Breaking...

Green ABS from Goldwind, the 1st labelled green ABS listed on Shanghai Stock Exchange

Chinese based wind turbine developer Goldwind has just issued the first green ABS on the Shanghai Stock Exchange (SSE). The announcement (in Chinese) is here.

Totalling RMB 1.275bn, with 6 tranches (5 are preferential, another 1 is secondary), an interest rate of 3.4%-4.5% and a maturity of 1-5 years.

Agriculture Bank of China is the issuer and Goldwind is the originator; it’s wind farms are the underlying assets.

Verification from DNV-GL.

The International Finance Corporation (IFC) has also provided an assessment of the environmental impacts of this ABS. The assessment demonstrates that the ABS could reduce 2.4bn kilograms of GHG emissions during the bond term.

We’ll keep you posted as more information emerges.

Big news – reports indicate that USD 150bn of green bonds have been issued since 2007

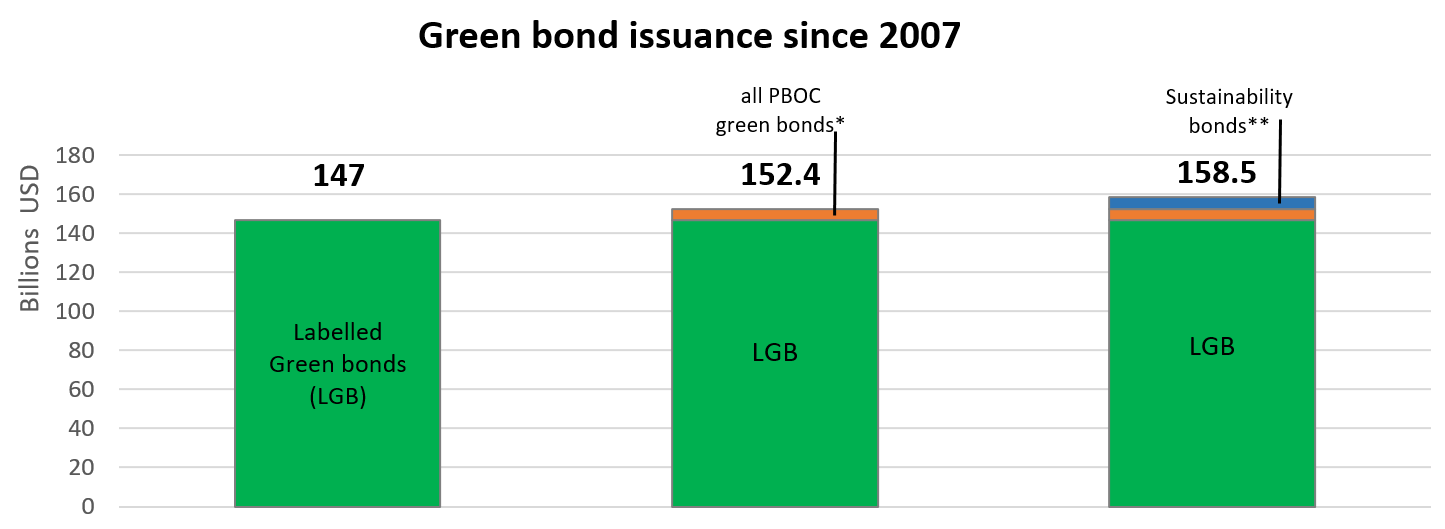

This week, our friends at Environmental Finance reported that $150bn of green bonds have been issued to date since the first bond was issued way back in 2007.

Our numbers are a tiny bit different (as are Bloomberg’s) BUT the main thing is that we’re close enough no matter which way you cut it.

Here’s our analysis of the cumulative figures since 2007:

Notes:

* A few Chinese bonds meet People’s Bank of China (PBOC) Guidelines but do not meet Climate Bonds Guidelines due to the inclusion of ‘clean coal.’

Accordingly, we have excluded some China green bonds from our headline figures.

** Some Sustainability Bonds are included in our headline figures if proceeds are allocated 100% to green projects. We do not track Sustainability bonds as closely as other sources, so our figures may differ.

