The last 2 weeks have seen more American elections shenanigans as one candidate is in denial over the existence of climate change while the other commits to clean energy.

Another intense hurricane hit the Caribbean, triggering this New York Times piece on storm surges and the vulnerability of America’s petrochemical industry on the Gulf.

Meanwhile, there’s been a whole lot of positive news going in the world of green bonds.

To keep you across it all, here’s a summary from the last 2 weeks.

Big news for the GB market: (LGX) now open for trading

The Luxembourg Green Exchange (LGX) is open for business after a big launch (with a key note speech from our CEO – which you can read here). The LGX is dedicated exclusively to green securities and aims to bring green issuers and green investors together.

The great news is – it’s not enough for the issuers to just say that the individual security is green – it also needs to comply with industry best practice and have 100% of proceeds for green projects.

Well done LUX SE! A great example of how stock exchanges can grow the green bond market by promoting best practice and making securities easily discoverable for investors.

FYI: We are proud to mention that Luxembourg Stock Exchange is a partner of the Climate Bonds Initiative.

Corporate

EDF go green again - this time with EUR 1.75bn bond

Global energy giant EDF has just issued one of the largest green bonds this year - a 10 year EUR 1.75bn (USD 1.96bn) bond.

The bonds will finance:

- Development of renewable energy generation by EDF Énergies Nouvelles;

- Upgrades to existing hydropower including the improvement of generation efficiency;

- Adaptation of existing hydro to changing climate patterns;

- New hydropower developments in mainland France.

Looking at Hydro

The IPCC classifies hydropower into three main categories; run-of-river, storage (reservoir) and pumped storage hydropower.

In addition, in-stream technologies (new and less developed) can be added as a fourth category.

From a climate perspective, measuring impact of large scale storage is very complicated and includes many factors such as reservoir size and location, as well as vegetation density.

Other forms of renewables such as solar, wind and geothermal are all quite easy to assess, but as regular readers of this blog will know, we find parts of hydropower tricky areas.

Which is why we have a Technical Working Group of experts currently looking at all aspects hydro.

Transparency from EDF

To be fair – while we have our reservations, EDF has provided a lot of detailed information and has anticipated concerns like ours on this helpful Q&A document. This specifies (among other things) that eligible projects will not result in large new dams being created.

It also notes that all hydro projects must meet French Hydro E&S criteria (range of criteria from biodiversity to health and safety).

The commitment around reservoirs is important as the major climate impacts can occur with the creation of new reservoirs, so we’ll certainly give them the benefit of the doubt.

Bravo! Another green bond out of France.

Read more about EDF’s green bond framework here.

And Vigeo 2nd opinion here.

Underwriters: Banca IMI, Banco Bilbao Vizcaya, Santander, Barclays, Credit Agricole, Credit Mutuel CIC, ING Bank, La Banque Postale, Mediobanca, Natixis, Société Générale and Unicredit.

More on Hydro

As a side note, all the fuss we make whenever we see ‘hydro’ in a use of proceeds is not just to make a noise.

Hydropower will play an important role in the transition to a low carbon economy. It has significant energy storage potential and is an established renewable source.

But…. there are plenty of complex climate issues (in addition to the social ones that are more widely known) that particularly come with large reservoirs built for hydro power that can negate their positive climate impact.

Our view is that these impacts are not yet adequately understood or discussed in the green bonds market so that’s what we aim to do here.

Société Générale issues second green bond for EUR 500m (USD 559m)

Soc Gen are back in the market for their second ’Positive Impact Bond’ after a debut issuance for the same amount in November 2015.

Proceeds will be used to finance renewable energy projects through conception, construction and installation of renewable energy production units including: hydro, geothermal, wind, solar, biomass or any other renewable source of energy.

Wind, solar, geothermal – all green. As for hydro and biomass, those are complex areas of renewable energy and there isn’t the same level of information available for analysis.

