rolling stock vehicles including electric, hybrid and multi-modal transport

- Sustainable water management

The offer was 1.8 times oversubscribed and bought by investors in the US and Asia.

EY provided the external review here and the bond was listed on the London Stock Exchange.

Underwriters: Bank of China, Barclays, China Construction Bank, Citi, Credit Agricole, HSBC, Merrill Lynch, Societe Generale, Standard Chartered

Another first out of China!

Bank of America issues third green bond for USD 1bn and expands lending program

Bank of America has just announced their third green bond, which at USD1bn, is also their largest to date.

The proceeds will be used to finance energy efficiency and renewable energy projects under the bank’s ‘environmental business initiative’. This has been increased from USD 50bn to USD 125bn in low-carbon business by 2025.

For examples of previous projects funded by BoA green bonds, see here.

Bank of America is also a leader in our green bond underwriter league tables.

Bravo BoA – keep pushing!

Underwriter: Bank of America Merrill Lynch

Credit Agricole's INR 65m green Uridashi bond

Credit Agricole (CA) issued an INR denominated green bond for Uridashi investors (Japanese retail investors) as part of its green notes program.

Proceeds go to:

- green real estate

- renewable energy

- mass transportation

- waste and water

- energy efficiency

- sustainable agriculture & forestry

Sustainalytics have provided a second opinion here.

Also in case you missed it – CA recently announced that it will stop financing new coal-fired power plants or extensions. This extends its May 2015 commitment to stop financing coal mines.

The French text is here.

Amongst French banks, Societe Generale (SG) has made a similar announcement, BNP Paribas and Natixis have also restricted exposure to coal.

In addition, CA, SG & BNP Paribas have joined eight other international banks in ruling out finance to the giant Carmichael Mine project in Australia and other coal developments in Queensland’s Galilee Basin.

Whoa now there’s a double call to action – other banks, will you follow?!!

Rikshem's new SEK 500m green bond out (USD 54m)

Swedish real estate company Rikshem came to the market again this week with a SEK 500m, 6 year bond listed on the Stockholm Stock Exchange. Rikshem is a regular issuer of green bonds, having come to the market five times since 2014 and a total issuance of over USD 250m green debt.

Use of proceeds will target green property renovation projects. Under the Rikshem Green Bond Framework, eligible assets include renovated and/or properties under renovation compliant with a minimum target of 40% in energy savings. CICERO provided a review of the framework.

Lead manager: Handelsbanken Capital Markets.

Fabege receives Green Loan Differential Pricing from Danske Bank

According to Fabege’s press release and reported by Environmental Finance, this Sweden-based repeat green bond issuer has received a preferential borrowing rate from its green lender Danske Bank.

The ‘improved terms’ are essentially made possible because the green loan is financing lower risk green buildings.

The loan has a total value of SEK 1.6bn (USD 171.9m) and is made up of two parts, with its green element financing BREEAM environmentally certified properties.

This is fantastic news and could be a game-changer for increasing flows of finance for green buildings, we hope to see quality green loans attracting lower rates.

We are happy to note that Danske Bank is a Climate Bonds Partner.

Bonds not yet aligned with international definitions and best practice

Industrial Bank RMB 20bn (USD 2.9bn)

The China based Industrial Bank has issued its third whopper of the year with a RMB 20bn (USD 2.9bn) 5-year green bond.

Proceeds will be directed to a number of project types including:

- energy saving

- clean transportation

- pollution prevention and control

- resource conservation and recycling

- clean energy

As with the other green bonds, this one won’t be included in our numbers due to the potential inclusion of clean coal.

As regular Market Blog readers will recall, the People’s Bank of China’s Green Project Catalogue, released in December 2015, includes some tricky areas such as ‘clean coal.’ From an international perspective, any investments that will extend the life of a coal plants (including clean coal) is not included in the definition of green.

This is based on a 2-degrees trajectory which shows that existing plants need to be retired and new generation coal plant development needs to be wound down as quickly as possible for a global transition to a low carbon economy.

As we have mentioned before, clean coal is important in the local context as the replacement of old coal plants with modern generators reduces short term air pollution in Chinese cities – an incredibly important issue for Chinese people and investors.