Corporate Bonds

India’s Greenko issues USD 500m green bond for wind and hydro with a B+ rating

(8x oversubscribed, a sign of demand for high yield?)

Greenko just issued its debut green bond for USD 500m; it received a rating of B+ from both S&P and Fitch and was apparently 8.4x oversubscribed.

If you’ve been to any Climate Bonds talks recently, you may have heard us mention that in the current low interest rate environment, investors are seeking a bit of yield – we think this bond offers us some proof of that (albeit anecdotal). Bring on the high yield green bonds!

Greenko Group is an India based developer of renewable energy (and a bit of other energy). It currently operates approximately: 502MW Wind (402MW under construction), 258MW Hydro, 43MW biomass and 36MW Natural Gas (58.4MW under construction).

The proceeds of the bond will be used to refinance investments in five wind farms (totalling 274MW) and three run-of-river hydro projects (of which 2 are all under 25MW in size and the third one 96MW).

Wind is easy – its green. While hydro is a bit trickier (our new hydro technical working group is looking into criteria at the moment), it is generally recognised through international mechanisms such as the UNFCCC Clean Development Mechanism, that run-of-river projects are environmentally positive from a mitigation point of view so the fact that these are all run-of-river gets a big tick from us.

Sustainalytics provided a second opinion here.

Lead managers: Deutsche Bank, Investec, J.P. Morgan, Morgan Stanley and UBS.

Despite the fact that the portfolio mix meant it couldn't be Climate Bonds Certified yet, we note again (!) that the bond’s high oversubscription is just amazing.

Beijing Enterprises Panda Bond

We blogged recently about the first green ‘panda bond,’ issued by waste water and environmental services conglomerate Beijing Enterprises Water Group.

As promised, here are the details:

CNY 249.96m will be used for green projects that fall within the categories below, CNY 450m out of the total CNY 699.96m proceeds will be used for refinancing projects that also fall into these categories:

- Construction of sewer facilities; silt cleaning;

- Wetland environmental restoration projects;

- Green space construction along the river;

- Projects that can address soil erosion and enhance flood control capacities.

When it comes to water, everything is complicated. No doubt sewer facilities are environmentally positive but are all types of facilities in line with a low carbon and climate resilient economy?

That’s a tricky one – we’re not sure. Our water technical working group are working on this at the moment.

We are, of course, happy that SynTao Green Finance (SynTao) provided the review against the PBOC Green Bond Endorsed Project Catalogue.

SynTao is one of the Climate Bonds Initiative’s approved verifiers, although we note that the Climate Bonds Standard was not used for this particular bond.

The report has not as yet been published.

As strong advocates of transparency, we await the release of more information.

In case you missed read our last market update blog – a Panda Bond has nothing to do with the cute furry creatures found in China but is a bond type (much less cute) - a Chinese renminbi-denominated bond from a non-Chinese issuer, sold in China.

Lead managers: China Securities and Essence Securities.

China Energy Conservation and Environmental Protection (CECEP) issues first green bond RMB 3bn (USD 450.8m)

Hot off the press!! CECEP has just issued its first green bond for RMB 3bn.

CECEP is a state owned entity rated AAA by Dagong Rating. Through its subsidiaries, it develops, operates and manages energy saving, environmental and renewable energy projects.

Disclosure is great as they have listed all projects (future and planned) that the bond will invest in here (in Chinese).

Proceeds are used for:

- New green projects including solar, wind energy and sewage water heat pump (using sewage water as a heating source to save energy); and

- Refinancing of existing green including wind, waste to energy (with incineration process) and ‘environmentally-friendly thermal power plants’

The last category prompted some anxiety until we confirmed that it means waste-to-energy. Phew! (we had thought it might be clean coal).

The jury is still out on the greenness of Waste to Energy (WTE) projects but the general consensus is that new WTE technology is pretty green.

A great first effort – particularly on the reporting side which is ahead of the curve in both the Chinese and global context as they have listed every project that they intend to refinance or invest in. Given the size and importance of CECEP in the China context, this bond is also an important signal about the value of the green bonds market to other potential issuers – great stuff!