Soc Gen published an Initial Use of Proceeds report showing that 64% of the proceeds that have already been allocated have gone solely to wind and solar projects. We expect the remaining allocation to be similar.

SRI investors represented 74% of the order book.

Vigeo Eiris provided the second party opinion on the green bond. Read more about Operation Obligataire À Impact Positif here.

Underwriter: Société Générale (no surprises there!).

Rabobank issues debut green bond USD 500m for solar and wind projects

2016 has been a bumper year for Dutch issuers with Rabobank the latest to join the fray with its first green bond just out. The proceeds will all be used to finance wind and solar projects.

All very green in our view. Great stuff!

This is the first bond in Rabobank’s Green Bond programme where proceeds are exclusively allocated towards financing of renewable energy. Rabobank also has a Sustainability Bond programme through which they intend to finance loans to selected SME’s with sustainability certifications.

The second review was provided by Sustainalytics and is available here.

Underwriters: Credit Agricole, HSBC, Rabobank, SEB.

FYI: We are proud to mention that Rabobank is a partner of the Climate Bonds Initiative.

CECEP green bond – RMB 2bn (USD 300m)

Following a successful RMB 3bn green bond issuance in August, China Energy Conservation and Environmental Protection Group (CECEP) have returned to the market just one month later with a RMB 2bn green bond.

If you haven’t heard much of CECEP yet, mark the name, you will be hearing it more as the China market accelerates.

According to the prospectus, RMB 1.5bn will be used for green projects including wind power and waste-to-energy plants constructions and the other RMB 0.5bn will be used for repaying bank loans which were financing waste-to-energy and biomass projects.

The public announcement is here, but like the prospectus, it’s in Chinese.

EY did the verification against the China Green Bond Endorsed Project Catalogue released by the PBoC in December 2015.

In the interest of transparency, CECEP is one of our research partners.

Their consulting subsidiary has helped us develop and launch the new ChinaBond China Climate-Aligned Bond Index in conjunction with China Depository and Clearing Co Ltd (CDCC) last month.

Underwriters: China International Capital Corp, China Securities.

And lots of Nordic green bonds…

Norwegian Real Estate Entra issues inaugural green bond NOK 1bn (USD 120.7m)

The 7 year bond will finance existing, renovated and new buildings obtaining either ‘Excellent’ or ‘Outstanding’ BREEAM certification. This corresponds to the top 10% of new buildings’ performance – great ambition!

Entra is one of Norway’s leading real estate companies – it’s portfolio is primarily office buildings.

See here for Entra’s green projects pipeline examples. The green bond framework received a second review, and the highest green bond shading of ‘dark green’ from CICERO.

Underwriters: SEB, Swedbank.

First green bond from Swedish Castellum SEK 1bn (USD 116m)

The real estate green bonds have been coming out of the Nordic countries thick and fast with this latest one from Castellum, one of Sweden’s largest commercial real estate companies.

The bond proceeds will be directed to the development of new and existing real estate assets that meet the following criteria:

- New real estate assets: design stage or ‘in-use’ certification of Miljöbyggnad Silver or BREEAM Excellent;

- Existing real-estate assets: design stage or in-use certification of Miljöbyggnad Silver or BREEAM Very Good.

Reporting will occur annually in English and Swedish.

More information is here.

Underwriters: Handelsbanken.

And another from Sweden: Stångåstaden’s 2nd green bond for SEK 575m (USD 66.7m)

Stångåstaden has just issued its second green bond – although from the lack of coverage you might not know it. Details are a little sparse right now so we’re assuming that the bond has the same framework as its 2015 green bond which was reviewed by CICERO.

The use of proceeds is for:

- New projects of residential or commercial properties with certification to Miljöbyggnad Silver or Svanen;

- And at least 25% less energy use per m2 per year than required by applicable codes and regulations;

- Major renovation of residential and commercial properties leading to 50% reduction in energy use per m2;

- Renewable energy.