Underwriter: Industrial and Commercial Bank of China

Yunnan Provincial Energy Investment private placement of RMB 500m (USD 72.5m)

According to Reuters China, this is the first green Principal Protected Note (PPN) from a Chinese issuer. However, as it’s a private placement, we can’t see any details on the use of proceeds.

Although Yunnan Provincial Energy Investment Co. Ltd. is involved in the investment and management of energy and energy related industries, such as environmental protection and new energy, it principally engages in the investment and management of energy, natural gas, and coal energy.

Therefore, we need to see more disclosure on the use of proceeds to include this in our database.

Underwriter: Shanghai Pudong Development Bank

GEM Co. Ltd. issued RMB 500m (USD 72.5m)

GEM Co. Ltd is China’s first listed company in the WEEE (Waste Electrical and Electronic Equipment) recycling industry.

- RMB 400m will be used to remanufacture cobalt and nickel as well as other materials from recycled batteries, and to build up a waste water management system

- RMB 100m will be used for general daily operations

20% of the proceeds will go to general operations - this is a bit tricky as the proceeds cannot be linked to green infrastructure and tracked.

This means we can’t include in our data but we applaud this first from GEM and hope to see more bonds linked to recycling projects.

Underwriter: China Development Bank Securities

RMB 1.09bn (USD 158m) from Beijing SPC Environmental Protection Tech Co. Ltd

Beijing SPC Environmental Protection Tech Co. Ltd issued an RMB 1.09bn (USD 158m) labelled green bond and the allocation of proceeds is disclosed as:

- RMB 330m will be used for waste heat recovery and heat supply projects;

- RMB 220m will be used for air pollution prevention;

- RMB 540m will be used for daily operations.

Almost half of the proceeds will be used for daily operations which means again we can’t include this one. Furthermore, we note that while waste heat recovery falls within the CBI Climate Bonds Taxonomy, general heat supply projects are not.

Underwriter: Tianfeng Securities

Municipal Bonds

City of Decatur, Georgia: dredging project (USD 22.2m)

The City of Decatur just jumped into the green bond market with this interesting USD 22m bond.

Proceeds will be used to expand the City’s water supply by the dredging of the 11 square kilometres Lake Decatur formed from the damming of the Sangamon River in 1922. The goal of the project is to increase the capacity of Lake Decatur by 30 percent and thereby increase the number of days of available water supply in the event of a drought.

This is an interesting one – dredging is not something that has come up in the green bond market before so guidelines are unclear. While having negligible climate impacts, dredging is associated with local environmental issues relating to biodiversity and ecosystems which are often associated with marine environments.

This is also interesting because it is an example of an adaptation project that may have adverse impacts on the local environment. For instance, dredging of river systems is a recurrent national debate in countries such as the UK which are suffering from increased frequency, intensity and unpredictable floods.

Dredging can have adverse impacts on water courses and ecosystems and has implications for planned and unplanned flood plains. More information is available here.

The bond is included in our numbers but it’s flagged as a potential issue in the future.

Underwriter: Raymond James

Green bond from City of Tamarac, Florida (USD 22m)

Proceeds will go to improving the city’s sewer system.

Underwriter: RBC Capital Markets

LA Sanitation District green bond (USD 170.3m)

Proceeds of the bonds will be used to refinance improvements to the sewage system of the county.

Underwriters: BofA Merrill Lynch and RBC Capital Markets

Development Banks

Development Bank of Japan SRI bond (USD 500m)

Development Bank of Japan just issued its second Sustainability bond. The bond will finance and refinance loans that:

- Meet its green building certification programme – 3, 4 or 5 stars

Buildings (i) are certified after undergoing an assessment which is intended to ensure that the construction takes into account environmental considerations.

Additionally, it ensures that the buildings take other responsible factors into account:

- Disaster prevention and anti-crime measures

- Tenants’ comfort and convenience

- Harmony with the surrounding environment

- Collaboration with stakeholders (including tenants and investors)

- Environmental Investor Relations activities

- Meet environmentally-rated loan program eligibility criteria – A, B or C rating

The Environmentally-rated loan program incorporates environmental ratings into its lending products by evaluating the environmental management of its clients.

