As you know, we have shifted our bond reviews into a weekly format. To make sure you get the most of our news, we are also introducing a monthly round-up of Climate Bond stories.

The round-up is divided into

- New green bonds

- Market Developments

- Climate Bonds Standard news

- Climate Bonds Initiative news

New green bonds

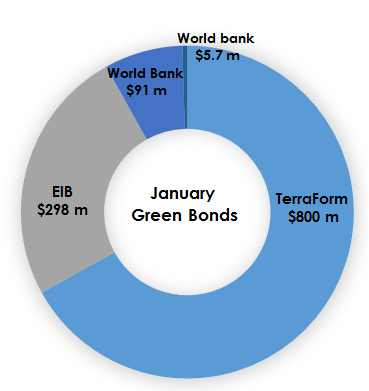

Although January started on a slow note, by the end of the month we’ve seen 4 green bonds issued totaling $1.1 bn.

TerraForm Power Operating, US$800m, 8 yr, 5.875%, B1/BB-

TerraForm Power Operating, US$800m, 8 yr, 5.875%, B1/BB-

The largest green bond so far in 2015 — a high-yield bond whose proceeds will partly fund the acquisition of wind and solar power generation assets from First Wind. Great to see that pure play renewable energy companies decide to add the green bond label on to their issuances. Read more

EIB Climate Awareness Bond increases size by €250m ($298m), 1.25%, 11 yr, AAA

The second tap of the 2026 Climate Awareness Bond issued last September took the bond’s total amount issued to €1bn. Read more

World Bank, US$91m, 7 yr, index-linked coupon, AAA

Strong demand among investors in Luxembourg and Belgium increased size of the bond from planned $15m to $91m in 3 days. As with all World Bank bonds CICERO has provided a second opinion. Read more

World Bank, INR 348.5m ($5.7m), 5 yr, 4.2%, AAA

Indian Rupee denominated green bond for Japanese retail investors. The World Bank has now issued green bonds in an 18 different currencies – that’s pretty fantastic! Read more

Green bond pipeline: Next month expect more green bonds from repeat issuers OPIC, World Bank, IFC and Credit Agricole.

Market developments

- In mid-January we have released the Year 2014 Green Bonds Final Report. It revealed that $36.6 billion green bonds were issued in 2014 – triple 2013 figure – making it the biggest year ever for green bonds.

- 2014 Green bonds underwriters league table saw SEB taking the top spot with BAML and Credit Agricole snapping at its feet!

- US green municipal bond market continued to dazzle with two green municipal water bonds closing in January; Massachusetts Clean Water Trust, US$228.2m, 2-14 years, 1.5-5% AAA and Chicago Metropolitan Water Reclamation, US$225m, 2-30 years, 2-5%.

Climate Bonds Standard news

EY has been confirmed as an approved Climate Bonds Standard verifier. It joins DNV-GL, Bureau Veritas, Oekom and others. Read more

Climate Bonds Initiative news

- We are looking for a brilliant person to join our London-based team as Standards Program Officer. Read more

- Philanthropist and Climate Bonds Partner Serge Martin made a CA$100,000 ccommitment to ‘turbo-charge’ Climate Bonds Initiative. Read more

- Dividend Solar – a leading US solar loan provider signs up as a Climate Bonds Partner Read more

- Great media coverage for green bonds in December 2014 Read more

Events:

Climate Bonds CEO Sean Kidney spoke about the potential for ‘Green sukuk’ at the World Future Energy Summit held in Abu Dhabi. The race is now on for 1st issuer in the Middle East! Read more

High-level green bonds seminar took place in Stockholm (speakers from IFC, SEB, Climate Bonds Initiative, Vasakronan, Swesif). Read more

See Climate Bonds schedule of upcoming speeches

Also, do have a look at an interesting article by Sean Kidney and Ulf Erlandsson (originally published in Institutional Investor). It explores ways of harnessing the power of the bond market for green: mainstreaming vs niche funds, benefits of secondary market and the role of government.