A reminder that Miljöbyggnad is a green building certification system specific to Sweden.

It is more detailed than LEED and BREEAM in some aspects such as energy efficiency but does not include others such as water and waste. The Nordic Swan scheme (“Svanen”) resembles BREEAM but is focused on the buildings themselves and has a few more obligatory criteria than BREEAM.

Never heard of Stångåstaden?

That’s because you probably aren’t from Linköping, Sweden (population: 104,232) about halfway between Gothenburg and Stockholm.

Stångåstaden is the largest housing company in Linköping and is owned by the municipality of Linköping. It owns and manages apartments and student flats.

Go the Nordics! Another great example of how Nordic issuers are pioneers in the market – even when they aren’t big.

Underwriters: Swedbank and Danske Bank.

Private Placements

Yes Bank raises INR 3.3bn (USD 50m) through green bonds from FMO

India’s Yes Bank has repeated its landmark IFC private green bond placement from 2015 – this time placing a series of entire Green Infrastructure Bonds with Netherlands development bank FMO.

FMO will invest in the bonds using capital raised from its own sustainable bonds.

The proceeds will finance green infrastructure in India including wind and solar energy projects. Yes Bank has committed to getting a second review done in line with the Green Bond Principles.

A three page joint press release with more details is here.

FYI: we are proud to mention that FMO is a partner of the Climate Bonds Initiative.

ABS

Renovate America’s 8th Securitised PACE Bond out - USD 320m

This is the 8th green ABS from Renovate America’s Home Energy Renovation Opportunity (“HERO”) Funding program. The 2016-3 Series are secured by a pool of bonds from the Property Assessed Clean Energy financing program (PACE).

HERO finances more than 60 types of home energy improvements, providing renewable energy, energy efficiency and water efficiency renovations to homeowners through voluntary property tax assessments.

According to Renovate America’s internal forecasting models, the estimated environmental impacts of the PACE bond projects related to this 2016-3 Series amount to:

- Annual GHG Emission Reduction (tons): 19,933;

- Lifetime Water Savings: equivalent to more than 1,515 Olympic pools (total of 1,183,356,285 gallons);

- Solar PV Capacity Installed: 10,6MW.

Sustainalytics provided the second opinion.

Muni Bonds

MuniFin bond out for USD 500m – go the Finns!

Municipality Finance (or in Finnish - Kuntarahoitus Oyj) issued its inaugural bond which is also Finland’s first green bond.

80% of proceeds will go to climate change mitigation and adaptation projects and 20% to environmental management projects. Specifically, eligible projects will be in the following areas:

- Renewable energy (wind, solar, hydro less than 10MW, geothermal, bioenergy and biogas from waste;

- Energy efficiency (district heating/cooling, recovered energy, smart grids);

- Sustainable public transportation;

- Waste management (recycling, re-use and rehabilitation);

- Water and waste-water management;

- Sustainable buildings:

- Finnish energy classification of B or higher;

- Major renovations leading to 25% energy reduction per M2;

- Environmental management.

Phew – lots in there!

CICERO has provided a good analysis of the ‘greenness’ of each area as well as potential issues in the second review here.

MuniFin has also established a Green Bond Committee to analyse and monitor each loan. You can find more information from MuniFin here.

Debt aggregation at a municipal level

A quick note on the interesting thing about how MuniFin works; MuniFin acts a debt aggregator for municipalities in Finland, as does Komuninvest in Sweden (see gossip section) and Kommunalbanken in Norway (both have issued green bonds).

The interesting thing about these Nordic municipality aggregators is that they enable small municipalities to access low cost capital through the bond market despite their small size.

The size of each bond is based on the finance requirements of each municipality but bonds are not ABS’s – just a regular corporate bond backed by MuniFin which is rated AA+ / AAA due to its ownership by the Government of Finland, Finnish municipalities and the public sector pension fund.

The result is very high rated bonds and low cost of capital for small munis!