EY and CECEP Consulting provided the verification for the bond.

Underwriters: China International Capital Corp, China Securities

In case you didn’t know…

In the interests of full disclosure, we’re happy to highlight to all our Blog readers that the consulting arm of CECEP is a partner of the Climate Bonds Initiative on our China project.

Sovereigns and Development Banks

Asian Development Bank goes big for its latest green bond USD 1.3bn

The Asian Development Banks (ADB) has just issued its latest green bond, its biggest yet in two tranches of USD 500m and USD 800m. This is the first ADB green bond of the year and only their 3rd since 2014.

Investors included AGI, Banque Syz & Co SA, Black Rock, Calsters, Calvert Investments, Compass AM, Mirova and State Street Global Advisors.

For the USD 500m tranche, 49% of the bonds were placed in Asia, 32% in Europe, Middle East and Africa and 19% in the Americas.

For the USD 800m tranche, 58% of the bonds were placed in the Americas, 37% in Europe, Middle East, and Africa, and 5% in Asia.

ADB’s green bond framework has a second opinion from CICERO. Eligible projects fall into four categories: Renewable energy, energy efficiency, sustainable transport and adaptation.

Lead managers: Bank of America Merrill Lynch, Credit Agricole, JP Morgan

ADB also backed the first Certified Climate Bond from the Philippines in February this year and this latest offering is a further indication of their green finance direction.

OPIC’s issues its 6th and 7th green bonds since January 2016!

The Overseas Private Investment Corporation (OPIC) has recently offered 2 new investment grade Green Guaranties to the US domestic debt capital market.

The first is a USD 2m, 10-year maturity bond with Stifel Nicolaus as a sole manager. The second totals USD 49.3m and has a 24-year tenor. Bank of America Merrill Lynch was the underwriter.

Issued by the U.S. Government’s development finance institution, these guarantees support the financing of climate-friendly projects, such as the inaugural investment in a Chilean solar plant back in September 2014.

Since then, the OPIC has raised more than USD 405m for green projects on an international scale.

Muni bonds

City of Aurora, Colorado, issues USD 437m green water bond.

The city of Aurora issued its first green bond and the largest public muni bond in Colorado in 2016. The bond received AA+ ratings from both S&P and Fitch.

The proceeds are to be used to refinance the Prairie Waters project and other improvements to the water system.

Prairie Waters was designed to provide a sustainable long-term water supply to the city’s population under drought conditions. It makes use of:

- Riverbank filtration,

- A natural pre-treatment process,

- Optimizing the utilization of existing water supplies of the System,

- Increasing the availability of water to the System by approximately 20%, without the acquisition of new water rights or construction of additional raw water storage.

This fits into an adaptation/resilience part of the Climate Bonds Taxonomy; it’s equally as important as the mitigation part.

Prospectus here, no second opinion

Underwriter: Morgan Stanley

Massachusetts Water Resources Authority’s goes green again with a USD 104m bond

This week the Massachusetts Water Resources Authority returned to the green bond market for a second time in 2016 to finance water projects. The proceeds will be used to finance:

Wastewater projects:

- Interception and pumping

- Treatment and residuals

- Combined sewer overflows

and waterworks projects:

- Drinking water quality improvements

- Transmission systems

- Distribution and pumping

These are all undoubtedly good projects for the provision of clean water to people and in reducing water pollution. The more difficult issue (from our perspective) is to asses which water investments are high climate mitigation and adaptation priorities – i.e. are all water-related projects and investments good enough or if not, what is their fit within a low carbon and climate resilient economy?

We are working on this through our Water criteria. Adaptation planning will certainly be part of this assessment as will other factors so watch this space.

You’ll find the Prospectus here.

Underwriter: J. P. Morgan Securities

Upper Mohawk Valley issues first green bond and receives GB1 rating from Moody’s

New York’s Upper Mohawk Valley Regional Water Finance Authority issued a USD 8.77m green bond last week. It was the first muni bond to receive a green bond rating from Moody’s – it achieved the highest Moody’s score of GB1.

