Quarter 3 - the main points

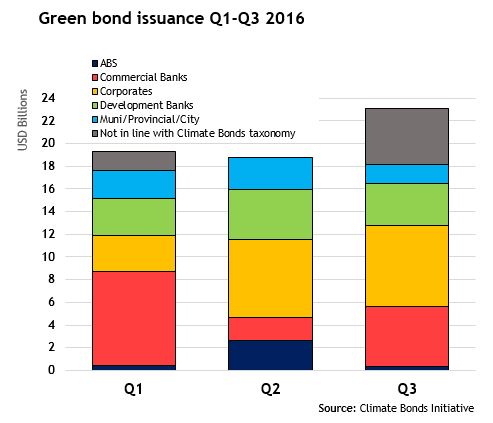

Over USD 18bn was issued in Quarter 3 2016, bringing Q1-3 issuance for the year to just under USD 55bn.

This makes Q3 2016 our second largest quarter to date (with USD 18.1bn) – with Q2 this year narrowly holding onto the lead (USD 18.8bn).

Including all ‘green labelled’ issuance (some of which does not meet international definitions* of green), Q3 issuance topped USD 20bn.

The remaining figures in this Round-Up only reflect bonds that meet international definitions of green.

*This excludes ‘clean’ coal and large hydro power projects.

Q3 Largest Issuance

The largest bonds were issued by Bank of China (USD 3bn), Shanghai Pudong Development Bank (USD 2.2bn) and Mexico City Airport (USD 2bn). The Bank of China bond was of particular significance as it was issued in three different currencies (USD, EUR, RMB) and in three different markets.

New Certifications

Certified Climate Bond issuance amounted to USD 522m, bringing the total Certified bonds for 2016 to USD 5bn. Certified issuance for the quarter came from Treasury Corp of Victoria (Australia) and NTPC (India).

More Verifications

88% of green bonds received external reviews – this is up from 65% in Q2 and lifts the average for the year to 71% - great news!

Other key points

Issuance from corporates and commercial banks amounted to 70% of the Q3 total, further demonstrating just how much the market has shifted from development banks to corporates. Issuance from development banks and municipalities were down a little compared to Q2, but remained strong.

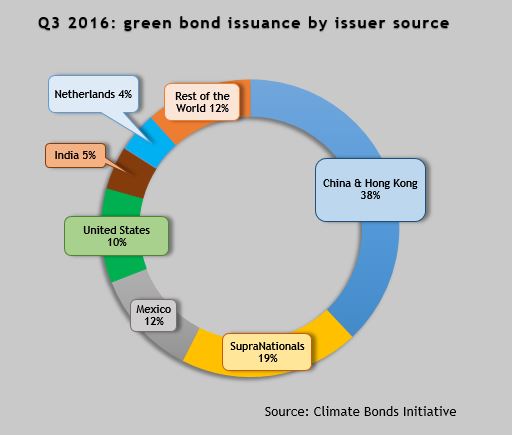

Emerging markets setting the benchmarks, with China leading global issuance at 38% of the Q3 total and Mexico in 2nd place.

New issuers made up approximately 55% of issuance and included Bank of China, the first issuer from Finland (MuniFin) as well as a first from the BRICS Bank the newest multilateral development bank.

Diverse range of currencies: USD accounted for 58% of issuance and Chinese RMB 22%.

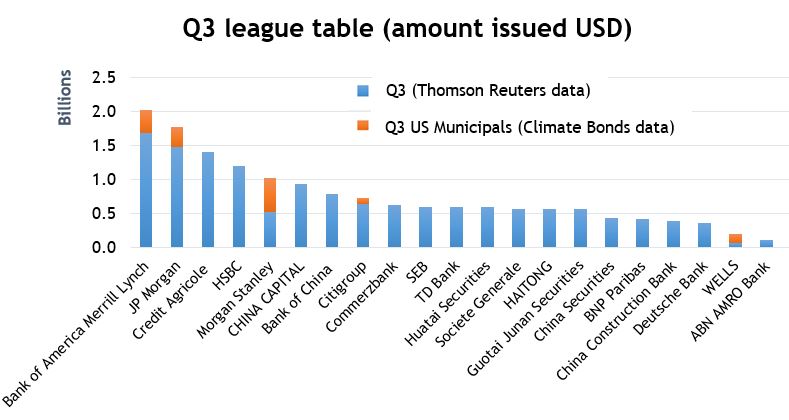

New Underwriter League Tables

League tables collated using Thomson Reuters data show BoA Merrill Lynch in top spot!