Trust those clever Nordics to come up with these great solutions!

Underwriters: Bank of America Merrill Lynch, HSBC, SEB and Credit Agricole.

Swedish Municipality Orebro Kommun issues latest green bond SEK 500m (USD 58m)

Örebro Kommun has issued their third green bond (after a bit of a break – their first bond was in 2014 for SEK 750m).

The bond proceeds will finance projects that target climate mitigation, climate adaptation and sustainable environment projects. Specifically, it has outlined the following investment areas:

- Renewable energy;

- Energy efficiency;

- Sustainable public transport excluding fossil fuels;

- Waste management (recycling and re-use);

- Water management;

- Sustainable buildings (new construction <55KWh/m2 per year or for existing building renovation, a reduction of 20% energy use);

- Nature conservation;

- Development of non-toxic environments.

Lots more details in the green bond framework here and the review from CICERO here.

The previous bond issued was 51% allocated to wind power and 44% allocated to green buildings. Although it can be hard to judge how ‘green’ or ambitious building eligibility criteria are when they are expressed in KWh/m2, we note that it is very positive that they are based on actual energy consumption and that they are seen by CICERO as ‘Very Good’.

Underwriter: SEB.

DC Water and Sewer Authority USD 25m private placement with payments based on success

Interesting new ‘Environmental Impact Bond’ out from DC Water & Sewer Authority. The proceeds of the bond will be used to construct green infrastructure practices, designed to mimic natural processes to absorb and slow surges of stormwater during periods of heavy rainfall, which will reduce the incidence and volume of combined sewer overflows that pollute waterways.

This has become an increasingly urgent environmental challenge, a result of climate change, and has increased the frequency and/or severity of intense rainfall events.

So, an adaptation bond is very important given the level of climate change embedded into the global ecosystems.

The real innovation here is that under the terms of the deal, payments to investors will be based on the proven success of the project in addressing the stormwater runoff.

If the outcome of the project meets expectations, no contingent payment will be due to investors. If it exceeds expectation, investors will make a Risk Payment Share of USD 3.3m to DC Water, if it does not achieve expectations, DC Water will make an outcome payment to investors.

Interesting idea – read more about the complexities here.

Clearly investors liked it; the deal was sold in a private placement to Goldman Sachs and the Calvert Foundation.

Learn more in the press release and fact sheet.

Port of Los Angeles issues its inaugural green bond (USD 35.2m)

This is another first from the US with POLA venturing into the green bond market with this issuance.

Proceeds will refinance debt incurred from the construction of:

- Parkland located alongside the port with large open green space, pedestrian and cycle lanes, the park shields the community from the noise and maritime activity;

- The Police Headquarters which achieved LEED Gold certification; and

- The Cabrillo Saltwater Marsh, a shallow water replacement habitat for birds and fish.

Sustainalytics provided the second review (here).

More information is also here and here.

In terms of greenness - LEED Gold buildings meet our guidelines and show great climate ambition.

We don’t have guidelines or expertise on saltwater marshes but we note that marshes have both potential biodiversity and climate adaptation impacts – through stormwater and flood protection.

The park… well, let’s just say it will add great value to the community for sure, but it’s not exactly a climate priority.

Our opinion is that if there is limited capital to spend on climate-related infrastructure – we need to target the highest impact first which, is probably not the case with a park (as much as we do love parks).

Underwriter: RBC Capital Markets.

American Municipal power issues 2nd green bond in 2016 – USD 209.5m

American Muni Power (AMP) has just come to market again with this latest issuance being to finance 3 run-of-river hydro projects: Cannelton (88MW – already in operation), Willow Island (44MW – already in operation) and Smithland (76MW- expected to be operational in February 2017).

AMP’s projects are all run-of-river (ROR) hydro projects, located on ‘lock and dam’ facilities. To date, our hydro criteria have no restriction on the generation capacity of run-of-river schemes in temperate zones. But as mentioned previously in this blog for EDF’s hydro green bond, eligible criteria are evolving in parallel of climatic scientific evidence.