Companies are rated from A – D based on general management, business activities and environmental performance. Companies rated A or B receive discounted interest rates:

- A = Companies with excellent advanced environmental initiatives

- B = Companies with advanced environmental initiatives

- C = Companies with sufficient environmental initiatives

There is a great deal of detail and rigour that has been put into the selection process, which is great. We do, however, note three areas for improvement:

1) The criteria are a bit of a black box so it is difficult to understand what would qualify as ‘excellent’ and how this might compare to other certification schemes.

2) We are unsure from the disclosure if the buildings criteria take energy metrics into account, which is a critical part of the ‘green’ in green building – ‘tenant comfort’ while important, is not material to the environmental impact of the building.

3) The Environmentally-rated loan program focuses entirely on the entity that it is financing rather than the asset it is financing which is inconsistent with how the green bond market is generally regarded, that is, focused on the greenness of assets rather than entities.

The framework was reviewed by Sustainalytics here.

The transaction was placed with SRI investors including AP2 (Second Swedish National Pension Fund), Fukoku Mutual Life Insurance Company & Meiji Yasuda Life Insurance Company.

The Development Bank of Japan is 100% government-owned financial institution devoted to regional development, environmental conservation, social infrastructure and technology.

Underwriters: Goldman Sachs, BoA Merrill Lynch, Daiwa, Morgan Stanley

NRW.BANK Green Bond EUR 500m

German development bank NRW.BANK issued its 4th green bond this week, with a 10 year tenor.

The bond is listed in Düsseldorf and, for the first time, also at the newly launched Green Exchange of the Luxembourg Stock Exchange (LGX). The majority of the investors came from Germany, France, the Netherlands and Asia and many of them have a clear focus on sustainability.

Proceeds will finance:

- Renewable energy projects such as onshore wind power (almost 100 wind turbines), offshore wind power (two wind turbines) and photovoltaic installations (3,700 kWp)

- Energy efficiency projects such as brownfield manufacturing facilities and public buildings

- Low carbon transport

- Sustainable water management projects such as river restoration, flood management and sewer construction

NRW.BANK was an early pioneer in the green bond market issuing its inaugural green bond in November 2013 and committed in May 2016 to a minimum of one green bond issuance each year.

Underwriters: Bank of America Merrill Lynch and DZ Bank

Other thematic products

‘First of its kind’ forest bond from the IFC USD 152m

The International Financial Corporation has just issued the world’s first Forest bond. The bond is not labelled as green and proceeds will finance the IFC’s normal development projects.

The Forest bond aspect to it is named because investors in the bond have a choice - they can opt to be paid their coupon in carbon credits or cash. Those who opt to receive credits can either use them to cover emissions or sell them on the carbon credits market.

The carbon credits will come from the Kasigau Corridor REDD project in Kenya, run by Wildlife Works.

The project covers 500,000 acres of dryland forest in the corridor between Tsavo East and Tsavo West National Parks in Taita Taveta.

BHP Billiton, one of the world’s largest resources companies, then provides a price-support mechanism so that if investors elect the cash coupon instead of the carbon credit coupon, BHP Billiton offtakes the carbon credits generated and delivered by the Kasigau Corridor REDD project.

The bond was sold to major global institutional investors - including CalSTRS, Treehouse Investments LLC, TIAA-CREF, and QBE.

The IFC said the bond had been intended to be half the size, but was increased because of demand.

It’s not labelled as green so we will not comment in detail, only to note that the deal has attracted some questions.

Netherlands BNG USD 600m Socially Responsible Investment bond

BNG Bank has just issued a USD 600m SRI bond, promoting best in class of sustainable municipalities in the Netherlands. See more here. The detailed framework for the bond received a review from Sustainalytics.

UK energy supplier Ecotricity launches EcoBond

The retail bond is Ecotricity’s 4th Ecobond. Proceeds will go to renewable energy infrastructure in the UK.

Caja Rural de Navarra debut EUR Sustainable Covered Bond

Spanish based Caja Rural de Navarra has issued the first sustainable covered bond of the year - a EUR 500m 7 year covered sustainable bond.

It is fully compliant with the 2016 Green Bond Principles as well as the Social Bond Guidance. Proceeds will finance projects that are in line with the bank’s sustainability principles (such as renewable energy, waste management, and education).

Review provided by Sustainalytics. SRI investors accounted for 30% of the deal.