We are proud to announce that for the first time, the Q3 underwriters league tables are collated using data from Thomson Reuters, (a member of the Climate Bonds Initiative Partnership programme).

Please note that all data is provided by Thomson Reuters except for US municipal bonds (represented in orange below) which are calculated by the Climate Bonds Initiative.

As such, ranking volumes differ from Thomson Reuters tables.

Please also note that volumes may differ from other league tables as they include all ABS deals and US municipal bonds and exclude bonds which have less than 100% of proceeds going to environmental assets/projects. All deals meet international definitions of ‘green’.

These tables do not include bonds with use of proceeds going to assets that aren’t within the Climate Bonds Taxonomy. See notes* below for methodology.

Table 1

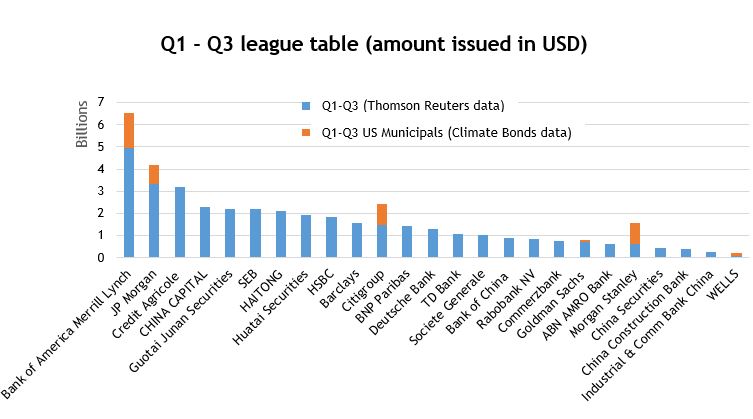

Table 2

*Introductory notes from Thomson Reuters on new Underwriters League Tables:

- Primary Issuance only

- Underwritten transactions only

- Thomson Reuters data excludes tax exempt Muni bonds

- The global table includes transactions that mature at least 360 days after settlement, for international 18 months and above.

- Transactions that mature or are callable/puttable less than 360 days after settlement are excluded, for international 18 months and above.

- Self-funded straight debt transactions are excluded (excluding mortgage and asset securitizations) unless two or more managers/underwriters unrelated to the issuer are present. The unrelated firm in a self-funded transaction with only two Book runners in the syndicate will receive league table credit.

- Transactions with an issue size of less than USD 1 million (equivalent) are included, sole led MTN take owns with a minimum size of USD 50m for core currencies are included, USD 10m for non-core.

- Deals must be received within five business days of pricing to be eligible.

- For a transaction to be green league table eligible, deals must have 100% of proceeds formally earmarked for green projects.

- Issuances where there is a mixed use of proceeds designated across different projects, are not eligible for example, ESG bonds that combine both social and green projects.

For further queries please contact ian.willmott@thomsonreuters.com

----------

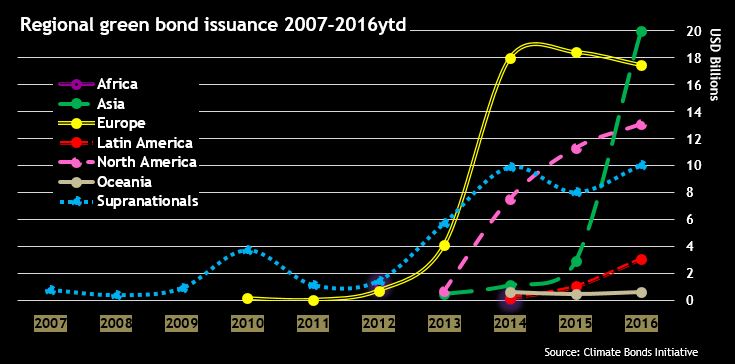

Issuance by Region - The long view

Notes:

- Asia had the fastest green bond issuance growth ever, in the order of 600% from 2015-2016!

- Asia has moved up from being the 4th largest region of green bond issuance in 2015 to being 1st in 2016!

- European 2016 green bond issuance is 24 times higher than 2012!

The Last Word

The healthy growth during Q3 is welcome, as are the increases in verifications. The increase in supporting information around the league tables reflects our new partnership with Thomson Reuters, we hope you find them valuable!

Lastly, looking ahead to Q4, where will we land by the end of the year?

We now estimate USD 80bn+ of green bonds for 2016, but it could be more!

We’ll keep you up to date.

Till next time,

The Markets Team

Disclaimer: The information contained in this communication does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.