Read the second review from Sustainalytics here and the prospectus here.

Multilateral Development Banks (MDB)

EIB issued its second longest-dated green bond to date

The European Investment Bank has just issued its latest Climate Awareness Bond which has a tenor of 21 years! It’s the second longest duration of EIB’s green bonds to date.

This is an important step given that the average tenor of a green bond is about 8 years (higher for muni bonds). Given MDBs usually make the first moves in this market – maybe this is a sign of changes to come…

EIB has also made the news because it has just published extensive GB reporting and it’s been verified externally!

Yes, EIB has just released extensive project-by-project reporting on their Climate Awareness Bonds; see the reporting along with verification from KPMG here.

Gossip

Reuters @Umesh_Desai reports China’s Bank of Communications has just received approval to issue USD 4.5bn in green bonds. The announcement is here.

Canada’s Province of Ontario announced thier third green bond at our recent report launch in Canada.

Canadian CoPower is rumoured to be planning their next green bond! More information soon!

Vasakronan rumoured to be out soon with latest SEK 400m (USD 45m) green bond.

Kommuninvest expected to issue largest SEK bond to date – SEK 3bn (USD 338m), also its first green bond in SEK.

Nigeria is a step closer to their first green bond.

Tokyo governor Yuriko Koike announced possible green bonds for Tokyo!

New green bond soon out from TenneT – as with previous bonds, this one will finance offshore wind power grid connections. Second opinion from Oekom here.

Aloha! – First GB from City of Honolulu out soon for USD 143.6bn.

London Borough of Waltham Forest pension fund has just become the first UK public authority pension to commit to divesting 100% from fossil fuel companies.

Australia green finance roundtable

Australia doesn’t figure prominently in global green bond discussions despite three of its four big banks (ANZ, NAB & Westpac) issuing green bonds, a world first certified green ABS and the first certified sub sovereign issuance from the State of Victoria.

With a AUD 2tn in long term retirement funds, (some of which are now global infrastructure players) and a well-developed domestic funds management sector, we see great potential.

This roundtable discussion is worth a read if you want a glimpse into where the green bond market could go Down Under.

Who really started the green bond market?

Now here’s an interesting one… We just found out that the Japanese City of Kawasaki issued JPY 2bn ‘Kawasaki green promotion bonds’ for retail investors in 2006 – this is earlier than the first green bond we have from the EIB in our data (2007).

The bond has now matured and would probably not be considered ‘green’ by today’s definitions, as the use of proceeds went to public parks and nature conservation, but they were way ahead of their time!

Official report by Akane Enatsu (Nomura subsidiary), our source. Press Release from Kawasaki city (also in Japanese) here.

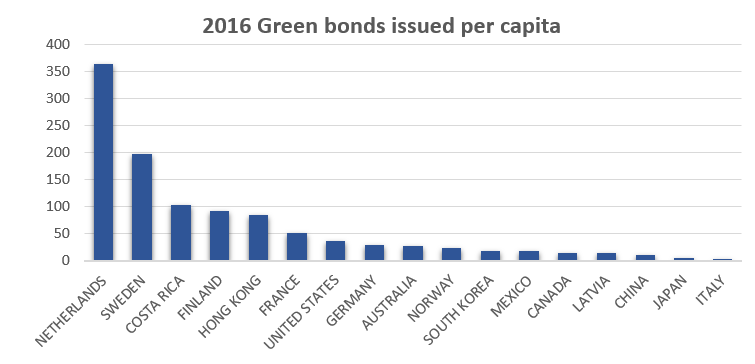

And we finish with our quirky chart of the week: 2016 Green bonds per capita – Go Netherlands!!

Till next time,

The Markets Team: Bridget, Camille and Alan

Disclaimer: The information contained in this media release does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.