The proceeds from the issuance will be used exclusively to fund or refinance projects and activities that serve to increase the water system's resiliency, provide greater operational continuity and further the authority's mission of providing safe drinking water to water users within its service area. These include:

- Raw water transmission upgrades,

- New water storage facilities,

- Refinancing of treatment facilities.

As with Massachusetts, water is a tricky area and it is difficult to analyse which water treatment and transmission technologies are the ‘greenest’, but we note that all water projects should be built with strong adaptation planning in place to ensure that the life of the assets meet changing climate patterns.

Gossip

New green bond out soon from Mexico’s NAFIN who announced it will issue its second green bond this week at the launch of the Mexican edition of our State of the Market report. It will be a peso-denominated bond (it will be the 1st domestic peso green bond) with an estimated size of between MXN 1-2bn (USD 54-108m) and 7 years’ tenor.

More announcements soon out of Mexico, watch this space.

First bond out of Middle East soon… National Bank of Abu Dhabi (AA- rated) has begun its roadshow for the first green bond out of the Middle East. They are reportedly aiming for a $500m which will have a tenor of 5 years and the second review is provided by Vigeo Eiris.

Port of Los Angeles is set to issue its debut green bond. Details are light at this stage but the bond will refinance an existing LEED certified building. Sustainalytics is providing the second review.

Potential Green Sukuk out of Malaysia? Malaysian RAM Ratings, has issued a rating methodology on renewable energy projects which aims to foster the development of the green sukuk market. Malaysia, which pioneered Islamic finance 30 years ago is the world’s biggest Shariah-compliant debt market.

Mexico: More clean energy bonds? The Mexican government will auction USD 8bn worth of clean energy projects this year as Mexico pushes to improve air quality. The move could see more project bonds for clean energy development such as the Oaxaca wind farm bonds. See more here.

Kenya’s first green bond set for 2017 - the Kenya Bankers Association in partnership with the Nairobi Securities Exchange (NSE) has set early 2017 as the target date for beginning the launch of Kenya’s first Green Bonds. This short TV News Clip from Geeska Africa Media tells more of the story.

NRW.Bank is looking to bring a euro green bond later this year, possibly as soon as October. The development bank of the German State of North Rhine-Westphalia, will issue a EUR 500m green bond later this year, with maturity expected to be at least ten years. Use of proceeds will fund renewable energy projects.

IREDA green bond potentially out in November - the public Indian Renewable Energy Development Agency, is planning to issue about USD 100m to USD 150m of offshore rupee-denominated to increase its lending to green power. The ‘Masala bonds’ will be issued either on the London Stock Exchange or the Singapore Stock Exchange.

The Midpeninsula Regional Open Space District set to issue USD 57.4m green bond next month. Their mission is to preserve a regional greenbelt of land, and to protect and restore the natural space. It has received an AAA rating from S&P. https://www.openspace.org/sites/default/files/20160727_R-16-94.pdf

Last but not least... The sun is strong in Chile: solar energy sold is half price of coal!

According to Bloomberg, solar energy has reached its lowest historical price (USD 29.1/MWh) at a Chilean auction last week, after the earlier Dubai bid record of USD 29.9/MWh last May.

The low number is attributed to the increased competitiveness of solar technology as well as the location of the future 120MW "Granja Solar" power plant in the Atacama Desert.

The tender was awarded to Solarpack to supply 280GWh annually to its Chilean-based customers starting 2021. The Spanish developer will build the 120MW PV plant via its subsidiary Maria Elena Solar S.A in order to meet the annual 280GWh supply.

Just to Avoid Any Confusion - These are Pandas Bonding - Not Panda Bonds

Till next time,

The Markets Team

Disclaimer: The information contained in this media release does not constitute investment advice and the Climate Bonds Initiative is not an investment adviser. Links to external websites are for information purposes only. The Climate Bonds Initiative accepts no responsibility for content on external websites.

The Climate Bonds Initiative is not advising on the merits or otherwise of any investment. A decision to invest in anything is solely yours. The Climate Bonds Initiative accepts no liability of any kind for investments any individual or organisation makes, nor for investments made by third parties on behalf of an individual or organisation.