Gossip and News Bites

China’s Bank of Communications has been approved by PBOC to issue RMB 70bn (USD 10.1bn) of green bonds by the end of 2017, reports Xinhua.

Tongling Dajiang Investment Holdings has been approved by the National Development and Revolution Commission (NDRC) to issue RMB 1.5bn of green bonds. Proceeds will be used to finance recycling facilities and sponge city projects in Tongling, a prefecture-level municipality with 75k population in south Anhui province.

This will be the first green bond issued by a China’s LGFV (Local Government Financing Vehicles).

Hebei Financial Leasing Co. Ltd. has been approved by PBoC to issue RMB 2bn (USD 290m) green bonds on the China interbank market. This will be the first green bond issued by a financial leasing company in China.

China's Three Gorges Corporation will issue its second RMB 4bn (USD 580m) green bond with two tranches. We have covered our concerns with this project in a previous blog.

Bank of Qingdao will issue another green bond at RMB 4bn (USD 580m) soon.

California is seeking independent third party verification for all future muni bonds.

Nigeria released guidelines for their initial sovereign green bond issuance programmed for early 2017. The Climate Bonds Initiative is acting in an advisory role. Speaking at a COP22 press briefing, Environment Minister Amina J Mohammed has confirmed Nigeria’s intention to issue sovereign green bonds in 2017.

Read more about it here and here.

Climate Bonds Initiative fellow Soren Elbech to become Treasurer of Asian Infrastructure Investment Bank (AIIB) on December 7th.

China and France’s Ministries of Finance have completed the fourth China-France High Level Economic and Financial Dialogue (HED) in Paris. Of specific interest to Blog readers in the Communique is the commitments to climate action and green finance commitments:

- Promoting cooperation amongst PBOC, Bank of France, EUROPLACE, NAFMII and Green Finance Committee on green finance issues.

- Promoting cooperation between China and France on green bonds market development, supporting green bonds issuance in both countries.

Go to Part 2, Clauses 17-24 in the English version fact sheet or read the Chinese version here.

Paris Europlace mise sur la finance verte pour briller face à Londres.

BNP Paribas roadshow for an EUR 500m green bond to start on Nov 21 – see more here.

It is being reported that they plan to issue a EUR 500m in renewable energy green bonds as early as this week.

Green Climate Fund is 'considering issuing green bonds.'

Australian listed property giant Investa commits to zero carbon target by 2040 across its USD 10bn office portfolio and business operations.

This is a great step by Investa and an early boost for the Climate Bonds Low Carbon Buildings target of zero emissions from property by 2050.

Scottish financier sets out the case for community investment in green energy bond in Scotland.

India’s Energy Efficiency Services Limited (EESL), one of the largest efficiency based companies in the world, foreshadows plans to raise USD 100m via green bonds.

CALSTERS green bond program’s 7-year birthday!

Meanwhile in Marrakesh, our CEO has been called the ‘rockstar’ of green bonds and had a more colourful description of his ‘global peregrinations’ in this blog post here.

Check out his address to the High Level Ministerial Dialogue on Climate Finance Plenary 2 here.

Proceedings really warm up at around 2.53.20. Take the ten minutes.

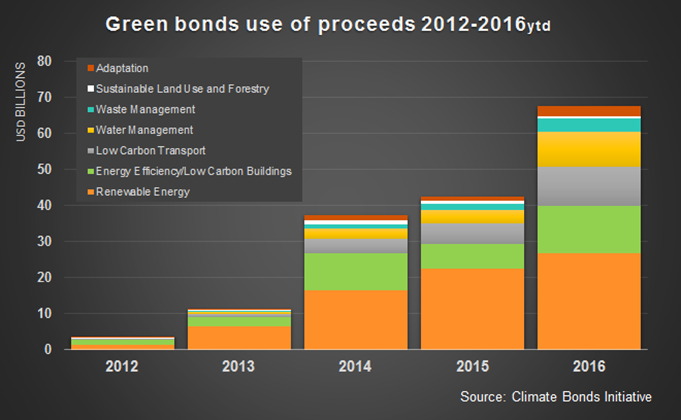

November Graph

If you’ve made it all the way to the end of the blog your reward is our latest graph.

Note the 2016 growth in energy efficiency/low carbon buildings, low carbon transport and water management.

‘Till next time,

The Markets Team

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments that any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.